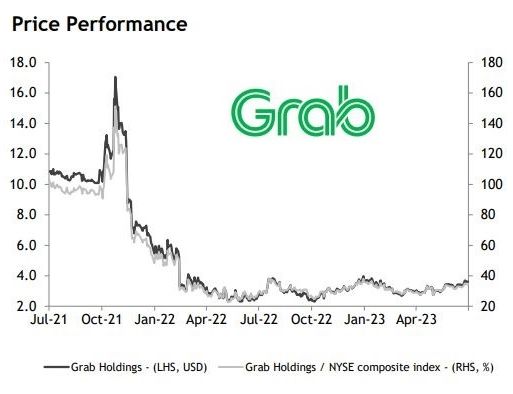

• Grab taxis and delivery services have successfully become part and parcel of daily life across Asean but Grab's stock hasn't exactly been an investor's darling -- at least not yet. Maybe that time is not too far away. Grab stock is listed on Nasdaq. It currently has a market cap of US$13.4 billion, a fraction of what it used to be at its 2021 peak. Grab stock is listed on Nasdaq. It currently has a market cap of US$13.4 billion, a fraction of what it used to be at its 2021 peak. • Grab has been bleeding big-time but losses are narrowing. • Grab has been bleeding big-time but losses are narrowing.• Monetary incentives for commuters and taxi drivers alike have largely disappeared, so Grab taxi fares are no longer the bargains they were for commuters in the past. • As Grab focuses on reining in corporate expenses, it is signaling to the market that shareholder value is gaining in priority. • As it strives for profitability, it is being aided by economies reopening and tourism recovering after the pandemic. Why is Maybank KE calling for a 'buy" on the stock? Read on .... |

Excerpts from Maybank KE report

Analyst: Kelvin Tan

| 1H23 results preview: narrower adj.EBITDA losses |

|

GRAB |

|

|

Share price: |

Target: |

We estimate 1H23 gross merchandise value (GMV)1 (2Q results due Aug-23) will fall by a slight 2% YoY to USD9.96b as recovery in the mobility business largely offset weakness in delivery due to normalisation post-Covid-19 and financial services (currently focuses on off-platform transactions - buy now, pay later) that are contribution negative.

1 (GMV: The sum of the total dollar value of transactions from Grab’s services, including any applicable taxes, tips, tolls and fees.)

We believe Grab was able to reduce incentives further and increase monetisation as competition eases.

Hence, we estimate the adjusted EBITDA loss likely further narrowed to -USD106m in 1H23 from -USD233m in 1H22, tapering towards its breakeven target in 4QFY24E.

Retain BUY and our SOTP-based TP of USD4.00.

| Grab increases focus on cost reduction |

Grab crystallised its intention to reduce its workforce by 11% on 14th June 2023.

| PROMISING OUTLOOK |

| “We see a promising growth outlook for Grab this year due to the potential for a strong 2H23 recovery, irrespective of employee-related costs, although cuts will establish a more competitive cost base long term.” -- Maybank KE |

This is to rationalise costs and help the platform achieve long-term growth.

As Grab sharpens its focus on cost efficiency, it may cut expenses further as corporate costs are still meaningfully higher than 2020 levels.

We see a promising growth outlook for Grab this year due to the potential for a strong 2H23 recovery, irrespective of employee-related costs, although cuts will establish a more competitive cost base long term.

We think near-term profit targets can still be achieved even without recent cuts, which focus on geographical cost imbalances and potential automation through generative AI.

Grab has reinvented itself as an early stage superapp in Southeast Asia with core businesses in on-demand delivery, mobility/ride-hailing and digital financial services. |

Full report here.