Excerpts from latest analyst reports.....

UOB KH initiates coverage of BRIGHT WORLD PRECISION with 70-c target

Analyst: Brandon Ng

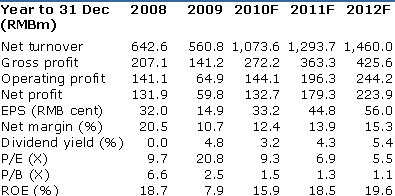

Earnings Forecast

We forecast BWP’s revenue to grow 91.4% yoy to Rmb1.1b in 2010 as the number of units sold on both conventional and high-tonnage stamping rebounded from the trough in 2009.

We expect net profit to jump 122% yoy for 2010 to Rmb132.7m due to higher revenue and gross margins despite higher selling and administrative expenses.

Although the company does not have a fixed dividend policy, we project the company will pay out 30% of its net profit in 2011, giving us Rmb0.10/share or 3.3% in dividend yield as of 17 Jan 11’s trading price. BWP distributed Rmb60.0m or Rmb0.15/share in dividends for FY09.

Valuation

We have a target value of S$0.700, implying a 0.4x PEG based on 5-year earnings CAGR of 20%. This translates to 10.8x 2010F PE and 8.0x 2011F PE.

However, as share price has advanced 10.0% on news of an Rmb48.0m contract secured by the company, profit taking may occur in the near term. Initiate with BUY.

Recent story: BRIGHT WORLD: Growth factors echo Deutsche Bank call on capital goods makers

SIAS Research initiates coverage of SINOPIPE with 40-c target

Analyst: Ng Kian Teck

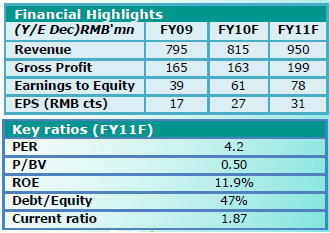

We initiate coverage on Sinopipe Holdings Limited (Sinopipe) with an Increase Exposure rating based on an intrinsic value of S$0.400, representing an upside of 60% over its current price of S$0.250.

We like Sinopipe for its favorable industry trends and unique business strategies.

The company is currently trading at an attractive discount of 4.7X FY2010F P/E and 0.51X FY2010F P/B compared to its peers’ average of 27X P/E and 9.2X P/B.

Though we are upbeat about Sinopipe’s prospects, there are several issues that we would like to highlight to investors.

1) Raw material prices have increased significantly since end 2008. Whilst the company has taken actions against the surge in raw material prices, margins will still be affected should the increment continue.

2) Slower than projected growth in China as well as the government’s intention to cool the overheating economy may affect the number of infrastructure projects in the country and thus, impact Sinopipe.

Recent story: Insider buying: CHINA ENVIRONMENT, SINOPIPE

DBS Vickers maintains ‘buy’ on CONSCIENCEFOOD and 38-c target

Putting in place value drivers for the next two years. Value earnings drivers for the next two years are in place especially from the developments in CSF beverage business, in our view.

Beverage business to generate net profit of Rp56b by FY12. According to our base assumptions of Rp5,000 on average selling prices and 50% utilization, the beverage business will generate an additional Rp324b revenues in FY12F or 37% above our FY12F revenue estimates.

CSF’s FY12F net earnings should reach Rp200b, a 39% increase from current FY12F estimate of Rp144b. CSF’s beverage business is likely to contribute close to 30% in revenue and earnings in FY12F.

Still attractive. Since our initiation, CSF has surged 40% from S$0.225 to S$0.315. We have increased FY11F earnings by 8% from Rp111b to Rp120b to reflect ramp up of the beverage business in 4Q11F.

Based on our 7x valuation (30% discount to Mamee Double Decker’s valuation) of CSF’s FY11F earnings, we derive a TP of S$0.39, a 5% increase from our previous TP of S$0.38. Maintain Buy.

Recent story: CONSCIENCEFOOD: Analysts check out its Medan factory