This article was recently published on Calvin Yeo's blog, www.investinpassiveincome.com, and is reproduced with permission.

RECENTLY, THERE has been a lot of discussions about Keppel REIT's acquisition of Ocean Financial Center. There are many who criticize it as a conflict of interest, Keppel Land being the sole beneficiary of the transaction. Yet, there are shareholders who voted to approve the transaction, apparently attracted by the rise in dividend yields. So is this an attractive transaction?

Transaction Details

Keppel Land will sell a 87.5% stake in Ocean Financial Center for a period of 99 years (OFC is actually on 999-year lease) at $2.01 billion with a rental support of $170 million for five years.

Keppel REIT will issue a 17 for 20 rights issue at $0.85 strike price to raise $976.3 million and raise debt of $602.6 million to finance the transaction.

Arguments Against The Transaction

Firstly, Ocean Financial Center is only 80% occupied, a far cry from the over 90% standard occupancy rate in the CBD. However, it has only been completed recently in April 2011, so it will take some time to fill up. Also, the car park lot and retail podium is not even completed yet and will complete by end 2012. Why should K REIT buy now? Why not wait for the office to fill up and the other parts to be completed first?

Secondly, the valuation is on the high end at $2,600 psf, based on Savill’s and Knight Frank’s valuation.

The report is skewed in that they try to take the net price of rental income support to calculate the acquisition price, which is a typical developer gimmick. They guarantee 5 years rental, but the rental income has already been built into the price!

So they try to convince the investors that the true price paid is actually only $2,380 psf, which is definitely not the case. Using $2,600, which is a new high, higher than even Marina Bay Financial Center at $2,400 psf!

They also mention Royal Brothers transaction at $3,050 psf, but it is not really comparable as the Royal Brothers Building is much smaller with only a floor plate of 4,000 sf vs 20,000 sf for OFC.

Thirdly, if it was such a good acquisition, why the need for rental income support? Most properties bought by REITs are standalones which are already income producing. That is the only way we can calculate the yield on the property - based on current rental, not expected rental.

Fourthly, the proposed pro forma leverage level will stand at 41.6% post transaction. However, if the valuations paid for OFC is indeed too high, then the price will drop eventually cause leverage to increase to at least 45-48%. In an economy downturn, office rentals and valuations are the first to take a big hit, causing both leverage to go up and dpu to go down. See my explanation on Understanding REIT Categories.

I actually believe there is too much concentration in the Marina Bay and Raffles Place, with this acquisition, the only diversified building at Bugis will become even smaller as a proportion of total office portfolio.

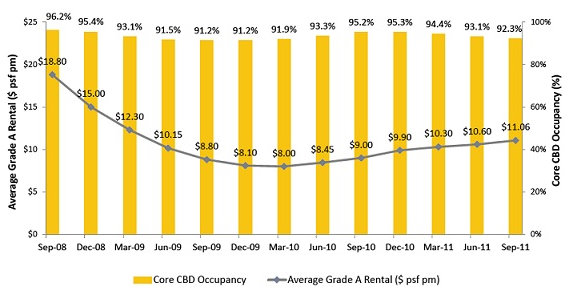

While the transaction is forecasted to be yield accretive by 2.3% to 8.4% based on issue price of $0.85, the forecasted DPU yield is based on current rental values, I wouldn’t count on them being very accurate especially with all the crisis in Europe and US going on. In fact, if you look at the chart below from the recent report by K REIT, average Grade A office rental per month dipped significantly in 2008/2009.

There is, however, one plus point of the transaction, which is to produce tax free returns for investors under a REIT structure. It’s not too significant though, as I assume Keppel Land and Keppel REIT have different investors.

Summary

The whole transaction seems skewed to be more beneficial to Keppel Land than to Keppel REIT. With the disposal of OFC, Keppel Land will basically be getting equity from Keppel REIT rights issue, raise debt through Keppel REIT to shore up capital for further acquisitions, all without burdening its own balance sheet.

Keppel REIT investors will be diluted and left with a huge debt burden which may require another cash call if valuations turn sour. While I questioned the timing of the sale, it makes perfect sense to Keppel Land as it can dipose OFC at peak prices and wait for further downturn before buying new assets for cheap.

At $0.85, dividend yield will stand at around 8%, however the downturn may drop yields to about 5-6% based on the 2008/2009 rental prices. There is also a potential oversupply of office space, especially in CBD sector which will have to contend with lower office rentals outside CBD.

With all the negativity surrounding the transaction and the potential headwinds from the crisis in Europe and US, I will probably sit out this one and continue to monitor the stock.

Related story: The Value in Suntec REIT, the Upside from $400m of Asset Enhancement Initiatives