Excerpts from UOB KH report

Analysts: Heidi Mo & John Cheong

China Sunsine Chemical (CSSC SP)

2H22: Results In Line With Expectations;

Stronger Performance Forecast |

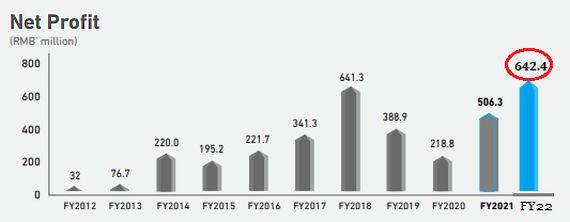

Sunsine recorded 2H22 net profit of Rmb214.9m (-10.9% yoy), taking 2022 core profit to Rmb606.3m (+11.8% yoy), largely in line with our forecast.

|

China Sunsine

|

|

Share price:

46.5 c

|

Target:

57.5 c

|

The lower 2H22 revenue was driven by a decline in sales volume and ASPs.

While we have raised earnings expectations for 2023-24 due to capacity expansion projects, we also accounted for an expected decline in crude oil price by the US EIA.

Maintain BUY with a 28% higher target price of S$0.575. |

RESULTS

| • Results in line with expectations. |

China Sunsine Chemical’s (Sunsine) 2H22 net profit fell by 11% yoy to Rmb214.9m, bringing 2022 core profit to 95% of our full-year estimates.

2H22 performance came on the back of lower revenue of Rmb1,802.5m (-8.4% yoy) due to both a decline in sales volume to 95,731 tonnes (-6.4% yoy) and a 2% yoy decrease in ASPs of rubber accelerators to Rmb18,532/tonne.

For 2022, overall ASP increased by 8% yoy to Rmb20,237/tonne, as Sunsine was able to pass on the increase in raw material prices to customers.

This drove the 2.7% yoy rise in 2022 revenue, offset by the 5% lower sales volume.

2022 core profit of Rmb606.3m (+11.8% yoy) excludes a Rmb36.1m tax refund received in 1H22 for the overpayment of 2021 tax expenses.

2022 core profit of Rmb606.3m (+11.8% yoy) excludes a Rmb36.1m tax refund received in 1H22 for the overpayment of 2021 tax expenses.

| • Higher margins recorded; special dividend proposed. |

Due to lower recorded revenue, gross profit fell by 4.9% yoy to Rmb469.9m in 2H22.

|

Higher valuation

|

|

“Previously, we valued Sunsine based on 4.9x (-0.5SD below mean) 2023F PE, in line with its historical five-year average. We have raised our valuation multiple due to a less challenging outlook with China’s reopening.”

-- UOB KH

|

However, 2H22 gross margin expanded 1.0ppt yoy to 26.1% (2H21: 25.1%, 1H22: 34.3%), with a more favourable sales mix comprising a higher proportion of antioxidant products.

Full-year gross and core profit margins also improved by 2.3ppt yoy to 30.4% and by 1.3ppt yoy to 15.9% respectively.

Management has proposed to pay out S$0.025/share, consisting of a final DPS of S$0.01/share and a special DPS of S$0.015/share (2021: S$0.01/share).

| • Continuous expansion projects undertaken. |

In Oct 22, Sunsine commenced the construction of a project with a 20,000 tonnes/year capacity for an intermediate material used to produce many kinds of accelerators.

Construction of Phase 2 of an insoluble sulphur project will also increase insoluble sulphur capacity by 50% to 90,000 tonnes/year.

These projects are expected to be completed by end-23, and are likely to lift sales volume when operational.

STOCK IMPACT

| • Strong balance sheet and healthy cash flow. |

As of end-22, total cash and bank balances stood at Rmb1,364.9m with no debt outstanding, which equates to Rmb1.41/share (S$0.27/share).

Additionally, free cash flow generated in 2022 remained positive at Rmb122m (2021: Rmb163m) despite capacity expansion efforts.

Correspondingly, net cash per share is estimated to increase from Rmb0.86/share (S$0.16/share) to Rmb1.06/share (S$0.20/share) and Rmb1.21/share (S$0.23/share) in 2023 and 2024 respectively.

• Due to lower expectations for crude oil price according to US Energy Information Administration (EIA), we have tweaked our 2023 and 2024 gross margin assumptions from 30.0% to 29.0% and 30.0% to 29.1% respectively.

• Accordingly, we have raised earnings estimates for 2023/24 by 6%/7% to Rmb491m/Rmb575m respectively.

|

• Maintain BUY with a 28% higher target price of S$0.575 (from S$0.45), pegged to a multiple of 5.9x 2023F PE, its long-term average mean.

Previously, we valued Sunsine based on 4.9x (-0.5SD below mean) 2023F PE, in line with its historical five-year average.

We have raised our valuation multiple due to a less challenging outlook with China’s reopening.

|

SHARE PRICE CATALYST

• China’s reopening leading to higher consumption.

• Production commencement for new capacities.

Full report here.