- Posts: 541

- Thank you received: 72

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Sound Investment

5 years 1 month ago #25611

by Rock

Replied by Rock on topic Sound Investment

UNION GAS

Union Gas has not yet reach its peak growth potential. It's business supplies three forms of fuel:

Liquid Petroleum Gas (LPG)

Compressed Natural Gas (CNG)

Diesel

It’s customers base are residential and commercial.

Since IPO in 2017 Union Gas had acquired and added new businesses every year:

In April 2018 acquired Semgas supply.

In May 2017 Expanded into commercial business for LPG, mainly to Hawker centres, growing from zero to 45 Hawker centres in just a few years.

January 2018 Union Gas Holdings incorporated Union LPG Pte Ltd to provide fuel for more commercial customers such as coffee shops and central kitchens.

In 2017, it launched the UNIONSG mobile app to help streamline the order process and provide cashless payment options for all its customers.

Union Gas had license to supply and retail pipe natural gas (PNG) and liquid natural gas (LNG) since 2017 but made decision to focus on growing and expanding their existing business to gain momentum to be on the right trajectory of growth.

In November 2020 the Group secured contracts to supply PNG to 4 customers who hail from the packaging, food production, hospitality and waste management industries.

The Group has also signed a letter of intent with a potential fifth customer to conduct technical and feasibility studies to supply LNG to its food production plant.

As Union Gas existing business has since gained sufficient traction are now ready to revisit the plans to offer PNG and LNG and promulgate this gas as a viable, sustainable and environmentally friendly alternative fuel.

Following the entering into the contracts, PNG and LNG form the Group’s fourth fuel product.

Between its financial years ended 31 December 2017 and 2019, Union Gas’ revenue and net profit grew at a compound annual growth rate of 41.8% and 55.6% respectively.

Despite the COVID-19 pandemic situation in 2020, the Group achieved strong performance for the six months ended 30 June 2020 with net profit surging 76.7% year-on-year to S$7.0 million on the back of revenue which rose 27.2% to S$43.2 million.

The Group’s healthy showing in recent years was mainly attributed to strong sales of LPG to domestic customers and its entry into the supply of LPG to commercial customers.

The new PNG and LNG business will fuel its future business growth.

Price @ 53 cents;

PE = below 10x

Yield = about 5% (50% payout)

Union Gas has not yet reach its peak growth potential. It's business supplies three forms of fuel:

Liquid Petroleum Gas (LPG)

Compressed Natural Gas (CNG)

Diesel

It’s customers base are residential and commercial.

Since IPO in 2017 Union Gas had acquired and added new businesses every year:

In April 2018 acquired Semgas supply.

In May 2017 Expanded into commercial business for LPG, mainly to Hawker centres, growing from zero to 45 Hawker centres in just a few years.

January 2018 Union Gas Holdings incorporated Union LPG Pte Ltd to provide fuel for more commercial customers such as coffee shops and central kitchens.

In 2017, it launched the UNIONSG mobile app to help streamline the order process and provide cashless payment options for all its customers.

Union Gas had license to supply and retail pipe natural gas (PNG) and liquid natural gas (LNG) since 2017 but made decision to focus on growing and expanding their existing business to gain momentum to be on the right trajectory of growth.

In November 2020 the Group secured contracts to supply PNG to 4 customers who hail from the packaging, food production, hospitality and waste management industries.

The Group has also signed a letter of intent with a potential fifth customer to conduct technical and feasibility studies to supply LNG to its food production plant.

As Union Gas existing business has since gained sufficient traction are now ready to revisit the plans to offer PNG and LNG and promulgate this gas as a viable, sustainable and environmentally friendly alternative fuel.

Following the entering into the contracts, PNG and LNG form the Group’s fourth fuel product.

Between its financial years ended 31 December 2017 and 2019, Union Gas’ revenue and net profit grew at a compound annual growth rate of 41.8% and 55.6% respectively.

Despite the COVID-19 pandemic situation in 2020, the Group achieved strong performance for the six months ended 30 June 2020 with net profit surging 76.7% year-on-year to S$7.0 million on the back of revenue which rose 27.2% to S$43.2 million.

The Group’s healthy showing in recent years was mainly attributed to strong sales of LPG to domestic customers and its entry into the supply of LPG to commercial customers.

The new PNG and LNG business will fuel its future business growth.

Price @ 53 cents;

PE = below 10x

Yield = about 5% (50% payout)

Please Log in to join the conversation.

3 years 11 months ago #25941

by Rock

Replied by Rock on topic Sound Investment

Amount the 3 local banks I’m only vested in DBS. DBS had done well, profit had been growing. The bank had increased it quarterly dividend back from 18 cents to 33 cents. The latest quarterly dividend had been increased further to 36 cents. Total yearly dividend will be $1.44.

Share Price @ $31.23,

Dividend yield = 4.6%

PE = 11.7

My holding in DBS reduced from about 40% to 20% as share price increased as high as $37.

PROPNEX

PropNex had done well as compares to APAC in term of profit and share price. The share had crossed its peak of over $2 but had seen corrected to $1.65 before of government property cooling measures.

Share Price @ 1.65

Dividend yield = 7.57%

PE = 10.2

I had taken some profit when share price overruns

The company profit increased more than 100% and dividend. I had bought back to about 10% holding.

APAC

I have sold all my previous shares.

Recently bought back APAC. It’s profit increased over 100% and dividend also increased. APAC is cheaper than PropNex in term of PE and yield.

Share price @ 66 cents

Dividend yield = 11.3%

PE = 6.6

My holding about 10%

Challenger

5% of my holding.

Company business is sound and dividend yield of 4.8%.

PE = 11.5

Singapore O&G

Company business affected by pandemic for the past 2 years.

At price = 25 cent yield = 6.2%.

At offer price 29.5 cents, yield = 5.25% which I believe the offer price is low.

At 35 cents and above should be fairer offer. Yield = 4.4%.

My holding about 5%.

ESR-REIT

Bought this stock last year below 40 cents, dividend yield of about 7%.

As the merger don’t seem to. move smoothly I had reduced my hold from 10% to 5%.

RIVERSTONE

Riverstone is one of the cheapest stock.

PE = 2.5

Dividend yield = 19%.

Profit margin = 45%.

This company had been increasing dividend over the past 10 years.

The last 2 years profit and dividend increased very high.

Share price at it’s peak of over $2 in August 2020 but since then price had been gradually fall to as Low as 60 cents inspire of the super high profit and dividend paid out.

I had accumulated this stock to 10% of my holding.

Ex dividend of about 12 cents on 14/3/2022.

THAKRAL

Company profitable for the past 2 years. Company business had been diversified into properties and other ventures which are profitable.

Share price @ 57.5 cents

PE = 4.6

Yield = 6.95%

Final dividend = 2 cents

My holding about 5%.

SAMUDERA SHIPPING

Bought some @ 56 cents before announcing of final result.

Fy 2021 performance was super high.

CD 13.5 cents

Share price @ 74.5 cents, dividend yield of 18.5%.

UNION GAS & CASH

I had sold all Union Gas shares after company performance not up to expectations.

My cash holding is about 20%.

Share Price @ $31.23,

Dividend yield = 4.6%

PE = 11.7

My holding in DBS reduced from about 40% to 20% as share price increased as high as $37.

PROPNEX

PropNex had done well as compares to APAC in term of profit and share price. The share had crossed its peak of over $2 but had seen corrected to $1.65 before of government property cooling measures.

Share Price @ 1.65

Dividend yield = 7.57%

PE = 10.2

I had taken some profit when share price overruns

The company profit increased more than 100% and dividend. I had bought back to about 10% holding.

APAC

I have sold all my previous shares.

Recently bought back APAC. It’s profit increased over 100% and dividend also increased. APAC is cheaper than PropNex in term of PE and yield.

Share price @ 66 cents

Dividend yield = 11.3%

PE = 6.6

My holding about 10%

Challenger

5% of my holding.

Company business is sound and dividend yield of 4.8%.

PE = 11.5

Singapore O&G

Company business affected by pandemic for the past 2 years.

At price = 25 cent yield = 6.2%.

At offer price 29.5 cents, yield = 5.25% which I believe the offer price is low.

At 35 cents and above should be fairer offer. Yield = 4.4%.

My holding about 5%.

ESR-REIT

Bought this stock last year below 40 cents, dividend yield of about 7%.

As the merger don’t seem to. move smoothly I had reduced my hold from 10% to 5%.

RIVERSTONE

Riverstone is one of the cheapest stock.

PE = 2.5

Dividend yield = 19%.

Profit margin = 45%.

This company had been increasing dividend over the past 10 years.

The last 2 years profit and dividend increased very high.

Share price at it’s peak of over $2 in August 2020 but since then price had been gradually fall to as Low as 60 cents inspire of the super high profit and dividend paid out.

I had accumulated this stock to 10% of my holding.

Ex dividend of about 12 cents on 14/3/2022.

THAKRAL

Company profitable for the past 2 years. Company business had been diversified into properties and other ventures which are profitable.

Share price @ 57.5 cents

PE = 4.6

Yield = 6.95%

Final dividend = 2 cents

My holding about 5%.

SAMUDERA SHIPPING

Bought some @ 56 cents before announcing of final result.

Fy 2021 performance was super high.

CD 13.5 cents

Share price @ 74.5 cents, dividend yield of 18.5%.

UNION GAS & CASH

I had sold all Union Gas shares after company performance not up to expectations.

My cash holding is about 20%.

Please Log in to join the conversation.

3 years 11 months ago #25959

by Rock

Replied by Rock on topic Sound Investment

STOCKS OF THE SEASON

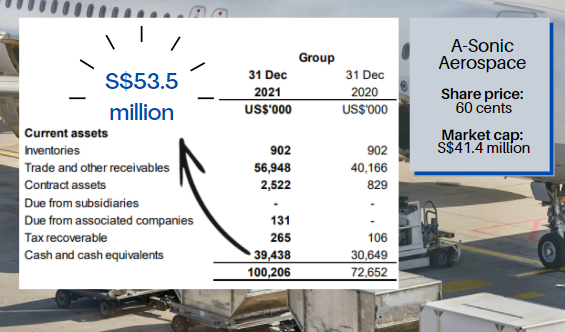

A-SONIC AEROSPACE

Market Cap = $46.5m

EPS = 13.8 cents

Cash flow = $53.5m

Cash/share = 77 cents

Share Price = 67 cents

P/E = 4.82

Dividend = 5.3 cents

Dividend Yield = 7.9%

RIVERSTONE HOLDING

Market Cap = $1.475b

EPS = 30.8 cents

Cash flow = $505,691m

Share Price = 99.5 cents

P/E = 3.2

Dividend = 15.4 cents

Dividend Yield = 15.45%

SAMUDERA SHIPPING

Market Cap = $492m

EPS = 32.4 cents

Cash flow = US$186m

Share Price = cents = 91.5 cents

P/E = 2.82

Dividend = 13.5 cents

Dividend Yield = 16.9%

GEO ENERGY

Market Cap = $655.2m

EPS = 17.1 cents

Cash flow = US$272m

Share Price = cents

P/E = 2.7

Dividend = 9 cents

Dividend Yield = 19.35%

GLOBAL TESTING

Market Cap = $52.81m

EPS = 36.2 cents

Share Price = $1.50

P/E = 4.14

Dividend = 20 cents

Dividend Yield = 13.33%

REX INTERNATIONAL

Market Cap = $486.7m

EPS = 7 cents

Cash flow = US$86.91m

Share Price = 35.5 cents

P/E = 5.07

Dividend = 0.5 cents

Dividend Yield = 1.4%

A-SONIC AEROSPACE

Market Cap = $46.5m

EPS = 13.8 cents

Cash flow = $53.5m

Cash/share = 77 cents

Share Price = 67 cents

P/E = 4.82

Dividend = 5.3 cents

Dividend Yield = 7.9%

RIVERSTONE HOLDING

Market Cap = $1.475b

EPS = 30.8 cents

Cash flow = $505,691m

Share Price = 99.5 cents

P/E = 3.2

Dividend = 15.4 cents

Dividend Yield = 15.45%

SAMUDERA SHIPPING

Market Cap = $492m

EPS = 32.4 cents

Cash flow = US$186m

Share Price = cents = 91.5 cents

P/E = 2.82

Dividend = 13.5 cents

Dividend Yield = 16.9%

GEO ENERGY

Market Cap = $655.2m

EPS = 17.1 cents

Cash flow = US$272m

Share Price = cents

P/E = 2.7

Dividend = 9 cents

Dividend Yield = 19.35%

GLOBAL TESTING

Market Cap = $52.81m

EPS = 36.2 cents

Share Price = $1.50

P/E = 4.14

Dividend = 20 cents

Dividend Yield = 13.33%

REX INTERNATIONAL

Market Cap = $486.7m

EPS = 7 cents

Cash flow = US$86.91m

Share Price = 35.5 cents

P/E = 5.07

Dividend = 0.5 cents

Dividend Yield = 1.4%

Please Log in to join the conversation.

3 years 11 months ago #25960

by Joes

Replied by Joes on topic Sound Investment

Please Log in to join the conversation.

3 years 7 months ago #25993

by Joom

Replied by Joom on topic Sound Investment

Recovery post-Covid is an interesting theme in which one stock looks good -- KSH Holdings (34 cents). Current FY23 earnings expected to grow double digit, with contribution from Gaobeidian project in China.

Company paid generous 2 cents in FY22, so dividend yield of 5.7% is very decent.

Company has net cash of S$23.2 million.

Company paid generous 2 cents in FY22, so dividend yield of 5.7% is very decent.

Company has net cash of S$23.2 million.

Please Log in to join the conversation.

3 years 1 month ago - 3 years 1 month ago #26017

by Rock

Replied by Rock on topic Sound Investment

Reporting season is drawing near, below are some of the stocks worth accumulating. These stocks are trading at very low PE ratio, paying high dividend and are cash rich with low or no debt.

SAMUDERA SHIPPING

1H 2022/2021 on 27/7/2022

Rev = US$476m/$209m (+128%)

G.Pf = $185.7m/$45m (+315%)

N.Pf = US$172.4m/$38m(+355%)

Cash flow from US$105m to US$244m

Debt = US$25.28m

NAV = US81.27 cents

* EPS = 43.5 cents

* EPS = US31.92 cents

* Dividend = S7 cents (0.5 cents)

9 months Based on a preliminary assessment of the Financial Results, the Group has recorded a significant improvement in revenue and earnings for 9M2022 as compared to 9M2021.

PE = slightly over 1x

Expect bumper final dividend

GEO ENERGY

9M2022 on 9/11/2022

Rev = US$533m

N.Pf = US$142m

Div = 1 cents

Total dividend paid for 9 months = 5 cents.

Cashflow = US$214.7m (S$300m)

Share @ 32.5 cents PE = less than 2x.

A-SONIC

1H 2022/2021 on 10/8/2022

Rev = $222m/$192.6m (+15.3%)

N.Pf = US$5.4m/$4m (+34.5%)

EPS =US5.94 cents (S8.18 cents)

Cash flow from $29.76m to $48.3m

NAV = US61.15 cents (S84 cents)

Share price had been increasing for the past 2 months from about 60 cents to 73.5 cents, PE = 6.6x

Possible takeover target as CEO has been actively buying up the shares.

QUOTE BY PETER LYNCH

BECOMES HARDER TO BE OUT OF THE BUSINESS IF YOU OWE LITTLE OR NOTHING TO ANYONE

SAMUDERA SHIPPING

1H 2022/2021 on 27/7/2022

Rev = US$476m/$209m (+128%)

G.Pf = $185.7m/$45m (+315%)

N.Pf = US$172.4m/$38m(+355%)

Cash flow from US$105m to US$244m

Debt = US$25.28m

NAV = US81.27 cents

* EPS = 43.5 cents

* EPS = US31.92 cents

* Dividend = S7 cents (0.5 cents)

9 months Based on a preliminary assessment of the Financial Results, the Group has recorded a significant improvement in revenue and earnings for 9M2022 as compared to 9M2021.

PE = slightly over 1x

Expect bumper final dividend

GEO ENERGY

9M2022 on 9/11/2022

Rev = US$533m

N.Pf = US$142m

Div = 1 cents

Total dividend paid for 9 months = 5 cents.

Cashflow = US$214.7m (S$300m)

Share @ 32.5 cents PE = less than 2x.

A-SONIC

1H 2022/2021 on 10/8/2022

Rev = $222m/$192.6m (+15.3%)

N.Pf = US$5.4m/$4m (+34.5%)

EPS =US5.94 cents (S8.18 cents)

Cash flow from $29.76m to $48.3m

NAV = US61.15 cents (S84 cents)

Share price had been increasing for the past 2 months from about 60 cents to 73.5 cents, PE = 6.6x

Possible takeover target as CEO has been actively buying up the shares.

QUOTE BY PETER LYNCH

BECOMES HARDER TO BE OUT OF THE BUSINESS IF YOU OWE LITTLE OR NOTHING TO ANYONE

Last edit: 3 years 1 month ago by Rock.

Please Log in to join the conversation.

Time to create page: 0.284 seconds