Excerpts from analysts' reports

OSK-DMG raises target price for XMH Holdings to 42 cents

Analyst: Lee Yue Jer, CFA

XMH Holdings announced that it has entered into a non-binding MOU for the proposed acquisition of 80% of Z–Power Automation Pte Ltd (ZP), a marine controls company and OEM for the Niigata brand of engines and propulsion systems. The purchase consideration is SGD13.2m, to be paid in two tranches, implying a historical P/E of 9.6x before imputing growth. Maintain BUY, with our TP nudged up to SGD0.42 (from SGD0.41).

Z-Power Automation was set up in May 2008, specialising in the design and manufacture of high quality Marine Switchboards, Remote Control Distribution Systems and other integrated Marine Automation products. Photo: CompanyZP is a marine controls systems company under BH Global. ZP was set up in May 2008 and specialises in the design and manufacture of marine switchboards, remote control distribution systems and other integrated marine automation products. It is 60%-owned by BH Global (BHGM SP, NR) with the remainder held by four individuals. ZP will introduce the Niigata brand of engines to XMH’s portfolio. Also, XMH stated that ZP’s revenue for FY13 was SGD21.4m, which we find closely corresponds to BH Global’s marine switchboards segment.

Z-Power Automation was set up in May 2008, specialising in the design and manufacture of high quality Marine Switchboards, Remote Control Distribution Systems and other integrated Marine Automation products. Photo: CompanyZP is a marine controls systems company under BH Global. ZP was set up in May 2008 and specialises in the design and manufacture of marine switchboards, remote control distribution systems and other integrated marine automation products. It is 60%-owned by BH Global (BHGM SP, NR) with the remainder held by four individuals. ZP will introduce the Niigata brand of engines to XMH’s portfolio. Also, XMH stated that ZP’s revenue for FY13 was SGD21.4m, which we find closely corresponds to BH Global’s marine switchboards segment.

Structure of the deal. The purchase consideration of SGD13.2m will be paid in two tranches – SGD10.56m on completion and SGD2.64m after one year. The four individual vendors will remain with ZP for “3+3 years”.

Acquisition at a historical P/E of 9.6x. Assuming that BH Global’s marine switchboard segment earnings are solely contributed by ZP, its FY13 (ended Dec 2013) pre-tax profit was SGD2.08m. After imputing a 17% corporate tax rate, its net profit was SGD1.73m – reflecting a net margin of 8.09%, with the acquisition being priced at an historical P/E of c.9.6x. We think that a part-cash-part-share consideration plus potential growth in ZP would make this deal EPS-accretive to XMH shareholders.

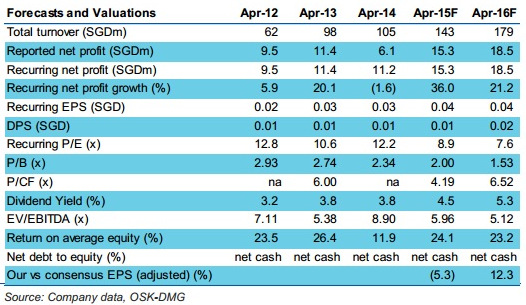

Maintain BUY with a SGD0.42 TP. We continue to expect double-digit growth for XMH, with mid-term core earnings growth driven by: i) contributions from Mech Power Group, ii) the completion of XMH’s Tuas facility in 2Q16, and iii) new contributions and synergies with ZP. While we await more details on ZP, which should follow a successful sale agreement, we incorporate six months of contribution for FY15F and raise our earnings estimates by 2.6/3.4% for FY15F/FY16F. We adjust our TP to SGD0.42 (from SGD0.41), based on a 12x FY15F P/E. Maintain BUY.

Recent story: XMH HOLDINGS: To Acquire 80% Of Z-Power For S$13.2 Million

UOB Kay Hian: Sell-down (-6.5% in last 3 days) of Centurion overdone

Analyst: Loke Chunying

|

Supply concerns over amplified. We note that 70,800 of the new beds (73% of total new beds) are temporary dormitories (on a 3+3 or 3+3+3 years’ lease); while 70% of Centurion’s local beds including Woodlands) are permanent dormitories with more than 20 years of lease remaining. With bulk of the supply being temporary dormitories, we believe the government can easily control the number of dormitories should there be an oversupply. We also note that the current leases for 30,000-40,000 temporary beds are expiring in the next few years, which could help ease the supply gut if the leases are not renewed. Watch CNA video above for glimpses of Centurion's Westlite dormitory in Mandai which is jointly owned by Centurion and Lian Beng Group. |