DEMONSTRATING CONFIDENCE in their businesses, a number of Singapore companies have activated their share buyback schemes in the last 2 days as the Japan disaster sank stocks here in Singapore and everywhere. Notably, the funds which are major shareholders of Saizen REIT have stepped into the market to buy. Here is our compilation of insider buying, and includes major shareholders of 3 companies, plus some notes extracted from official press releases on 2 of the companies' 2010 business performance plus Saizen's update on its Japanese properties.

It reported a net profit of $2.49 million for the fourth quarter ended 31 December 2010.

Group revenue increased 42.9% year on year to S$9.29 million, due to higher visits and higher yield achieved.

For 4Q, combined visitation to its two main attractions, Shanghai Ocean Aquarium and Underwater World Xiamen improved 25.2% year-on-year to 465,000 visitors.

Cumulatively, Group revenue for the year ended 31 December 2010 registered growth of 49.3% year on year, while Group profits more than doubled to $18.67 million.

Commenting on the results, Straco’s Executive Chairman, Mr Wu Hsioh Kwang said: “2010 was an exceptionally good year for our Group as we hit record revenue and profits since inception. Though our business units operate in generally favourable conditions – the buoyant PRC tourism industry, the positive impact from the World Expo event, and the incremental revenue and profits brought about from high yield achieved, credit must be given to our management and staff for their collective effort in ensuring smooth and incident free operations during the extended peak period.”

For the full year, revenue was up 49.3% and net profits surged 111.2% year-on-year. Earnings per share more than doubled to 2.15 cents.

Straco has proposed a first and final dividend of 0.75 cents per share.

*** Leeden: It provides total integrated solutions for Welding, Gas and Safety across Southeast Asia. Apart from being an established distributor of internationally renowned agency products, Leeden also possesses manufacturing capabilities in Welding, Gas and Safety products.

It recorded full year earnings of S$7.6 million for FY2010 despite a challenging economic environment.

Its revenue increased to S$191.5 million in FY2010 mainly driven by Industrial Division.

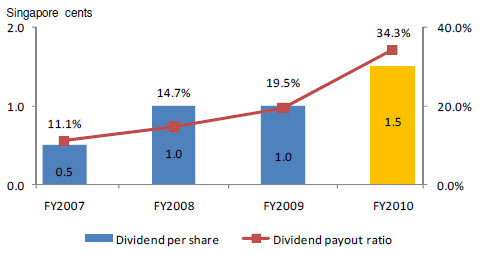

Its net gearing ratio improved from 0.47 times to 0.40 times, and it proposed a final dividend of 0.50 Singapore cent per share, marking a record dividend payout ratio of 34.3%.

Recent story: LEEDEN'S 46th anniversary: Oh what a bash!

However, the full extent of damage can only be ascertained after more detailed assessments.

The 14 properties yet to be viewed represent 5.1% of Saizen REIT’s total investment property value and 5.3% of annual rental income.

These properties belong to 3 out of 9 TK operators of Saizen REIT, viz. GK Choan (2 properties), YK Shingen (3) and YK Shintoku3 (9). They represent 0.6%, 1.4% and 3.1% respectively of Saizen REIT’s investment property value, and 0.7%, 1.5% and 3.1% respectively of Saizen REIT’s annual rental income.

To-date, Saizen has not received any reports of tenant casualties, and none of the properties viewed appear to have been vacated.