DMG has maintained its 'buy' call and target price of 71 cents for Lian Beng Group based on a target PE of 7X its forecast earnings for FY 2012 (ending May 2012).

That represents 100% upside potential from the recent 35-cent trading level of the stock.

Lian Beng's just-announced 2Q earnings (ended Nov 2011) were in-line with DMG's estimates, coming in at S$11m, easing 5.2% YoY on the back of lower construction work recognised.

DMG analyst Selena Leong said Lian Beng is set to ride on Singapore's building boom, and its ventures in private residential and industrial developments will help boost its bottom line.

Lian Beng has net cash per share of 15.6S¢ (1QFY12: 14.2S¢) which would be invested into the property business.

DMG said its checks with management found that previously-announced plans to spin-off its concrete and engineering businesses could materialise by 3Q2012, on the Taiwan Stock Exchange.

DMG estimated IPO proceeds would be ~S$28m, based on FY11 earnings of ~S$9m for both subsidiaries and 10.4x prospective earnings.

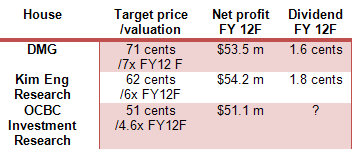

DMG noted the strong order book of S$772m (1QFY12: S$761m) of Lian Beng, and estimated FY12 earnings to come in at S$53.5m, which suggests a prospective P/E of 3.5x (peers at 6.3x blended FY11 and FY12 P/E).

Recent story: YANLORD loses Aberdeen; STRACO & LMA, LIAN BENG boss grab more shares

UOB Kay Hian has 70-c target price for SINO GRANDNESS

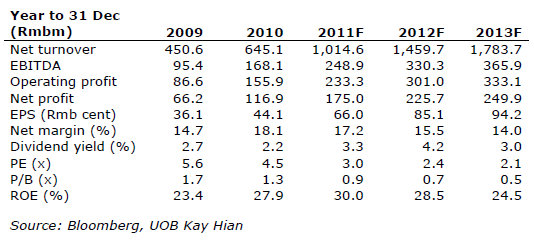

The research house this morning increased its 2012 revenue and net profit forecast for Sino Grandness to Rmb1.46b and Rmb225.7m, respectively, to account for stronger-than-expected growth in the beverage segment.

Analyst Brandon Ng, CFA, recommended a 'buy' on the stock for its stronger earnings from "firmer demand, higher ASP and greater juice production capacity."

Sino Grandness recently announced that it has secured a new supplier to produce its own Garden Fresh bottled juices, doubling its production capacity from 70,000 tonnes to 140,000 tonnes per year.

The analyst's target price of S$0.70 is signifiantly higher than the trading level of 40 cents recently. The target price translates into 4.0x 2012F PE, pegged at a 65% discount to Singapore-listed peers’ average.

Recent story: S-CHIPS: What analysts now say after 2Q results....

Bearish investor interest in Singapore and China property stocks, except for CDLHT and GLP

ON A RECENT marketing pitch to investors in Singapore, Kuala Lumpur and Hongkong, CIMB was greeted with an overall investor view that was unanimously negative.

CIMB analyst Donald Chua, in a report this morning, said that investors generally preferred S-REITs to developers. The retail and industrial S-REITs were their favourites.

The investors, numbering over 25, were surprised at the extent to which foreigners have accounted for the buying of properties in Singapore. The URA has said that foreigners made up 19% of private home sales in 2H11 and 36% of new units sold year-to-date.

The investors were generally also very cautious on the China residential market. "Some believed that Singapore developers with meaningful exposure to China are unlikely to do well this year. In our universe, CapLand (Neutral) and KepLand (Underperform) have the largest exposure to China residential at 11% and 26% of their GAV, by our estimates," wrote the analyst.

Among property-related counters listed in Singapore, CDL Hospitality Trust (Outperform, TP S$1.75) attracted high investor interest, wrote the analyst, as the stock has underperformed despite buoyant times in the industry.

"The hotel sector is highly cyclical, but we are not looking at a repeat of 2009. Arrivals and RevPARs remained strong in Nov (above 90% occupancy) with Asian tourists making up the majority of arrivals (more than 40% from ASEAN). Management indicated an ability to raise corporate rates during renewals. Asset leverage is low at 27%."

Another CIMB stock recommendation, GLP (Outperform, TP S$2.27), attracted investor interest. "Those who have and/or own the stock agree that GLP stands out as an Asian leader in logistics properties and like it for its scalable business."

Recent stories:

PROPERTY OUTLOOK 2012: 'The big unknown is demand"