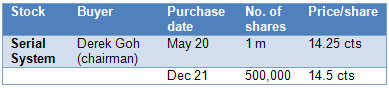

Chairman and CEO Derek Goh has resumed raising his stake in his company, Serial System, with a 1-million share purchase on Friday, May 20.

His previous purchase was made on Dec 21 at 14.5 cents, just a shade above the latest transacted price.

Derek now holds 298,727,698 shares, or 36.38%, of Serial, a distributor of electronic components throughout Asia.

As at May 31 last year, when he bought some shares at 10 cents apiece, he owned 259,538,711 shares.

Serial, which has just reported that its 1Q net profit rose 10.3% year on year to S$3.2 million, has made a number of acquisitions, including an impending purchase of a 57.6% stake in JEL Corporation.

Recent story: SERIAL: Steady profit growth in 1Q, closer to acquiring JEL

In the last 12 months or so, Meiban Group has been regularly buying back its shares, particularly when they fall below 30 cents.

The 8 April purchase at 33 cents wasn’t too out of line if you consider that the stock was then trading cum-dividend of 2 cents a share.

In addition, the purchase was at a level way below the stock’s Net Asset Value as at end-March of 46.6 cents a share.

In 1Q, revenue declined 17% to $90.1 million and net profit was down 29% to $2.7 million.

Investors would be looking out for how Meiban develops and markets what it touted as the “world’s most efficient LED headlamp.”

Straco Corporation has been a regular buyer of its shares only this year, accumulating 1.082 million shares so far.

Straco, though listed on the Singapore Exchange for 7 years already, is a low-profile developer and operator of tourism-related attractions in China.

It is not quite a S-chip as its top shareholder is Straco Holding which is 100% owned by its Singaporean executive chairman Wu Hsioh Kwang and his wife.

It reported a 8.4% increase in net profits to $1.10 million for the first quarter ended 31 March 2011.

Group revenue was S$7.39 million, an increase of 12.4% as combined visitor numbers to its two main attractions, Shanghai Ocean Aquarium and Underwater World Xiamen increased 11.3%.

Its market cap is about S$139 million, of which S$65 million is cash. Straco has no bank borrowings.

The stock’s trailing PE is 7.4X based on the recent stock price of 16 cents.

Recent story: INSIDER BUYING during Japanese fallout Mon-Tues

The stock has been trading in a tight range of 14-15.