THE STRAITS TIMES Index was recently at 2764, around the same level as the beginning of this year after a leap to 3000.

That is not to say there are no stocks that have chalked up exceedingly handsome gains. In fact, there are some 70 stocks that are up more than 50% in the year to date.

And, as we highlighted last week, there are even stocks that have very recently hit their 52-week highs, despite the market slump (see: 9 Stocks Riding High: FRASERS, INTRACO, SARIN, JAYA, SELECT, VIZ BRANZ, Etc)

Here, we highlight five of the more recognisable names which have 50-plus percent returns since the start of the year. Are you lucky enough to be holding any of them?

Interra Resources – Myanmar oil & gas multi-bagger

The top performing stock year-to-date must be Interra Resources, a Catalist stock whose price has multiplied more than 3-fold over the past 6 months.

From being range-bound at 10 to 15 cents last year, Interra started its phenomenal run-up at the beginning of the year and last closed at 34 cents.

Investors love its two investment themes: Firstly, it operates producing oilfields. Secondly, it is in Myanmar, where on-going political and economic reforms hold the promise of abundant business opportunities as the nation emerges from decades of underdevelopment and isolation.

From its contracts from Myanma Oil and Gas Enterprise and Pertamina to operate oilfields, it drills for oil and shares oil sale proceeds with these Myanmar and Indonesia national oil & gas companies.

Its 1Q2012 net profit after tax improved to US$1.5 million compared to US$361,000 in 1Q2011, mainly because of increased profit sharing after acquiring greater interests in the oilfields.

Oil exploration and production stocks are risky because there may be write-offs for exploration, evaluation and development costs, which implies high earnings volatility.

Its market cap is S$100 million and historical PE is 7.8 times.

Bloomberg data

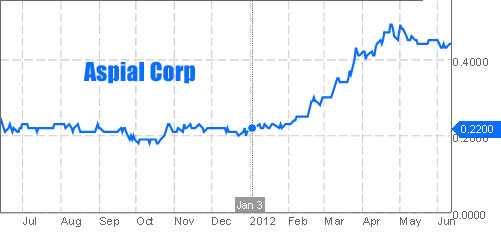

Aspial – Cash injection from subsidiary listing

Aspial Corp's stock price has doubled year-to-date to 43.5 cents.

A household name for its jewelry retail brands - Goldheart, Lee Hwa and Citigems, Aspial created a buzz with investors after it announced intention to list its pawn broking business on Catalist.

Pawn broking (Financial Service) accounted for about a quarter of Aspial’s 1Q2012 revenue. It has 24 Maxi-Cash pawn broking stores all over Singapore accepting as collaterals gold, jewelry and branded timepieces for a quick loan to individuals.

Other than interest income, the pawn broking business enables the group to makes a tidy profit from the trading of pre-owned jewelry and watches.

This segment grew a hefty 46.8% in revenues for 1Q2012 to $22.9 million in 1Q2012.

1Q2012 group revenue was S$88.8 million, up 9.4% year-on-year. Jewelry accounted for 44%, property development accounted for 30% and financial services accounted for 26%.

Its market cap is S$527 million and historical PE is 9.6 times. The company is proposing a bonus issue of one for 5 shares held, its second bonus issue this year.

Bloomberg data

Sarin Technologies – Polished diamond market propels record earnings

Sarin Technologies develops, manufactures and markets precision technology products for cutting and grading diamonds and gems.

Its stock price has doubled from 62 cents at the beginning of the year to S$1.19 year-to-date.

It had traditionally focused on the rough diamond market but successful penetration of the polished diamond market with its Galaxy trademark product has propelled sales and profits into high-growth phase. 1Q2012 revenue rose 61% to a record US$19.7 million while net profit rose 137% to US$7.8 million.

Last month, it announced that Borsheim’s Fine Jewelry has become a Sarin client for its Diamond Assay Service, which provides transparent diamond information, estimated cut grades and solutions for optimal recut.

Borsheim’s Fine Jewelry has been majority-owned by Warren Buffett’s Berkshire Hathaway since 1989.

After the company declared a bonus issue of one new share for every 4 shares held as at 22 May, Kim Eng analyst Yeak Chee Keong adjusted his target price for Sarin to S$1.82, and maintained his ‘Buy’ recommendation.

Its market cap is S$403 million and Bloomberg’s consensus forecast for its 2012 PE is 11X.

Bloomberg data

Related story: SARIN TECHNOLOGIES: Sparkle Of Hope In Q4, If Not Q3

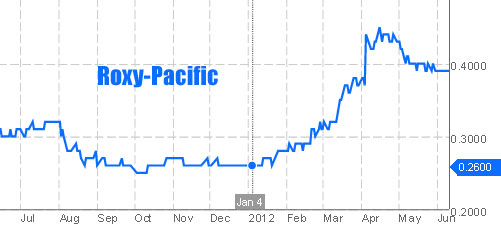

Roxy-Pacific – Strong revenue recognition pipeline

From 26 cents at the beginning of the year, property and hospitality group Roxy-Pacific last closed almost 50% higher at 38.5 cents.

The Group’s revenue from property development fell 35% year-on-year in 1Q2012 to S$24.6 million, but savvy investors are beginning to see that its progress billings from projects launched and sold are on an uptrend.

It had progress billings of S$778.9 million as at 2 May, to be booked as revenue over 2Q2012 to FY2016 as work is completed for its property projects, including Spottiswoode 18.

Progress billings as at 2 May 2012 were some 30% higher than its outstanding progress billings as at 31 Dec 2011.

Also, the group’s Grand Mercure Roxy Hotel is a beneficiary of Singapore’s rising tourist arrivals.

Visitors to Singapore for Jan to Mar 2012 rose 14.6% year-on-year to 3.6 million, and Roxy’s revenue per available room in 1Q2012 increased by 9.8% year-on-year to S$187.

Property development contributed 61% while hotel ownership contributed 38% to Roxy’s pretax profits during this period.

Its market cap is S$368 million and Bloomberg’s consensus forecast for its 2012 PE is 7X.

Bloomberg data

Related story: Insider Buying: ROXY-PACIFIC, XINREN, SERIAL, KOH BROS

Super Group – Foot in China’s booming milk-tea market

Top gainers are mostly small cap stocks but Super Group is one whose price has throttled full force ahead since the beginning of the year in spite of its larger market capitalization.

From being range bound around S$1.50 last year, it has now broken past the S$2 mark and last closed 43% higher at S$2.14.

On 11 Jun, CIMB maintained its ‘Outperform’ call on the largest manufacturer of 3-in-1 instant coffee-mixes in Southeast Asia, and raised its target price to S$2.43.

CIMB analysts Kenneth Ng and Lee Mou Hua are excited over Super’s ingredients division, which grew 1Q2012 segment sales 78% year-on-year to S$28.9 million.

China’s milk-tea market is booming, with an estimated growth of 140% in 2011. The analysts expect Super to benefit from supplying non-dairy creamer to Uni-President, the market leader for milk tea in China.

The big boys are buying Super’s growth story driven by ingredients sales to China. Capital Group purchased 3.173 million Super shares over 7 to 15 May through the open market, increasing its interest to 7.0%.

The company generated net profits of S$62.1 million in FY2011 and had cash reserves of S$95.8 million as at 31 March.

Its market cap is S$1.2 billion and Bloomberg’s consensus forecast for its 2012 PE is 18X.

Bloomberg data

Related stories: SUPER, COMFORT DELGRO, SIA: What Analysts Now Say...

9 Stocks Riding High: FRASERS, INTRACO, SARIN, JAYA, SELECT, VIZ BRANZ, Etc