Notes from the AGM of Hongwei Technologies, whose stock has been suspended from trading since March 2011.

Venue: The Heritage Place, 21 Tan Quee Lan Street

Time & date: 2 pm, July 13

I ATTENDED the AGM of Hongwei Technologies yesterday afternoon (July 13) at The Heritage Place near Rochor Road. Unusual choice of place but anyway.....

Shareholders (about 25 were there) had lots of questions regarding the situation leading to the suspension of trading and whatever had happened after that.

I will share my notes here of the Q&A but first, I would say that Koo Ah Seang, the ED and CEO, managed the situation well by calmly answering questions thrown at him. He had been appointed only in March as Contract CEO to assist the interim chairman (also appointed in March) after the accounting issue broke out.

My notes & observations:

1. As was expected, the two key people from the management (who are also the largest shareholders) didn’t show up. They are Lin Jimiao, executive chairman and CEO (redesignated as executive director for the time being), and his wife, Zuang Xinxin, who is a non-executive director.

2. Tembusu Growth Fund, which owns 13.9 m shares or 5.67% stake, had a rep there. He fired the first 2 questions – what is the progress of the Special Audit and when might the suspension of stock trading be over?

Mr Koo basically said Hongwei had been as forthcoming as was possible. After all, it had made 20 announcements to keep the market updated. The management has been working closely with the Singapore Exchange, external auditors and Special Auditor to resolve the issues.

3. He didn’t want to comment beyond what had been announced. “What is not finalized, I can’t tell you.”

4. What exactly is the issue being investigated? Kevin Kwok, senior partner of Ernst & Young, the external auditor, said it has to do with a “significant” disparity between the cash balance stated in the financial statements and the cash that can be confirmed to be in Hongwei’s bank accounts. Despite being pressed, neither he nor the board would say how big the disparity is.

5. There are also some issues surrounding the prepayments for goods and for capex for new production lines. The company had made large prepayments for raw materials. According to the COO, this was to lock in prices which might escalate if the oil price moves up.

6. The prepayments were done in January and February this year. Prepayments tripled from end-2010 to end-March 2011 - OMG!

7. Any guarantee from the suppliers? Yes, Hongwei can take delivery of the goods if and when it wants to.

8. Who now controls the finance seal of Hongwei? Mr Koo said he did, and proper steps have been put in place to ensure the right people use it in the course of business.

9. Why was there a share placement last September that brought in an insignificant S$4.2 million when the company was going to end the year with about RMB130 million in cash? The CFO Tony Lam said the placement was to ‘introduce investors’ into the company. They were German investors who would not have found it easy to buy 20 m shares on the open market --- mainly because the stock was illiquid as Chairman Lin and his spouse owned 70% of the issued share capital.

The querying shareholder took issue with the placement. He said the placement was too cheap at PE of 4. Instead, the investors should have been asked to buy on the open market, thereby causing the price to rise and benefitting all shareholders.

10. At the AGM, there was a special resolution for shareholders to vote on. It is the usual 'authority to issue shares' but the shareholder mentioned above in Note 9 urged fellow shareholders to vote against it.

11. What processes have been changed to ensure the accounting issues do not happen again? Mr Koo cited an example: Hongwei had changed banks, from a local one to an international and “stronger’ one which “understood the requirements.”

12. The COO said one of the two subsidiaries of Hongwei continues operations as normal. But not the other subsidiary where another plant, rather old, has stopped operations for 2 months already and is being revamped.

13. Mr Lin and his wife continue to report to work and receive their normal salaries. The CFO highlighted that the lady receives a nominal salary of RMB10,000 a month.

Many questions remain unanswered and, hopefully, more light will be shed soon. Questions such as: what is the cash level of the company (it had dropped from RMB130 m as at end-2010 to only about RMB10 m as at end-March 2011)?

Who should eventually take the rap for the accounting issues? Was any money illegally stuffed into anyone's pockets? Will Hongwei survive as a going concern?

Given these dark clouds, shareholders should be happy if they can get back at least 50% of their capital back if and when stock trading resumes.

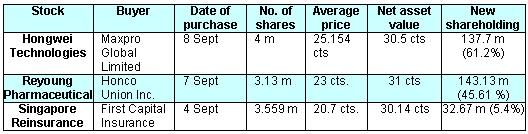

Recent story: CEO's wife on last-minute 510K sgd shopping of shares

Recent story on another S-chip: Shame on CHINA MILK management!

Got 20 announcements, got AGM and got Annual Report.