|

SINARMAS LAND, an Indonesian property developer listed on the Singapore Exchange, made a very large share buyback of $88.5 million last Friday (Sept 18).

And it was its first buyback since as far back as 2010, according to checks on the SGX website.

Adding to the exceptional characteristic of the buyback, this was the largest single-day buyback seen in a long time among Singapore-listed companies.

Sinarmas Land announced it bought 149,810,900 shares "by way of market acquisition", amounting to 4.92% of its issued capital, at 59 cents a share.

The purchase accounted for 98.5% of the volume of Sinarmas Land shares traded on that day.

The share price closed unchanged at 60 cents.

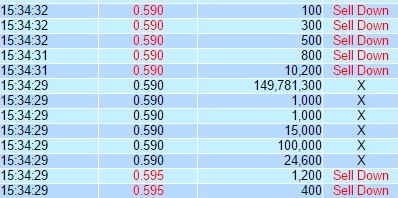

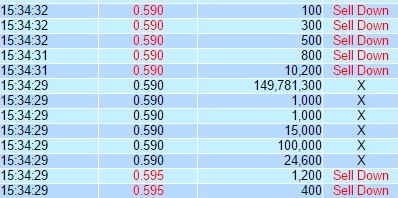

Source: PoemsUsing Poems, a check on individual trades showed that a single block of 149,781,300 shares was transacted during late afternoon of that day. Source: PoemsUsing Poems, a check on individual trades showed that a single block of 149,781,300 shares was transacted during late afternoon of that day.

Was this a married deal, and was Sinarmas Land the buyer?

Sinarmas Land's investor relations manager, Ronald Ng, said it was not a married deal, when contacted by NextInsight.

"This is not a married deal.

"As announced, the Company has obtained shareholders approval in the last AGM to conduct share buyback when the Board deem it's necessary. In this instance, SML has acquired the shares through the open market and we do not know who the seller or sellers are."

The acquired shares will be kept as treasury shares.

Upcoming warrant conversion

| Stock price |

S0.60 |

| 52-week range |

0.420 - 0.855 |

| PE (ttm) |

7.36 |

| Market cap |

S$1.83 billion |

| Price/book |

1.07 |

| Dividend yield |

0.83% |

| Outstanding shares |

3.042 billion |

The acquired shares will probably come in handy soon for release as shares to Sinarmas Land warrant holders.

There are 1,520,978,744 warrants outstanding which will expire on 18 Nov 2015. They are "in the money" (ie, they are worth exercising) as warrant holders pay 10 cents per warrant to convert them into shares which currently are worth 60 cents.

The warrants now trade at 41.5 cents, or an effective 14% discount to the underlying shares after accounting for the 10-cent exercise price.

Assuming all the warrants get converted, Sinarmas Land will receive a cash inflow of S$152.1 million, which will more than replenish its coffers after S$88.5 million was spent on last Friday's share buyback.

|

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors