- Posts: 809

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

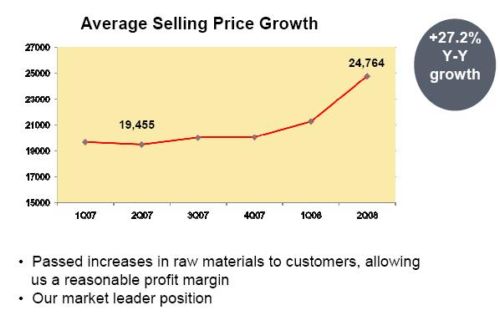

China Sunsine raised its average selling price by 27%!

17 years 6 months ago - 17 years 6 months ago #48

by Mel

China Sunsine raised its average selling price by 27%! was created by Mel

wow, this stock may have been a disappointment in terms of performance. and people never expected it to have strong pricing power. after all, Sunsine\'s products are commodities - just chemicals for the tyre-making industry. but latest results: look at its 27% jump in ASP, which led to its net profit for Q2 to be up 52%.

in June, CIMB kept China Sunshine Chemical at Outperform; target price at $0.49. Says recent discussion with management reinforces belief that earnings momentum remains good for the rest of 2008. \"Sunshine has been able to pass on rising raw material costs through higher selling prices,\" says broker; expects gross margins to stay at 20%-21% for FY08 from 20% in FY07. Adds, \"we see catalysts from further deliveries of improved results and potential M&As.\"

Last edit: 17 years 6 months ago by Mel.

Please Log in to join the conversation.

16 years 6 months ago #1679

by Mel

Replied by Mel on topic Re:China Sunsine raised its average selling price by 27%!

how now can fly or not? several analysts have set the target prices high - even got 42 cts by Winston Peak of AmFraser. PE not so cheap. if u annualise the 09 earnings, may become 8-9 X.

Please Log in to join the conversation.

16 years 6 months ago #1681

by Bestworld

Replied by Bestworld on topic Re:China Sunsine raised its average selling price by 27%!

Sure....flying now!! World NO 1 in this business, deserved more than PE8-9x!! Some more they have RM286m CASH!

Please Log in to join the conversation.

Time to create page: 0.220 seconds