ARA ASSET’S has a REIT management business which is pretty well understood since REITS are listed entities that have been on the market for many years.

Lesser known is its private real estate fund management business, which is a channel for ARA to diversify its revenue sources and something that is all the more relevant when the economic outlook is uncertain.

“Some people think that as a fund manager, we would be affected by economic problems in Europe and the US. On the contrary, if the China property market bubble bursts, that is the greatest opportunity for us because our private real estate property fund manager can then go out and buy,” said CEO John Lim at a recent talk at Kim Eng Securities.

Secondly, unlike equity funds, private real estate funds do not face redemption risk, where a call by investors on capital committed poses liquidity problems for investment manager.

All of its 5 private real estate funds have delivered stellar performances so far. It has an Internal Rate of Return target of 20% and its track record has so far ranged from 23.7% to 64.8%.

ARA's other core business -- REIT management -- is not vulnerable to real estate downturns.

“We manage real estate, but our income does not follow real estate cycles,” said Mr Lim.

As a real estate fund manager, ARA's income is primarily fee-based, so any fluctuation in the value of assets under management affects its income in only a small way.

Unlike equity fund managers, which can have very volatile stock prices due to income being pegged to the stock market performance, ARA’s income is pegged to property valuation and property rental income, which are relatively stable.

Below is a summary of questions raised by investors at the Kim Eng event, and Mr Lim’s replies.

Q: What are the synergies between your REIT management business and its private property fund?

Property funds tend to acquire assets during an up-cycle while REITs prefer to acquire assets during a down-cycle when cap rates are high. This diversification improves the income stability of ARA as we can be involved at different parts of the property cycles.

Secondly, the REITs that ARA manages are a ready pool of potential buyers for the assets that may be divested by the private property funds that we manage. We receive a commission of about 1.0% from the REIT upon any successful acquisition that it arranges. Also, we have in place stringent rules that ensure such transactions are conducted at arm’s length.

Cheung Kong, which holds 16% in ARA, is one of the region’s largest real estate developers, and the alliance certainly helped us become one of the region’s largest real estate fund managers.

Q: What sectors and geographies are you looking at for expansion?

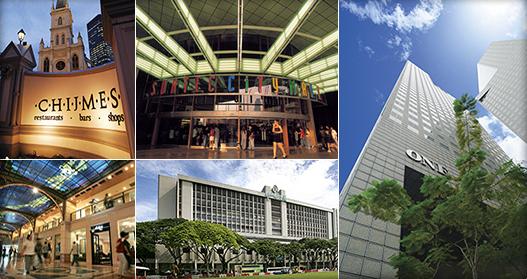

Our core markets where we have listed our REITS - China, Hong Kong and Southeast Asia, including Singapore and Malaysia. These are markets where we are relevant and strong, where we have very good network and connections. And we will continue to grow in those markets.

The other markets in Asia are Japan, India, Australia and the Middle East. We have made some headway in two of these countries. We have invested in a small Aussie fund manager, APN, with A$2 billion of assets under management. It has a similar recurring fee-based income model as us. We hope to invest in Australia through this vehicle.

We also have a partner in Qatar to do hospitality trusts. But we intend to hold back on our Middle East expansion for a while. We are still working on Japan and India. India is a very tough market to crack. China is going to be the immediate focus for the next couple of years.

As for sectors, to be honest, we do anything that has to do with real estate without actually buying the physical real estate. We do mezzanine loans to real estate. We do REITS to real estate. We do under-performing loans. We cover all sorts of shapes and sizes, from a private fund to the public market. Q: Is there any opportunity for you to raise your fees?

Q: Is there any opportunity for you to raise your fees?

For the REIT product, the answer is no. The reason is because the REIT is an established product in Singapore, Hong Kong and Malaysia.

But for private fund management, the answer is yes. How much we charge depends on our track record, the product and the market. For example, given the current economic outlook, if we are able to do a non-performing loan fund and bring in the returns, we have a lot of leeway in the rates we command.

Similar to boutique fund managers, if we have this gilt-product and the connections, people are even willing to pay 5%. On the other hand, if we offer a product that anyone can do, then we have to reduce our fees to be competitive.

In general, the whole industry doesn't compete on fees. We are not property agents. People come to us because we are good in terms of our track record, not because we are cheaper.

Being cheap is no use if we can’t deliver. Our customers are coming in with S$5 million to S$500 million in ticket size and fees are not an issue. If we cut our fees, the institutions think we are desperate and we lose our business. So we even raise our fees when rolling out premium products. In this type of market, if I outperform my target, I will charge a higher rate for the portion on profit sharing.

Related stories:

1 m share buyback by YANGZJIANG, 1 m by ARA chief

ARA ASSET: Resilient Earnings With Decent Dividend Yield