Excerpts from latest analyst reports...

Credit Suisse UNDERWEIGHT on PRC BANKS

The People’s Bank of China, the country’s central bank, hiked interest rates across the board (except demand deposit rate) by 25 basis points last week, the fifth rate hike in the current cycle.

One-year lending rate and deposit rates now stand at 6.56% and 3.50%, up 125 bp since October, while the demand deposit rate is unchanged at 0.50%.

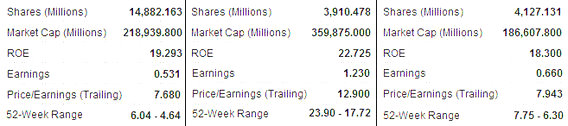

“We estimate China banks gain 2-8 bp margin expansion within 12 months timeline. China Citic Bank (HK: 998), China Merchants (HK: 3968) and China Minsheng (HK: 1988) should enjoy about 7-8 bp widening (the most levered), while ABC (HK: 1288) and CCB (HK: 939) should benefit more among big banks.

"Every 10 bp margin expansion leads to 2-3% 2011E earnings impact at China banks,” said Credit Suisse.

However, higher interest rates should pressure the already decelerating GDP growth and further burden corporate borrowers’ debt-servicing ability.

“Local government financing vehicles, who received bank financing in 2009-10 at around 5.0% rates, may also face some difficulty in meeting their obligations. Every 10 bp increase in credit cost leads to 3-5% earnings impact.”

Credit Suisse added that it would be a tussle between margin expansion (positive) and asset quality (negative), and is maintaining its UNDERWEIGHT recommendation on Hong Kong-listed PRC banks.

See also: CHINA AIRLINES, COAL, PROP, HK BANKS: What Analysts Now Say...

Credit Suisse says COSCO PACIFIC its top port sector pick

Credit Suisse said June volume growth slowed further at Shanghai and Ningbo ports, while tightening may have hit SME exporters.

“Our channel check reveals that both Shanghai and Ningbo ports saw further slowdowns in YoY volume growth of 7% (versus 8.2% in May) and -3% (versus 4.6% in May), respectively, in June.

"Sequentially, June daily volume was down 3-6.6% MoM at Shanghai and Ningbo,” Credit Suisse said.

The slowdown seems largely expected, Credit Suisse added.

However, the faster deterioration in Ningbo is still surprising, and may be due to China’s credit tightening having led to a funding shortage for SME exporters in Zhejiang.

“Latest leading indicators are mixed. June China PMI new export orders further slowed to 50.5 while June US ISM improved and Greece debt issue eased.

"The latter suggests possible stronger 3Q11 demand, when we are heading to traditional high season. However, the tightening is a concern for the SME exporters.”

Sector valuations are below historical averages, reflecting the softening volume growth.

“In the near term, we expect sector performance to continue to be capped by growth concern until positive data points come out.

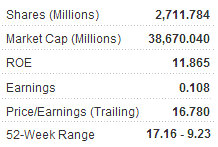

"COSCO Pacific (HK: 1199; OVERWEIGHT; target: 18.20 hkd) remains our top pick in the sector given its more resilient volume and earnings growth.”

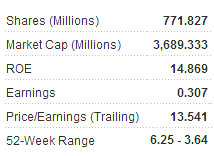

Most of the stocks are trading well below their historical average P/Es and P/Bs after the recent pullback.

China Merchants Holdings (HK: 144; OVERWEIGHT; target: 39.00 hkd) trades at 14.4x and 12.5x 2011-12E P/E versus the historical mean 16.2x, while COSCO is at 12.6x and 11.1x 2011-12E P/E versus the historical mean 14x.

“In our view, the valuations suggest the softening volume growth largely priced in."

The brokerage added that COSCO is its most preferred stock in the sector in 3-6 months, as Credit Suisse expects it to deliver better throughput growth and earnings

“COSCO achieved a 20.3% YoY rise in 5M11 container throughput, outperforming peers and the national average. We expect such stronger growth momentum to continue given its better regional mix and the turnaround of Nansha and Piraues ports.”

See also: YANGZIJIANG, STAMFORD TYRES, SARIN: What Analysts Now Say...

Credit Suisse OUTPERFORM on CITY TELECOM

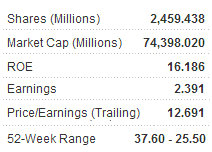

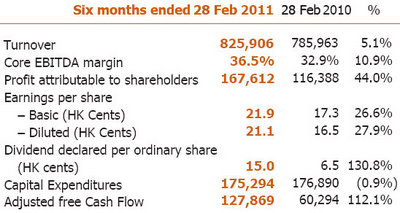

Credit Suisse says it is OUTPERFORM on Hong Kong’s No.2 broadband provider City Telecom (HK: 1137) given that CTI remains subscale relative to the incumbent while the network is already invested (~2 mn home passed), and CTI is incentivized to grow its subscriber scale quickly.

“The company turned more aggressive on price again in June 2011 and expects to improve its subscriber growth from a slowdown in during September 2010–May 2011.”

Credit Suisse added that given its growing scale and variable compensation structure, CTI management still maintains its aggressive EBITDA growth target (+21% YoY to HK$580 mn) for FY11E.

“An improvement in EBITDA, together with the decline in capex to sales from 20% in FY11E towards 10% longer term, should allow CTI to deliver strong operating cash flow growth going forward.”

See also: PCCW: Breaking Up Hard To Do?