QINGMEI GROUP is a S-chip which has attracted the buying of an Australian fund.

Qingmei is a manufacturer of high-end sports shoe soles, and is based in Jinjiang City in Fujian Province.

It listed on the Singapore Exchange in March 2010 at 31 cents a share.

Australian fund Hunter Hall Investment Management Limited has just emerged as a new substantial shareholder with the purchase of 9 million shares at 34.02 cents apiece on Jan 19.

It now holds 40 million shares, or a 6.25% stake.

As far as we know, there is no analyst coverage of this stock but a NextInsight reader has highlighted it recently as one of his top stock picks for 1Q2011 in our forum.

SIAS Research initiated coverage of Sinopipe Holdings on 19 January with a target price of 40 cents. The stock closed on Friday at 28 cents.

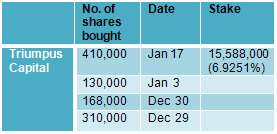

On Jan 21, a substantial shareholder of Sinopipe, Triumpus Capital, continued its accumulation of the company’s shares. It bought 590,000 shares of the company at an undisclosed price.

Triumpus, which became a substantial shareholder with a stake of 5.5% in August last year, is run by Dr Pu Weidong, who once was an investment analyst with UOB Kay Hian in Singapore.

In 2006, he joined Sinomem as Vice President for Corporate Planning, Strategic Investment and Investor Relation, and resigned in 2009.

Recent story: BRIGHT WORLD, SINOPIPE, CONSCIENCEFOOD: What analysts now say....

Wa Kok Liang, the COO of HLN Technologies, bought company shares after they plunged following an announcement of its plan to venture into property development in China.

Leslie Wa, who stepped down from being CEO after he sold a chunk of his shareholding to a third-party, coughed up $158,000 for 452,000 shares on Friday (Jan 21), raising his direct stake to 7.6%.

His previous purchase was of 169,000 shares in June last year at 23.9 cents a share.

In August last year, his deemed interest in HLN went up after his wife bought 2.988 million shares in a married deal at 28 cents a share.

Immediately prior to this, she didn’t hold shares of HLN.

Previous story: Insider buying: LEEDEN, HLN, BRIGHT WORLD

Toe Teow Teck, a substantial shareholder of XinRen Aluminum, has bought 7,408,000 shares in the open market.

This brings his direct interest to 13,058,000 shares, or 1.189%, while his deemed interest amounts to 11.822%.

He is the first insider trade since XinRen was listed in October last year.

Recent story: XINREN ALUMINUM: On-the-ground insights into its fast-expanding fabrication plant