Photos by Sim Kih

TECHNICS OIL & GAS' customers are mainly oil and gas majors, leading FPSO operators and end-users such as Chevron, PetroChina and Petronas.

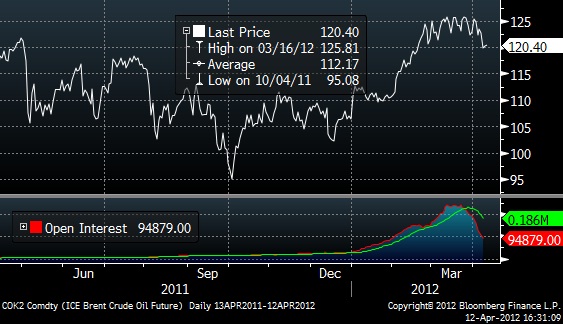

While high oil prices drive oil exploration and production (E&P) activity, the long-term perspectives of these oil majors on their operation requirements and their committed capital expenditure on offshore drilling are not normally affected by the fluctuation of oil prices.

As such, the management believes that demand for Technics’ compression systems and process modules used in offshore platforms and vessels will remain firm.

The leading full service integrator of compression systems and process modules for the global offshore oil and gas sector is growing fast.

It grew revenue 48% year-on-year to S$85.1 million for 1H2012 (Sep year-end), outperforming growth in global E&P spending this year.

Global E&P spending is estimated to reach US$598 billion, up 10% from the previous record of S$544 billion in 2011, according to estimates by Barclays.

The Group's gross profit margin was lower at 37% compared to 39% a year ago.

This was due to the recognition of more contract engineering (CE) projects, which command relatively lower margins compared to its engineering, procurement, construction and commissioning (EPCC) projects.

Profit after tax grew 60% to reach S$12.5 million.

Gearing ratio (total debts / net tangible assets) decreased to 0.61 as at 31 March, compared to 0.84 as at 30 Sep 2011 due to a decrease in total debts.

As of 11 April 2012, the Group had a total outstanding order book of about S$95.5 million for progressive delivery through to 1H 2013.

At its 1H2012 results briefing yesterday, executive chairman Robin Ting, executive director David Tay and CFO Maggie Lam provided updates on the Group’s plans.

Dividend Play

The company is a strong dividend yield play (9%) with good capital gains potential (34%), according to an AmFraser Securities report by analyst Lee Yue Jer.

At the briefing, the management gave guidance that it intends to pay an 8-ct dividend after its 3Q2012 results are announced some time in July.

"We find this cash flow to shareholders extremely attractive," said Yue Jer.

The analyst maintained his 'Buy' call and target price of S$1.22 (11.5 X 2012F EPS) on the company yesterday.

“Barring unforeseen circumstances, the Group is anticipating a better performance for FY2012 compared to FY2011. This is in line with our PATMI estimate of $22m, 18% higher than last year," he said.

Below is a summary of questions raised at the briefing and the management’s replies.

Q: Why was there a profit attributable to minority interests of S$2.3 million compared to a loss of S$786,000 last year?

We increased our effective interest in a subsidiary from over 20% to over 80%.

Q: Which businesses are you listing in Taiwan?

We are working on combining two subsidiaries providing contract engineering services and specializing in marine for listing. The two subsidiaries are Norr Systems and Wecom Engineering. We hope to list in one year.

Q: Why list in Taiwan?

Taiwan has a more actively traded stock market where retail investors contribute to as much as 75% of trading turnover. Even with our relatively small issue of 80 million TDRs, we already have 8,000 shareholders in Taiwan. The Taiwan stock market also has richer valuation compared to Singapore.

Q: Do you have any listed peers in Taiwan?

No. There are very few oil & gas players in Taiwan. Even though Taiwanese investors are very new to oil & gas businesses, they are very excited over this sector. Our listing will also arouse novelty interest.

Related story: TECHNICS' New Major Shareholder, HU AN Wins Big Contract, CHASEN Wins IR Award