Cordlife's strategy is to transform from an operator of cord blood storage banks to a healthcare service provider for mother and child has translated into strong profit growth.

Cordlife's strategy is to transform from an operator of cord blood storage banks to a healthcare service provider for mother and child has translated into strong profit growth. ANALYSTS ARE expecting healthcare service provider Cordlife Group to deliver strong results for its financial year ending 30 June 2014 (FY2014).

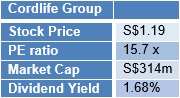

ANALYSTS ARE expecting healthcare service provider Cordlife Group to deliver strong results for its financial year ending 30 June 2014 (FY2014).

Voyage Research, Macquarie Bank and Maybank analysts issued positive calls on the stock after it reported a surge of 49% in 9MFY2014 earnings.

|

“FY2016/2015E is set to be a strong year as positive catalysts converge, helped by new product rollouts, Singapore’s Golden Jubilee Year and stronger contributions from China.” - Maybank Kim Eng analysts John Cheong and Gregory Yap |

|

“Cordlife experienced huge growth in the emerging markets, particularly India where deliveries grew more than 45% year-on-year. It now has presence in more than 50 Indian cities and is looking to expand further. - Voyage Research analyst Ng Kian Teck |

"Our umbilical cord lining banking services have received good market acceptance," said Cordlife CEO Jeremy Yee.

"Our umbilical cord lining banking services have received good market acceptance," said Cordlife CEO Jeremy Yee.

NextInsight file photoNew product rollouts

>> Cord lining storage

Cordlife is a leading provider of cord blood and cord lining banking services in Singapore, India, the Philippines, Malaysia, Indonesia and Hong Kong. It also has a presence in Thailand and China.

According to Mr Ng, cord blood banking now forms about 90% of Cordlife's revenue and he believes that new services will help propel its revenue growth over the next five years.

In addition to cord blood storage, Cordlife has progressively launched storage services for umbilical cord lining in India (2010), Hong Kong (March 2011), Singapore (May 2013) and the Philippines (August 2013).

It also recently launched the service in China and Malaysia.

Stem cells harvested from cord lining have the potential of treating many more disorders than the hematopoietic stem cells harvested from cord blood.

>> Metabolic screening

Last October, the Group’s Indian subsidiary launched a metabolism diagnostic service known as MetaScreen that detects genetic defects so that diseases can be treated early.

Metabolic disorders are usually not apparent at the time of birth.

If left undiagnosed and untreated, the baby can develop irreversible damages such as neurological impairment and physical deformities.

Hence, early detection is critical in preventing adverse effects and providing essential care.

Most countries in the European Union and some parts of Asia and United States have already made newborn screening for metabolic disorders compulsory.

For example, Congenital Hypothyroidism, a disorder that affects one in 4,000 people, is the disorder most commonly identified by routine metabolic screening.

Affected babies don't have enough thyroid hormone and so experience retarded growth and brain development. (The thyroid, a gland at the front of the neck, releases chemical substances that control metabolism and growth.)

If the disorder is detected early, a baby can be treated with oral doses of thyroid hormone to permit normal development.

Not only is MetaScreen non-invasive as urine samples are tested instead of the traditional blood test, it is also able to detect a far wider range of disorders - as many as 110 inborn errors of metabolism.

Stronger contributions from emerging markets

>> Greater presence in China

>> Greater presence in China

In March 2014, the Group announced its strategic alliance with CellResearch and China Cord Blood Corp.

The Group owns 10% in China Cord Blood Corp and will export to China technology for cord lining banking that has been patented by CellResearch unit CordLabs Asia.

The Group has strong partners. NYSE-listed China Cord Blood Corp is China’s largest cord blood bank operator while CellResearch is a leading provider of primary cell strains, culture media and support services to researchers and corporations.

>> Greater contribution from Malaysia

Last December, the Group increased its stake in StemLife (an associated company listed on Malaysia’s secondary stock market) to 31.8% by paying RM17.66 million in cash for an additional stake of 11.89%.

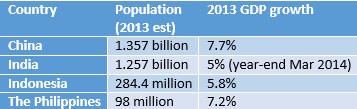

>> Contribution from India, the Philippines, Hong Kong and Indonesia

Last June, the Group announced that it completed the acquisition of ASX-listed Life Corporation Limited’s assets for A$5.5 million. Life Corp was previously also known as Cordlife Limited.

The Aussie company disposed its cord blood and umbilical cord lining banking businesses and assets in India, the Philippines, Hong Kong and Indonesia to the Group.

Singapore’s Golden Jubilee Year

Next year is the 50th anniversary of Singapore's independence and the government has announced that every Singaporean child born next year will receive a special Jubilee Baby Gift.

The management believes that this will result in a bumper crop of new births next year.

49% surge in 9MFY2014 earnings

Bloomberg data

Bloomberg data

Revenue for the period from July 2013 to March 2014 grew 40.7% to S$35.3 million, thanks to contributions from new subsidiaries in the Philippines and India, as well as Indonesian assets acquired in June 2013.

Revenue contributions from these regions with large populations of the increasing affluent more than offset the decrease in revenue from the Group’s Hong Kong subsidiary.

New birth deliveries in Hong Kong have declined due to a ban on mainland Chinese mothers from giving birth in the Special Administrative Region’s private hospitals with effect from 2013.

Recent story: Analysts: CORDLIFE -- Buy, TP $1.43, SG Equities Heading To Sweet Spot