- Posts: 261

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Dutech -- will there be higher takeover offer?

4 years 7 months ago - 4 years 7 months ago #25805

by BNN

Dutech -- will there be higher takeover offer? was created by BNN

Dutech privatisation:

1. 2 independent directors -- Dr Hedda Juliana im Brahm-Droege and Mr Christoph Hartmann - disagree with IFA recommendation to accept 40-cent offer. Too low lah.

Both are connected to the Droege Group.

2. Droege Capital GmbH holds 8.8%, and is a stumbling block to delisting by the Offeror (ie CEO Dr Liu). Another subst. shareholder Robert Stone holds 6.5%.

Together they can block the privatisation by preventing Offeror from achieving 90% threshold.

Many shaeholders not happy either. Just look at the low acceptance offer as at 22 June 2021 -- only 46.19% takeup, including controlling shareholder. U know 40 cents is not going to cut it.

3. The Offeror has explicitly stated it does not intend to maintain the listing status of the Company.

4. Likely, in my view, Offeror will nego with Droege and agree on a higher offer price. This potential offer price (45 cents? 50 cents? 55 cents? ) will then apply to all other shareholders. Hoping... dyor

Currently the closing date is 5.30 p.m. (Singapore time) on 16 July 2021. It can be extended by Offeror

1. 2 independent directors -- Dr Hedda Juliana im Brahm-Droege and Mr Christoph Hartmann - disagree with IFA recommendation to accept 40-cent offer. Too low lah.

Both are connected to the Droege Group.

2. Droege Capital GmbH holds 8.8%, and is a stumbling block to delisting by the Offeror (ie CEO Dr Liu). Another subst. shareholder Robert Stone holds 6.5%.

Together they can block the privatisation by preventing Offeror from achieving 90% threshold.

Many shaeholders not happy either. Just look at the low acceptance offer as at 22 June 2021 -- only 46.19% takeup, including controlling shareholder. U know 40 cents is not going to cut it.

3. The Offeror has explicitly stated it does not intend to maintain the listing status of the Company.

4. Likely, in my view, Offeror will nego with Droege and agree on a higher offer price. This potential offer price (45 cents? 50 cents? 55 cents? ) will then apply to all other shareholders. Hoping... dyor

Currently the closing date is 5.30 p.m. (Singapore time) on 16 July 2021. It can be extended by Offeror

Last edit: 4 years 7 months ago by BNN.

Please Log in to join the conversation.

4 years 7 months ago #25814

by BNN

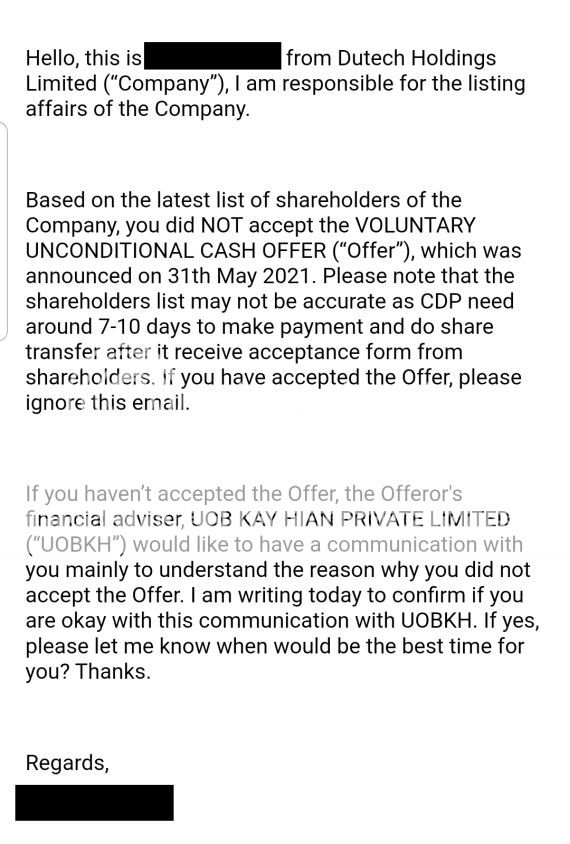

Replied by BNN on topic Dutech -- will there be higher takeover offer?

Offer document states, offer closing date is 16 July but it will remain open for another 14 days. (So that takes us to the end of July!)

Also, any revision to offer price will apply to all who have accepted the (lowball) offer of 40 cents.

Also, any revision to offer price will apply to all who have accepted the (lowball) offer of 40 cents.

Please Log in to join the conversation.

4 years 7 months ago #25815

by hh488

Replied by hh488 on topic Dutech -- will there be higher takeover offer?

Notice share price still stuck at around 40 ct. If likely to re-neg again, there should be momentum to drive the price higher, say 45-50 ct. How come not?

Please Log in to join the conversation.

4 years 7 months ago #25817

by BNN

Replied by BNN on topic Dutech -- will there be higher takeover offer?

Some people are buying 40.5 cents , even 41 cents on the belief that Droeger & Robert Stone will nego with Dutech CEO for a higher price. The 2 own 15% , can block privatisation plan of CEO.

If offer price is raised from 40 cents, the higher price will be applicable to every shareholder, even those who have accepted the offer.

If offer price is raised from 40 cents, the higher price will be applicable to every shareholder, even those who have accepted the offer.

Please Log in to join the conversation.

4 years 7 months ago #25819

by Joes

Replied by Joes on topic Dutech -- will there be higher takeover offer?

Offeror has given a final price of 43.5 cents. Lower than i expected but it's still a nice 7+% gain for a couple of days of owning the stock.

Please Log in to join the conversation.

Time to create page: 0.223 seconds