THERE IS NOW a buzz in the construction industry as the much-publicised ramp-up in the HDB building programme will shower a bonanza of jobs on the players.

These are the builders obviously. Less obvious are the companies that supply the finishing touches to bare walls and floors.

In this category belongs Hafary Holdings, a Catalist-listed company. After much consolidation in the industry, Hafary has emerged as the No.1 supplier of tiles, stones and mosaic in Singapore.

More recently, detecting synergy and opportunity, it ventured also into wood flooring and sanitary ware.

With a potentially sizzling period ahead, Hafary CEO Eric Low met up with analysts and the media recently, presenting the story of his company, whose name most investors would not have heard of even though it has been listed for one and a half years now.

Maybe such a low profile will not last for long, especially if it continues to deliver on its growth potential.

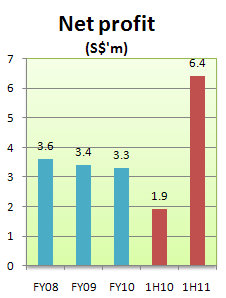

Already, in the first half of FY2011 (ie July 2010-Dec 2010), Hafary chalked up net profit growth of 237% to S$6.4 million compared to $1.9 million in the previous corresponding half.

Revenue stood at $30 million, up 64% year on year. In other words, the profit margin leapt too.

Digging into what makes Hafary stand out, Mr Low said it incorporates a high amount of design into tiles that it orders from factories in places such as China and Italy.

“Design is what differentiates us from our competitors and enables us to lift our profit margin,” he said.

And being the largest importer of tiles in Singapore, Hafary enjoys good pricing from its suppliers.

As a result, Hafary is “growing fast and furious --- to the extent that our closest competitor is now just about a third of our size.”

Mr Low said Hafary’s bottomline going forward will be boosted by its recent entry into the HDB market – ie supplying its tiles to HDB flats that are being constructed.

Hafary, you may be surprised to know, had zero share of this public housing market. Only last year did Hafary target this market, hiring experienced staff from a rival company, and locking in supplies from a Hong Leong subsidiary in Malaysia.

Mr Low said Hafary's designs and product proposals to HDB for its Build-to-Order projects have been "very well received."

So from nothing currently, the HDB building programme will contribute significant revenue (tens of millions of dollars a year) and profits to Hafary from 2HFY12, according to him.

“Our core management strength is we can identify where the money is, where the potential for growth is. Ten years ago, we went for made-in-China tiles when nobody was doing it – our profit margin was good.

“In recent years, we saw that Italian tiles would become popular – so many bungalows everywhere. We saw it coming and we bet on that market. We have become the biggest importer of Italian tiles.”

Hafary's revenue comes almost entirely from Singapore. About 70% of its revenue in FY2010 came from retail customers who bought directly from its showrooms in Balestier, Boon Lay Way and Eunos Ave 3, and customers such as architecture and interior design firms that do ad-hoc purchases.

The rest of the revenue came from project customers serving major property development projects in the residential, commercial, public and industrial spaces.

Such projects included Copthorne Orchid Hotel @ Tanjong Pagar, Double Bay Residences, and The Regency.

Stock matters

Hafary shares are illiquid, with the last traded price being 20 cents, which is the same as its IPO price at end-2009. The market cap is S$32.5 million.

Based on its 1H2011 profit of $6.4 million, the earnings per share at half-time was 3.9 cents.

For FY2010, Hafary declared a dividend of 0.4 cents a share, amounting to 20% of its net profit.

The stock is tightly held with the Low family controlling about 80%. The top 20 major shareholders hold 96.6%. Free float in the hands of the public is 11.4%.