The Hong Kong bourse lost nearly 3% in the first half of this year, with the benchmark Hang Seng Index so far this year exhibiting some of the least predictable and most erratic trends in recent memory.

A Chinese-language piece in Sinafinance asks if “group speculation” from PRC investors in penny stocks may have something to do with it.

One particular firm which is somewhat symptomatic of the first half market confusion and fluctuation is Radford Capital Investment (HK: 901), which recently endured a planned rights issue, which was delayed over shareholder objections then finally approved, culminating in a sharp selloff by the company’s executive director.

This resulted in its shares being suspended from trade beginning June 27 and recent top-level management changes.

Some analysts and market watchers have been pointing to the growing phenomenon of Mainland Chinese capital, often in the form of “investor clubs” or “investor circles”—loosely knit organizations of often family, friends, colleagues, or other like-minded individuals – engaging in group purchase behavior.

On the surface, this development could help to explain some of the sharp fluctuations in share prices in the first half, especially since PRC-based investor clubs are known to often favor low-priced “penny stocks.”

In fact, even casual research into the shareholding structure of penny stocks listed in Hong Kong reveals a large stake to be held by PRC-based investors.

However, given the dynamic and inexact nature of shareholding of any particular company at any given time, the growing phenomenon of PRC retail-level investor clubs buying up large stakes in penny stocks is still a relatively unknown entity, and is considered somewhat of a gray area for Hong Kong securities regulators.

PRC ‘Group Speculation?'

Over the past few years, precious metals like gold and tangible assets including antiques, jewelry and artwork have often enjoyed hot streaks as longstanding reserve currencies around the world experience rapid devaluation.

The phenomenon is sometimes manipulated by speculative investors who realize that a “positive reinforcement” calculus is at play.

As finite resources like gold, antiques and priceless works of art are snapped up, their value and the value of still-available proxies climbs exponentially given supply shortages – whether real or perceived.

This “supply side” manipulation is used to great effect to influence prices, and thus the sudden collapse in various high-priced tangible asset categories occurs when those orchestrating the speculative behavior suddenly cash in their chips, en masse.

The same can be argued has been impacting Hong Kong-listed penny stocks.

Looking again at the case of Radford Capital Investment, analysts believe that the recent rejection of management’s proposal to place additional shares, with 60% of the voting shareholders standing in the way of the plan, is proof positive that PRC-based group speculative behavior was at play.

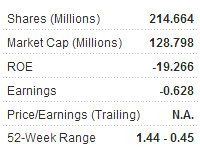

Radford Capital, the Hong Kong-based investment company that last traded at 60 Hong Kong cents – truly making it a “penny stock” – is one of the clearest examples of a Hong Kong-based/Hong Kong-listed firm seeing heavy influence on its share price thanks to PRC-based group speculation behavior.

Making matters even more complex is the fact that Radford Capital itself also focuses almost exclusively on investing in Hong Kong-listed shares.

While Radford Capital is likely the poster child of such investment activity from Mainland China, market watchers advise individual retail investors to keep a close eye on the movement of penny stock valuations, while always remaining cognizant that their valuations could exhibit violent shifts in either direction thanks to the apparently growing phenomenon from the PRC of rising interest in such low-priced counters.

See also:

PRC BANKS, PORTS, CITY TELECOM: What Analysts Now Say...

HK WEEKLY WRAP: Index Up 1.5%, 0.9% Today On H-Shares