Excerpts from latest analyst reports…..

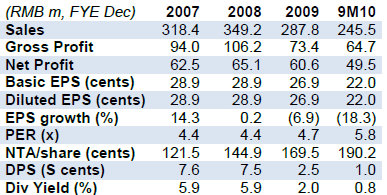

NRA Capital expects HONGWEI’s 4Q to be a ‘good quarter’

We recently had a teleconference with Hongwei’s key management.

Adding more capacity to SC segment. The group has earmarked about RMB 70-80m for two additional non-woven production lines used for Synthetic Cotton production. The newly-added facilities, which will increase its capacity by 40-50%, are expected to have material contribution in 2Q next year.

3Q results were affected by higher depreciation and provisions. While revenue jumped 12.7% to RMB88.8m in 3QFY10 from the same period last year, net profit declined 27.4% to RMB 12.9m. This was attributable to 95.5% increase in admin cost to RMB4.4m and 75.5% increase in income tax. Higher admin cost was due to provisions for performance bonus and depreciation charges arising from two new administrative buildings. Higher income tax was provided for withholding tax.

Dividend and 4Q results review. Barring unforeseen circumstances, management intends to pay more than 20% of earnings in dividends. 4Q is likely to be a good quarter given that most provisions have been made. The EPS for the first 9 months in FY10 was about RMB 22 cents, representing annualized EPS of about RMB 29 cents. With that, the annualized dividend yield is estimated to be more than 4.5% this year.

Recent stories:

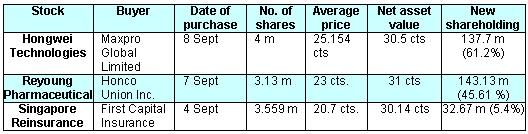

INSIDER BUYING: STAMFORD TYRES, HONGWEI, TECHNICS OIL & GAS

HONGWEI: Profit up in 1Q, 2Q, chairman may cut stake to boost share turnover

CIMB says CHINA FIBRETECH offers ‘big margin of safety’

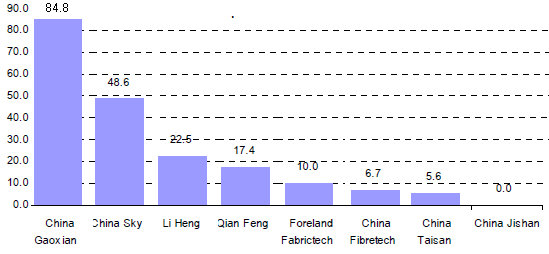

Investors who followed our call to turn bullish on the textile sector would have made money. Our three picks in our 30th November note have done well, especially China Gaoxian which has gained 85% since our recommendation.

• China Fibretech – big margin of safety. Why? Net cash per share is S$0.147. Book value per share is S$0.20 while last price was S$.0.08.

• Bad news all priced in. We spoke with management. No more profit warnings. 3Q10 profit Rmb1.3m, 4Q09 loss Rmb4.8m, piece them together, and given order recovery, management deserves a tight slap if 4Q10 can’t beat these numbers.

Lim & Tan Securities recommends investors take profit on LONGCHEER

We are downgrading our long-held BUY recommendation on Longcheer to “Take Profit” as our channel checks suggest that the company will likely disappoint consensus earnings of close to Rmb200mln for Full Year ending June’2011 by a meaningful margin.

* According to its major chip supplier Media Tek, after the

major ramp up in business volumes seen from 2009 to 2010 there are signs that excess inventories are building up for non-3G phones in India as well as China. This is especially so as the current “hot” products are smart phones which Mediatek and Longcheer are only expected to start rolling out (in meaningful volumes) in mid-late of 2011.

* This thus creates a short-term hiccup to both Media Tek and Longcheer as both companies are currently reliant on non smart-phones for the bulk of their business.

* Major shareholders of Longcheer sold 10mln shares at 80 cents in Sept ’10 and another 3mln shares at 70 cents in Dec ’10 when the stock was trading around the 74-75 cents level.

* Our initial buy recommendation on Longcheer was in Feb ’10 when the stock was trading at 50 cents and the company has also since paid out 4 cents in dividends, hence while we had missed out on its recent high of just over 80 cents, we believe it is still not too late to “Take Profit”. We would look for another opportune time to re-enter the stock.

NRA Capital sets 38-c target price for TEE INTERNATIONAL

The group proposed an interim dividend of 0.5 Sg cent, its first interim payout since listing. This signified the commitment by management to reward shareholders and confidence in managing the financing requirement for its property development projects. Its order book as of 1HFY10 was $284m.

Reiterate BUY

We maintained our forecast. Rerating catalysts include clinching new engineering contracts, higher ASP and better churn rate for property sales. Risks include execution risk for overseas project and lukewarm response to its property launches. We continue to adopt SOTP to value the company. Our target price of $0.38 was derived from application of 30% discount to its RNAV for real estate segment and 10x FY11 PER for engineering segment.