- Posts: 951

- Thank you received: 19

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

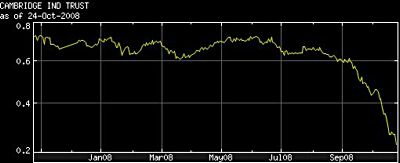

cambridge reit: 27% yield!

- Dongdaemun

- Topic Author

- Offline

- Platinum Member

-

Less

More

17 years 3 months ago #606

by Dongdaemun

cambridge reit: 27% yield! was created by Dongdaemun

just sharing an excellent posting by david yee in another forum (wallstraits.com): am vested in Cambridge and loaded some more shares on Friday. Following are what i like about this counter and personally I think the risk to reward ratio is good... 27% dividend yield and almost 60-70% discount to NTA. Even if price drop by 50%, NTA still $0.39 way above $0.23 last traded price. Just collect dividend for 5 years... Investment = FOC and which remain land and building space with lease from 30 to 50 years. I call this dirt cheap that is difficult to find except in this Sub-Prime Sales. a) All income and asset are in Singapore. b) All lease average more than 6.4 years to expiry. c) All lease come with more step up in rental not downward. d) NTA is $0.79 vs last traded price of $0.23 (enough safety margin) e) Dividend Yield now about 27% f) Security Deposit of 17 months in case of tenant default g) 43 Industrial Property - different tenant and risk is distributed h) Different Industrial Property including warehousing, car showroom, repair shops, light industrial, etc. i) Interest Rate is hedge for 5 years starting 1st Qtr 2008 means not going to be affected by any increase in interest rate. Only key concern at this moment is the refinancing of >$300 million loan which going to be payable in early 2009. HSBC is tasked to hold the refinancing and complete by 3rd Qtr 2008.

Please Log in to join the conversation.

- Dongdaemun

- Topic Author

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

17 years 3 months ago #607

by Dongdaemun

Replied by Dongdaemun on topic Re:cambridge reit: 27% yield!

Please Log in to join the conversation.

- Dongdaemun

- Topic Author

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

17 years 3 months ago #608

by Dongdaemun

Replied by Dongdaemun on topic Re:cambridge reit: 27% yield!

hv just found a Kim Eng Securities report this month on Cambridge Industrial Trust (CIT): All eyes are on whether CIT can refinance by 3Q08, the S$390m loan due in Febââ¬â¢09. Its weaker profile of single-tenanted and sale-and-leaseback arrangements for all its leases is also a cause for concern. We believe these have been reflected in the 21.8% yield. On the bright side, the potential success in securing Islamic financing could help diversify its sources of funding. For lease arrangements, its security deposits on leases averaging 17 months can provide a buffer against default. Against macro-economic headwinds, a rebound may be slow, though downside is limited.

Please Log in to join the conversation.

- Dongdaemun

- Topic Author

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

17 years 3 months ago #609

by Dongdaemun

Replied by Dongdaemun on topic Re:cambridge reit: 27% yield!

results : 29th Oct: CapitaRetail China Trust 29 Oct: CDL Hospitality Reit 30 Oct: Cambridge Industrial Trust 4 Nov: Parkway Life REIT

Please Log in to join the conversation.

17 years 3 months ago #615

by MacGyver

Replied by MacGyver on topic Re:cambridge reit: 27% yield!

Hmm... If the refinancing costs is 100 basis point higher next week, you can kiss goodbye to your DPU assumption? Please be careful, u have to take into consideration that DPU could be cut next year given higher cost of financing. There was a Shipping trust recently who wants to rewards shareholders with units instead of cash... shows you how bad the corporate financing is now.

Please Log in to join the conversation.

- Dongdaemun

- Topic Author

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

17 years 3 months ago #626

by Dongdaemun

Replied by Dongdaemun on topic Re:cambridge reit: 27% yield!

macarthurcook industrial reit is stabilising at 33 cents. the yield is around 28%... the reit manager posted an interesting business update that could inspire confidence. see link :

info.sgx.com/webcoranncatth.nsf/VwAttach...ct08.pdf?openelement

Please Log in to join the conversation.

Time to create page: 0.223 seconds