TWO RESEARCH HOUSES have just put forth their picks of small caps as the penny stock rally continues to gather momentum.

Saying that the rally probably has legs, CIMB turned to historical data: "Looking at the major small cap rallies since 1999, we found that the shortest rally lasted a good five months while the longest took place over thirteen months.

"On average, the typical small cap rally enjoyed an eight months in the lime light."

Thus, with the current small cap rally starting end last year, the current rally, if history is any guide, could continue for a while more -- unless the damn Euro crisis inflicts bad news on the markets.

CIMB said its top small-mid cap picks based on a market cap of less than S$1bn, and double digit percentage upside potential are:

1) China Minzhong (target $1.43),

2) Tiger Airways (target 87 cents),

3) Swiber (target 94 cents) and

4) Yongnam (target 42 cents).

It said it also likes China Merchants (target 98 cents) and UMS (target 77 cents).

Maybank Kim Eng said investing in small-cap stocks invokes images of growth companies blossoming into multi-baggers.

But empirical evidence from the Singapore market suggests that this may be a rarity, with only 10 out of 412 small caps over the past seven years evolving into companies of more substantial size and yielding multifold returns.

It therefore proposed a value-oriented approach to investing, which, though unheralded, is differentiated and may prove more profitable.

It has put together a basket of 10 small caps that currently are unloved and ignored.

The 10 are:

> AusGroup Ltd (AUSG SP, $0.395),

> Broadway Industrial (BWAY SP, $0.385),

> China Minzhong Food Corporation (MINZ SP, $1.065),

> Eratat Lifestyle (ERAT SP $0.145),

> Lian Beng Group (LBG SP, $0.39),

> Li Heng Chemical Fibre Technologies (LHCF SP, $0.163),

> Mercator Lines (MRLN SP, $0.177),

> Midas Holdings (MIDAS SP, $0.395),

> Pac Andes Resources (PAH SP, $0.255), and

> Raffles Education Corporation (RLS SP, $0.495).

Saying that higher risks could accompany higher returns, Maybank Kim Eng noted that the 10 stocks were stock market darlings at various times in their history but have since fallen.

"They speak of disappointments and uncertainties. Individually, the stocks may not merit a Buy recommendation under normal context. Yet, taken as a whole, we think it makes sense to set aside some 'mad money' to put into these stocks to wait out – or lose."

Recent stories:

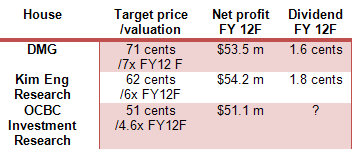

DMG: 5 companies expected to achieve record earnings for FY11

ERATAT: Why the renovation subsidies, the lower-than-expected cash balance, etc

LIAN BENG target 71-c, SINO GRANDNESS 70-c, SG property stocks bearish

AUSGROUP: 1H2012 net profit up 63% at A$8.3 million, margins rebound

That's when the stock has crashed to earth!

Yoma has just issued press release that they have acquired 70 % interest in Star City costing S$91m to be financed by a hefty 4 for 5 rights issue at 0.24 cents each! So the game plan has finally been revealed. I was expecting something like this to happen. When a counter has been overbought and its value highly overpriced, it is usually followed by a rights issue (although you cannot pinpoint who is exactly pushing up the price in a free market system). Can you imagine what the subscription would be like if Yoma had still been a 0.06 or 0.08 cent stock and they ask for a 4 for 5 rights issue?

the region provides ample fodder for Yongnam.