Ang Kok Tian, chairman and MD of ASL Marine, with analysts after the briefing at Fullerton Hotel. NextInsight photo

THE OUTLOOK for ASL Marine’s shiprepair business is ‘very good’ but the shipbuilding business will have to contend with the likelihood of no new orders for a while, said ASL’s chairman and managing director.

Answering questions from analysts and investors yesterday evening (Aug 19), Mr Ang Kok Tian first dealt with the good news: “The shiprepair outlook is very good. The market is resilient. We expect our revenue to be boosted by our new docks – we would be able to take on bigger vessels.”

The shiprepair business has been buoyant all this while. In FY09 (ended June this year), ASL repaired more vessels than in FY08 but the ships were smaller, said Mr Ang.

“We got fewer bulk carriers and container ships – in fact, for half a year, we repaired only one bulk carrier. But we still got a number of tankers and offshore support vessels.”

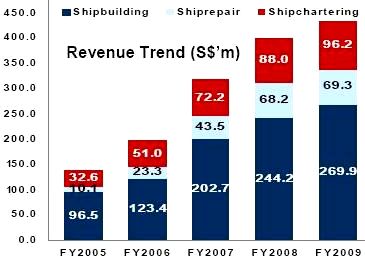

Source: ASL Marine

The contract value per job was also smaller, but the higher number of vessels repaired helped raise the full-year (ended June 30) revenue of ASL’s shiprepair and ship conversion segment to $69.3 million (vs $68.2 million in FY08).

An analyst asked about the threat posed by yards in China and Malaysia which have expanded their shiprepair capacity.

Mr Ang said the competition is another reason why the contract value per job at ASL has shrunk. In addition, it takes longer now to conclude the process for securing contracts.

“We have to go through a long tendering process. Last time, they knocked on our doors, and just want to come in. Now we have to knock on their doors and asked them to come back.”

Here are further highlights from the Q&A session at the Fullerton Hotel shortly after ASL Marine released its full-year results:

Q Can you shed more light on the doubtful debt provision of $3.6 million (versus $818,000 in FY08)? Which business segment and will there be further provision?

Lilian Tan, group financial controller: The provision is mainly for the shiprepair segment. It involves several customers. Shipbuilding customers normally have financing in place.

Mr Ang: We collect a certain percentage before the repaired vessels depart our docks. Usually, that can cover our cost. The doubtful debt is the balance owing, and they take their time to pay. In general, our experience over the years is that we can recover most of such debt.

Q If a shiprepair client has a bad debt, will you still take on its business next time?

Mr Ang: A customer who has not settled his debt definitely won’t come back because we will seize their ship. A lot our business is from repeat customers and the bad debt is mostly from first-time customers.

Q For your shipbuilding order book, what is the percentage that was announced in FY09?

Lilian: In FY09, we made only one announcement on new shipbuilding orders. In Oct 08, we announced a shipbuilding and ship repair project totaling $101 million. That project is still below the 10% recognition threshold as at June 30, so it’s still inside this $523-million outstanding orderbook.

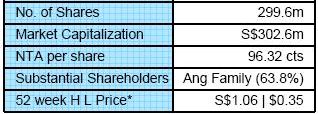

Source: Bloomberg, Aug 17 data

Q What’s the outlook for shipbuilding?

Mr Ang: Six months ago, it was bleak. It’s still the same today but the risk of cancellation of orders is much lower. We don’t expect to get sizeable orders as bank financing is still not in place.

I have some customers who ask if we can finance them – which means we either collect no deposit or a small one, build the ship and they will pay on delivery. This is common in China - many shipyards finance the customers and work with the local banks.

I don’t think it’s worth the risk. The time will come when there will be shipbuilding orders – maybe 2-3 years’ time. On and off, we think we can get smaller contracts as there is still good demand from other sectors – not oil and gas, as it is tough there but there is a lot of enquiries these days for special tugs, for example.

For the full company announcement, go to SGX website here.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors