HAFARY HOLDINGS has just had a memorable financial year: Its earnings and sales hit the highest levels in its 30-year history, and it has upped its dividend by 125%.

Will it be a challenge to top its FY11 performance?

Hafary is optimistic on its business outlook, going by CEO Eric Low’s way of thinking.

To those not familiar with Hafary, which is to say a lot of investors as the stock has been very low-profile, let’s backtrack a bit.

Hafary is an importer and distributor of tiles, mainly. In recent years, it has emerged as one of the biggest players in its industry in Singapore.

The key reason it had a great FY11 has to do with the strong spate of private property launches in the past two to three years.

FY11 was a time for many of the properties to be completed. And it was time for Hafary to deliver the tiles and surfacing materials that decorate bare walls and floors.

Not just that, but also the wood flooring and sanitary ware and fittings, to a smaller extent.

Sales to projects jumped 103.9% to $22.6 million for Hafary, which sold to Double Bay Residences and The Regency, for example.

Aside from project clients, Hafary's other business segment comprise walk-in individuals and architecture, interior design and renovation companies making ad-hoc purchases for smaller projects.

Sales to this segment grew 38.6% to $37.7 million in FY11. In absolute dollars, this is the larger contributor to group revenue.

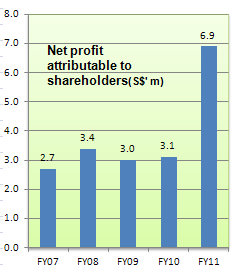

In all, net profit attributable to Hafary shareholders jumped from S$3.1 million to S$6.9 million.

Hafary declared a 0.9 cent dividend, up from 0.4 cent in FY10, translating into a yield of 3.6% based on the recent stock price of 25 cents.

To benefit from HDB building boom

In the current financial year, Hafary will continue to have lots of nearly completed private property projects to deliver tiles and surfacing materials to.

Said Mr Low: “In the next half year to 1 year, we will focus on delivering to private jobs. A lot of condos sold in the past 1 year are now receiving their orders.”

However, Hafary is wary of the economic slowdown resulting in fewer transactions of completed properties – if that happens, demand for renovation of existing occupied homes will slacken.

From the second half of calendar year 2012, Hafary will have a new growth driver: the HDB’s flat building programme which is being ramped up.

That is why Eric Low is bullish on this year and beyond – and is investing heavily in warehousing capacity for Hafary products.

Hafary has only recently targeted the HDB market. Given the sizeable supply that is required by the HDB and being a big player, Hafary is confident of making inroads into the market.

As a result, it expects a new stream of revenue from supplying to HDB flats from the 2H of calendar year 2012.

The profit margin will be anything but fat, though, said Mr Low. To improve its profit margin, it is for Hafary to exert its bargaining power with its Malaysian supplier, which is a subsidiary of the Hong Leong Group.

Profitable property divestment, initial overseas ventures

Hafary is embarking on ventures that would transform its revenue and earnings profile in the next few years.

Firstly, there is a property project which has come about fortuitously. Hafary had bought a freehold property near Aljunied MRT station last year for redevelopment into its HQ and showroom.

This month, the property has been instead launched for sale as an industrial project, and is expected to reap profits considering the recent transacted prices of properties in the vicinity. The profits would help reduce the gearing of Hafary.

In place of the Aljunied site, Hafary has acquired three properties in Eunos, Changi and Sungei Kadut for its HQ, showroom, warehousing and fabrication purposes. The cost is estimated to total $43.2 million, inclusive of development costs and stamp duties, etc.

These assets signal a new phase in Hafary's corporate life, along with the setting up of subsidiaries in Singapore this month to act as Special Purpose Vehicles for future investments in Vietnam and China to pursue new business.

Recent story: HAFARY: Sizzling 237% profit growth in 1H, more to come?

Given this situation, if the developer wants to make life difficult for Hafary, it will delay payment, or do further bargaining by complaining about the tiles (quality, etc). Hafary has not way to seize back the goods!

For FY11, I note that the allowance for impairment of trade receivables INCREASED BY $0.5 million from $141K to $640K. Reads like they are doubtful if $640,000 worth of receivables will be paid by their debtors. This is not a tiny amount, relative to the net profit of $$6.9 million.