This article was recently published on Calvin Yeo's blog, www.investinpassiveincome.com, and is reproduced with permission.

RECENT FEARS OF property bubbles and increasing regulations on housing loans in China have created a huge drag on any stocks related to China property, especially Capitaland and CapitaMalls Asia.

In the midst of all these troubles, there is bound to be attractive value propositions. One of these value buys happens to be an overlooked REIT, CapitaRetail China Trust (CRCT).

It’s amazing how little coverage it gets and how nobody talks about this retail REIT which owns 9 well located malls in China including 4 major malls in Beijing and 1 in Shanghai. The stock is current trading at close to its year-low of $1.15, which translates into an impressive current yield of 7.3%, highly unwarranted given the strong performance of the businesses themselves.

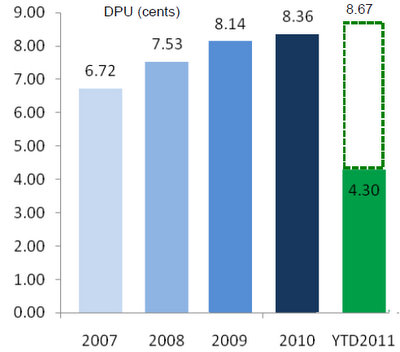

Firstly, let’s look at the dividend per unit pay out, which is the key criteria in assessing REITs. The distribution per unit since 2007 has been on an healthy uptrend, reflecting the rising rentals every year and the expenses are well managed. Not every REIT can boast of such a performance.

Resilient Property Portfolio

CapitaRetail China Trust is a pure play retail REIT with some of the strongest retail assets in China and is backed by a solid management team. Retail REITs are known to have very defensive rental incomes, see my post on Understanding Singapore REITs.

Backed by a very solid sponsor, Capitaland, which also happens to be the sponsor of Singapore’s top REIT CapitaMall Trust as well as CapitaMall Malaysia Trust; CRCT benefits from the synergies of mall management and access to capital. We can see that CapitaRetail China Trust has a very long weighted average lease expiry (WALE) of 6 years.

CRCT also enjoys an occupancy rate of close to 98% across all its malls. CRCT anchor tenants include top hypermarket operator Wal-Mart, Carrefour and many other international brands such as Mango and Uniqlo.

High Dividend Yield at Low Leverage

Given the weakness in stock price, CRCT is trading at a very high yield of 7.3%, much higher than any of the top name retail REITs such as CapitaMall Trust and Fraser Centerpoint Trust which only trade at about 5+% yield.

CRCT also happens to have much lower leverage of only 31%, so it is quite comfortable with any negative reversions in asset prices without having to resort to rights issue.

Further Rental Upside on Asset Enhancement Initiatives and Healthy Retail Spending Growth in China

CRCT like CapitaMall Trust management are excellent at carrying out asset enhancement intiatives which create further value for the REIT. With the recent acqusition of CapitaMall MinZhongleyuan, CRCT has been busy optimising the trade mix for maximizing value and attraction for traffic flow.

It has raised occupancy in the newly acquired mall from about 80% to over 94%, a significant achievement, in less than a year and continues to refurbish the facilities within the mall.

Further AEIs at Xizhimen mall basement connection and Saihan makeovers, DPU will continue on an uptrend without significant funding requirements.

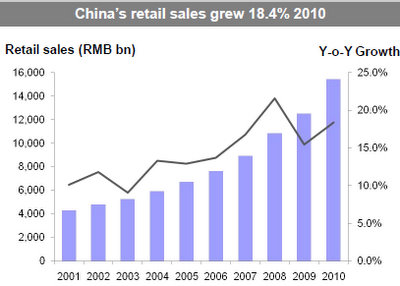

China is still growing with 2011 GDP growth at 9.6%; rapid urbanisation of the population and appetite for luxury products continue to bode well for retail mall operators. China’s per capita income grew at a CAGR of 10.5% over 5 years while retail sales grew 18.4% in 2010 to close to RMB 16bn.

CRCT also has first right of refusal for malls at CapitaMall Asia, ensuring a healthy pipeline of acquisitions.

Upon careful analysis and the reasons stated above, I have initiated a long position in CapitaRetail China Trust at $1.15. I believe the investments in this REIT will pay off in the long run and the current economic conditions create a perfect storm for buying it at a significant discount.

Recent stories:

LIPPO MALL Rights Going At Big Discount

K-REIT: "Why I will sit out this one"