'newbiestock', a regular contributor to our Forum, recently posted a comment on Lee Metal Group in the story When to buy stocks, what are highest yielding, lowest price-to-book stocks..... We followed up and asked if he would write a piece on Lee Metal Group, and he kindly obliged, marking the first time Lee Metal Group is featured on NextInsight.

I HAVE BEEN buying shares of Lee Metal Group (593.SI) since 2009, utilising cash and CPF savings. This Singapore-based company has two main business core activities, 1) steel merchandising and 2) fabrication and manufacturing.

The steel merchandising segment is involved in the international trading of steel and metal materials and/or products while the other segment is involved in the manufacturing of reinforcing mesh and processing of fabricated reinforcing bars.

A quarter of Lee Metal's revenue comes from the Singapore construction sector and the rest from its exports, with the bulk of export revenue from ASEAN countries and a small percentage of revenue export from Australia.

There are a few similar SGX-listed steel companies such as HG Metal, Union Steel and Hupsteel, but its consistent performance and attractive valuation made Lee Metal stand out.

Since 2000s, the economic boom in China and other Asian countries has benefitted steel companies due to rapid growing construction demand to build infrastructure. In fact, companies like Lee Metal Group and HupSteel Limited won the fastest growing 50 companies or the FG50 awards in 2007 (Source: here).

But when the financial meltdown came in 2008, many steel companies were not spared. Companies like HG Metal and Union Steel suffered a full year loss in 2009 and only from 2010 started to show signs of turnaround while others like HupSteel suffered a big plunge in profit in 2009.

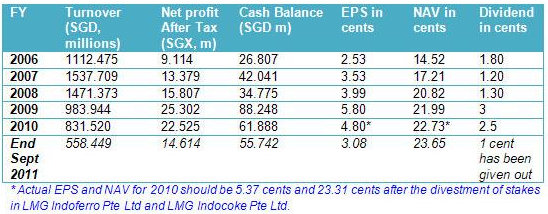

But since its listing in 2000, Lee Metal has been profitable every year, weathering the SARS crisis in 2003 and the financial meltdown in 2009, while paying generous dividends consistently every year to its shareholders since 2001. Year 2009 was, surprisingly, a record year of profitability for Lee Metal Group, as its EPS hit a record high of 5.80 cents.

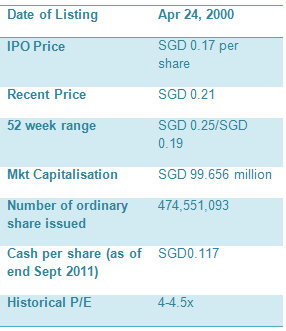

If you look at its financial ratios, it has the desired ratios that a value investor would seek: low PE (4x-4.5x), below book value (P/B about 0.9), high dividend yield of around 12% and lots of cash, and good management track record. The lack of interest among investors in this stock could be due to the following reason(s):

1. Lack of liquidity (low share base) and low trading volume.

2. Management is not proactive in doing investor relations. E.g. Lack of analyst coverage.

3. Steel industry may be viewed by some investors as unexciting, as it is a high volume but low margin manufacturing business.

4. Global macro uncertainty, which influences steel price movement, steel demand and steel supply.

5. Decline in EPS y-o-y in 2010 and 2011.

In Singapore, the construction players have benefited from a series of major projects such as the two integrated resorts, the expansion of the MRT network, as well as the launch of numerous HDB projects. In case, you wonder why I mentioned MRT - yes, the steel bars and steel welded mesh that you might have seen during the construction of the Circle Line were supplied by Lee Metal Group.

The HDB and SMRT are among the biggest Singapore customers for Lee Metal Group. Thankfully, after the Circle Line, Lee Metal Group still has the Downtown line project as well as a series of HDB projects. This should ensure business demand for Lee Metal Group over the next few years.

Lee Metal Group has been experiencing strong growth since its listing in 2000 until it achieved a record year in 2009. The question that concerns most investors is whether the group can continue to grow further.

In 2011, several key events contributed to the global macroeconomic uncertainty for the steel industry. The first event in early 2011 was the floods in Australia, which affected the supply of iron ore, the main raw material for producing steel. Next was the earthquake-tsunami in Japan. And, not to forget the Europe debt crisis.

Share of loss of associates are main reasons for dip in 2010 and 2011 EPS: The associate companies are PT Indoferro & PT Indocoke in Indonesia, as well as MaxLee Development Pte Ltd, a property joint venture with United Engineers.

As both of these joint ventures are in the development stage, revenue have not yet been generated but expenses incurred. If you exclude the loss due to the associate companies, considering the uncertainty in 2010 and 2011, the y-o-y dip in EPS is within an acceptable range.

- PT Indoferro and PT Indocoke joint venture - To build a blast furnace and a coke plant in Indonesia. The venture was formed in 2007.

- MaxLee Development Pte Ltd: A property joint venture company with United Engineers was formed in 2010 to launch the Austville Residences Executive Condominium project in Sengkang.

Delay and eventual withdrawal of Indonesia Joint Venture

The construction of the PT Indoferro and PT Indocoke plants would enable Lee Metal Group to move upstream in the steel business, which should help boost its margin and competitiveness. However, during the global financial crisis in late 2008, construction had to be temporarily stopped due to the anticipation of slowing steel demand. The construction of the two plants resumed in 2010.

As the plants are still not operationally ready to generate revenue, operational expenses incurred in this joint venture project accounted for the drop in the group’s EPS in 2010 and 2011.

In Oct 2011, Lee Metal Group announced its decision to divest all its stake in PT Indoferro and PT Indocoke. The rationale cited by the management was that the completion of the project was taking considerably longer time than originally planned. In terms of financial impact, the proposed divestment is expected to yield an excess of about $2.7m over the total net book value of the investments, of which about $2.5m will be realised in the financial year, ending 31 December 2012 and the sale of the stake would have an aggregate amount of $17.3 million.

After the proposed divestment, the EPS and NAV for FY 2010 would be revised to 5.37 cents per share and 23.31 cents per share, instead of the reported 4.80 cents per share and 22.73 cents per share. Overall, this is good news for shareholders but may not be good when you look at its long term core business growth. It’s good for shareholders because profits are made in this joint venture and once the sale transaction is completed, shareholders can expect a growing cash balance. The downside is, without the plants, what’s next for growth?

Joint Development of EC project – Austville Residences

Lee Metal Group’s subsidiary, LMG Realty Pte Ltd, owns about 35% equity stake in MaxLee Development Pte Ltd, a joint venture company with United Engineers to develop the Sengkang Executive condominimum project. As of 31 December 2010, the group had invested a total of $18.0 million in the JV, with the total project cost expected to be up to $20.1 million.

This explains the decrease in cash balance from SGD 88.2 million from year end 2009 to SGD 61.8 million at end-2010. Similarly, operation expenses incurred in MaxLee Development Pte Ltd joint venture also accounted for the drop in the EPS of 2011 against the EPS of 2010, as revenues have not been realised. Since United Engineers is an experienced property developer and given the strong housing demand in Singapore, I would expect the Austville Residences project to be very profitable and should be able to contribute strongly to the group’s future EPS growth.

Business Risk factors

a. Strong dependency on the construction industry

While Lee Metal has diversified out of Singapore, its business is highly dependent on the construction industry. It does not supply steel to niche industries like the booming offshore and marine industry, as what Cosmosteel Holding does. Neither does it produce steel panels to the automotive industry. While the property joint venture with United Engineers is a welcome move, it is a one-time gain. Furthermore, property is not really Lee Metal’s core business, although I don’t deny the synergy between property development and the steel construction business.

b. High directors’ bonuses

For FY2010, Lee Metal’s Executive Chairman and Executive Directors received total remuneration exceeding $2.5 million. It seems excessive, compared to companies of similar size. Nevertheless, as long as the company produces good results and rewards its shareholders with dividends generously, it should not be an issue at all.

The Good:

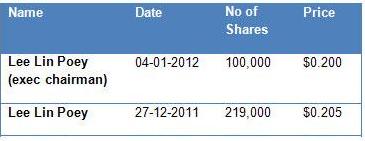

1. During the recent EGM, the company obtained shareholders' approval to authorise the directors to do share buyback. Another positive signal: Its executive chairman, Lee Lin Poey, has bought back shares recently on 27 Dec 2011 and 4 Jan 2012..

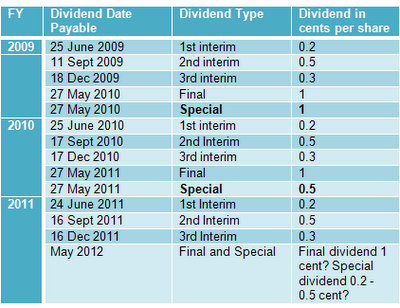

2. Expecting another special dividend in May 2012.

Given the dividend history of Lee Metal Group from 2009, we would expect at least 2 cents in dividend a year. The special dividend will vary, depending on the overall earnings performance of the group.

Under the most conservative scenario, an investor can expect a minimum yield of 9%-10%, assuming he purchases the shares around the current range of 20-21 cents. My prediction for its FY2011 EPS is 4 - 4.5 cents per share (without taking into account divestment).

Although the EPS in FY 2011 is expected to dip compared to FY 2010 EPS, my most optimistic guess is that the special dividend may remain at 0.5 cents per share.

If not, maybe a minimum of 0.2 cents per share, assuming a pessimistic scenario of the Q4 2011 earnings failing to meet expectations. But the probability of such a pessimistic scenario is low.

The signs are positive.

Firstly, the directors are buying back shares. Secondly, with the divestment of the Indonesian JV project, its projected cash balance should grow and there seems to be no reason for not distributing some of the cash to shareholders, unless the company can find new business ventures.

I prefer that Lee Metal distribute its dividends over quarterly periods, compared to companies like Innotek and Transpac Industrial which give out dividends once a year.

Distributing dividends over multiple periods eliminates speculation during the CD and XD periods and gives investors a convincing reason to hold the stock longer and maybe even accumulate more for the next round of dividend payment.

My view on the steel industry outlook

The global macroeconomic uncertainty has dampened the steel industry outlook. But I believe the worst is over and my reasons are as follows:

1. Starting from Q4 2011, there have been some encouraging economic signs from the US housing market. Furthermore, emerging economies in Asean still have plenty of room for infrastructure development. Steel is the most commonly used metal in engineering. As long as you see construction activity, steel will always be in demand.

2. Steel companies like HG Metal and Union Steel are returning back to profitability, though profit levels are still far from their peaks. It suggests that the bottom of the steel industry may be over.

3. Japan is now in a post-earthquake recovery state. I cannot tell exactly when the demand will start coming in, but when Japan starts rebuilding the destroyed cities, it’s common sense that they are going to need plenty of steel. And, the world demand for steel is going to increase dramatically because of that.

4. In Singapore, the construction industry probably peaked in 2009-2010 due to the completion of the Integrated Resorts and the Circle Line. After the General Election in May 2011, the government has pledged to launch more HDB projects to cope with the demand. Mass supply of ready HDB projects is likely to come only from 2014 onwards. Meanwhile, the construction of the Downtown Line will be in phases and full completion will probably be by 2018. Hence, I believe the local construction industry will have another peak coming sometime between the years 2013-2014.

Conclusion:

Compared to its peers, Lee Metal Group has an attractive valuation. Its high dividend yield and a good management track record made Lee Metal Group an ideal defensive stock for me.

It may not be a growth stock now, but it certainly is an undervalued stock. Even if its EPS stays stagnant, I would have no complaints as long as it continues to maintain its generous dividend payment.

On the one hand, I believe the management is actively seeking new opportunities to grow the business. The steel industry is a cyclical industry. I believe the bottom for the steel industry is most likely over, unless the situation in US and Europe worsens such that it sparks off another crisis. Otherwise, I'll hold Lee Metal Group until the cycle peaks again.

If the company can identify new business ventures, I won't be surprised if one day it turns out to be a multi-bagger stock. After all, it has surpassed a billion SGD dollar in annual revenue before. Plus. the second wealthiest man in India, Mittal, made his fortune through his steel empire.

Meanwhile, another reason for me to continue accumulating and holding Lee Metal Group is the potential gains from the Austville Residence project, which will enable me to maximise my returns from this stock investment.

hit 27 cents. hope LMG will give some bonus dividends.

Do not expect price of this counter to rise, it is too small a counter to attract funds' attention.

Rather, buy it for the strong dividend yield.

but overall, it's still not too bad. Austville got abt 85% sold...

But i do not see the liabilities as a problem as Lee Metal Group has a lot of cash. After the divestment ends, the cash balance should increase even more by end 2012.

if they are not confident about their liabilities, they would not be giving such a generous dividend.

Anything i missed ?

When the cycle peaks again, the turnover should rise back.