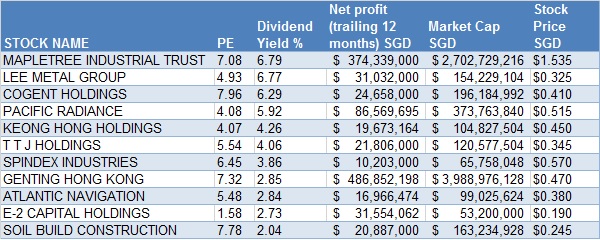

SGX-listed stocks with net profit of at least S$10 million, price earnings < 8 and paying dividends. Data: NextInsight / Bloomberg

SGX-listed stocks with net profit of at least S$10 million, price earnings < 8 and paying dividends. Data: NextInsight / Bloomberg

THE SLOWDOWN in global commodities demand, a tougher construction market, depressed oil prices and slowing GDP growth may have cast their shadow on the local stock market, but this has also made some stocks more attractively priced.

They include a structural steel manufacturer that defies the razor thin margins of the construction industry by operating a dormitory business, as well as a logistics player that gets around the limitations of land scarce Singapore by providing warehousing space in "high-rise housing".

Here are some reasons why you should consider stocks in the table above which we derived from Bloomberg, screened using three key metrics -- PE ratio, dividend and profitability.

Mapletree Industrial Trust | Dividend Yield 6.8% SG3 is a data centre at One-North that Mapletree Industrial Trust developed for Equinix, a global interconnection and data centre company routing more than 90% of the world’s internet traffic over 900 telecommunication exchanges.

SG3 is a data centre at One-North that Mapletree Industrial Trust developed for Equinix, a global interconnection and data centre company routing more than 90% of the world’s internet traffic over 900 telecommunication exchanges.

Defying the muted local stock market sentiment, Mapletree Industrial Trust’s stock price has appreciated 9% over the past 12 months to reach S$1.55.

One of the largest industrial property owners in Singapore with 84 properties valued at S$3.4 billion, Mapletree distributed S$180.8 million of its income in FY2014/2015 as dividends, up 8.9% year-on-year.

Distribution per unit (DPU) was 1.43 cents, translating into a yield of 6.8% based on a recent stock price of S$1.535.

Its DPU CAGR was a healthy 7.44% for the past 4 years, since listing in October 2010.

Even though overall rents for multi-user industrial developments are expected to ease further due to supply pressures, there are some bright spots.

» Rents for business parks and higher specification buildings are expected to strengthen on the back of a tightening in supply

» The trust manager has a strategy of maintaining a balanced mix of single-user assets and multi-tenanted buildings in its portfolio.

Single-user assets provide portfolio stability with their longer lease periods and built-in rental escalations, while multi-tenanted buildings enable the trust to capture rental upside during a buoyant rental market due to their shorter lease periods.

» In addition, the trust manager ensures that its lease expiries are well-staggered without concentration in any single year.