Confident of a rebound in Indonesia, OSK-DMG is forecasting that XMH will achieve $143 million revenue and $15.3 million net profit for the current FY.FOR SOME 6-9 months leading to the recent Indonesian Presidential elections, orders from XMH Holdings' customers in Indonesia dried up, while those whose goods had arrived at XMH deferred taking delivery.

Confident of a rebound in Indonesia, OSK-DMG is forecasting that XMH will achieve $143 million revenue and $15.3 million net profit for the current FY.FOR SOME 6-9 months leading to the recent Indonesian Presidential elections, orders from XMH Holdings' customers in Indonesia dried up, while those whose goods had arrived at XMH deferred taking delivery.Finally, on July 22, the winner of the election was declared -- Joko Widodo.

XMH's results for its 1QFY15 ended July 2014 thus did not capture any recovery in its Indonesian business.

Its inventory for Indonesian customers piled up at its warehouse in Sungei Kadut and accounted for the bulk of the S$23.7 million inventory on the balance sheet for 1QFY15.

In comparison, a year earlier at end-July 2013, its inventory stood at S$16.6 million.

L-R: Alphonsus Chia, deputy CEO of XMH Holdings, with Cliff Loke, MD of Mech-Power, which became a 100% subsidiary of XMH in Sept 2013.

L-R: Alphonsus Chia, deputy CEO of XMH Holdings, with Cliff Loke, MD of Mech-Power, which became a 100% subsidiary of XMH in Sept 2013. NextInsight file photoWith a gradual return to normalcy in business after the elections, XMH's customers in Indonesia have begun taking delivery, or placing orders, in 2Q (Aug-Oct 2014).

"We think the worst is over for XMH's business in Indonesia," said Alphonsus Chia, the deputy CEO of XMH during a 1Q results briefing last week.

Revenues in the near term will be boosted by customers collecting the engines they had deferred picking up, said Mr Chia.

The flow of new orders is picking up but may be described as "sluggish".

In the meantime, what has contributed substantially to XMH's bottomline is Mech-Power, the 100% subsidiary which was acquired in Sept 2013.

With sales of its standby gen-sets mainly in Singapore, Mech-Power contributed S$19.1 million out of the S$25.8 million group revenue in 1Q.

The remaining $6.7 million of group revenue came from XMH's core business -- chiefly as a diesel engine and propulsion solutions provider to the marine industry -- which was a sharp drop from the $21.4 million recorded in 1QFY14.

Jessie Koh, finance director of XMH Holdings.

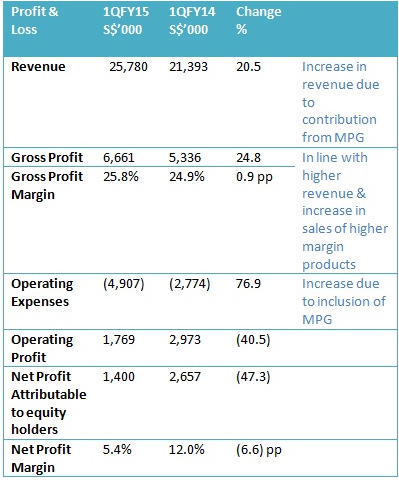

Jessie Koh, finance director of XMH Holdings. NextInsight file photoAs a group, XMH reported a 20.5% revenue growth in 1Q, 24.8% growth in gross profit -- but a 47.3% fall in net profit after factoring in a 76.9% jump in operating expenses with the consolidation of Mech-Power.

Going forward, the outlook at Mech-Power continues to be strong and "way above what we expected when we made the acquisition," said Mr Chia.

Back then, Mech Power was clocking annual revenue of the order of about S$28 million.

What's driving Mech Power's growth is the supply of gen-sets to new data centres that are being set up in Singapore, which accounts for about half of its revenue.

In the meantime, XMH's efforts at penetrating new markets for its core business are paying off.

In April 2014, XMH made a breakthrough in Vietnam with contract wins for more than 24 units of Mitsubishi marine engines. Another 10 units are expected to be secured in the next two months.

|

|

XMH's Powerpoint presentation slides are available on the SGX website.

For more, read: XMH HOLDINGS: To Acquire 80% Of Z-Power For S$13.2 Million