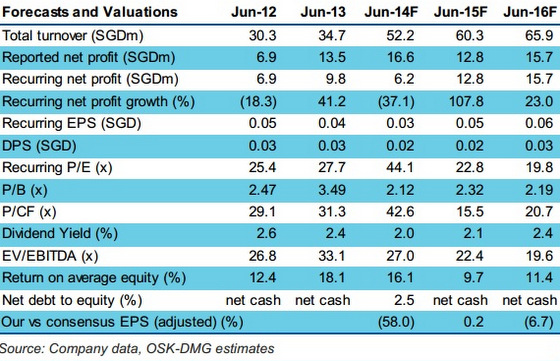

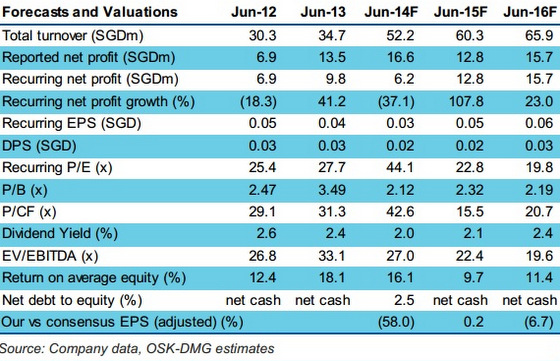

Excerpts from analysts' reportsOSK-DMG forecasts 55% annual earnings growth over FY14-16

|

Analysts: Arshath Mohamed & Shekhar Jaiswal

We remain optimistic on Cordlife’s growth following management’s recent meetings with Singapore- and Malaysia-based investors. We believe its: i) recent entry into high-growth Asian markets, ii) strong pipeline of diagnostics products, and iii) synergies from its investments in markets where it does not have a direct presence, could re-rate the stock.

With an estimated 55% annual EPS growth over FY14-16F, it is trading at a 23x FY15F P/E. BUY.

|

Investors positive about its diversified presence. Investors view Cordlife Group‟s (Cordlife) recent entry into India, Indonesia and the Philippines positively and believe that its exposure to mature markets like Singapore and HK along with high-growth markets should enable it to enjoy stable revenue while benefitting from rising penetration rates in the growth markets.

A cryovial containing processed umbilical cord lining segments. Photo: Company

A cryovial containing processed umbilical cord lining segments. Photo: Company

Local management for each country. Having built successful businesses in Singapore and HK now looking to replicate its business model across the new growth markets.

However, it is cognisant of the need to understand local consumer behavior and is looking to manage its subsidiaries locally, while leveraging on the technical know-how of its businesses in Singapore and HK.

Positive feedback from new products launch. Cordlife’s new higher-margin cord tissue storage offering has received promising response in Singapore, HK and the Philippines, with 35%, 25% and 20% of its new cord blood customers opting for this service respectively. This compares with our conservative estimates of 25%, 15% and 15% respectively. It will also roll out this service in Indonesia by August 2014.

Penetration rate growth not a concern. We estimate that penetration rates in growth markets like India, Indonesia and the Philippines may grow 10% per annum, vs 20-30% recorded during 2007-13. The penetration rates are still at dismally low levels of 0.10-0.20% in these markets, which offer high growth potential.

Valuation remains undemanding. Our DCF-derived SGD1.50 TP implies a 25x FY15F P/E, against a 55% EPS CAGR over FY14-16F, implying a 0.45x FY16F PEG.

Full OSK-DMG report here

|

Study of autistic patients using cord blood

Cordlife is helping to arrange for Singapore autistic children between 3 to 6 years of age to participate in Duke Medicine trials in the U.S. using cord blood stem cells for autism treatment.

The clinical trial is entirely sponsored by Duke Medicine and participants are not required to pay for the costs of treatment. There is also a travel stipend of U$1,000 per trip.

However, the participant must have had his or her cord blood stem cells stored privately.

There are currently about 24,000 autistic patients in Singapore. Autism affects about 216 children in Singapore every year.

Current treatment for autistic patients is limited to rehabilitation therapy to help improve their social interaction, communication skills and flexibility.

According to Duke Medicine, cord blood has been shown to lessen the clinical and radiographic impact of hypoxic brain injury and stroke in animal models and in infants with hypoxic ischemic encephalopathy.

Cord blood also engrafts and differentiates in the brain, facilitating neural cell repair in animal models and human patients with inborn errors of metabolism undergoing allogeneic, unrelated donor cord blood transplantation.

In this study, the investigators hypothesize that infusion of a patient's own cord blood cells can offer neural protection or repair in the brain and reduction of inflammation associated with this disorder.

Any member of the public in Singapore who is keen to find out more or participate in the Duke Medicine research program can contact Cordlife Group Limited at 6238 0808 or email to This email address is being protected from spambots. You need JavaScript enabled to view it..

|

Recent story: CORDLIFE: Analysts expect strong FY2014 growth

A cryovial containing processed umbilical cord lining segments. Photo: Company

A cryovial containing processed umbilical cord lining segments. Photo: Company