Terence Wong, head of research at DMG. Photo by Sim Kih

HEALTHCARE, REITS, telecommunications and land transport are the four sectors that earned an overweight’ rating in DMG & Partners’ 2009 Strategy report released on Friday (Jan 9).

Within those sectors, the DMG analysts have ‘buy’ calls on Raffles Medical, Comfort DelGro, Ascendas REIT and StarHub.

Other ‘buy’ calls are Capitaland, China Milk, Li Heng Chemical Fibre, UOB and Venture. They have a 'sell' on Cosco and SGX.

The analysts are 'neutral' on all other sectors, except for technology which earned their 'underweight' rating. Excerpts from the report on the 4 'overweight' sectors:

* HEALTHCARE

Demand for healthcare services underpinned by population growth and government initiatives.

Earnings from the healthcare sector are relatively more resilient, and cash flows are stable. Singapore’s private healthcare providers mainly focus on providing key medical specialties, such as oncology and cardiology, where treatments are more essential.

Collaboration with overseas healthcare providers and ownership of a network of family medicine clinics, coupled with Singapore’s reputation as a quality healthcare provider, would help healthcare providers expand patient volume.

The private healthcare sector is also expected to benefit from the government’s implementation of the means testing scheme in public hospitals in Jan 09.

Hence, we OVERWEIGHT the healthcare sector. We have a BUY recommendation on Raffles Medical, with a target price of S$0.85.

Comfort DelGro locked in higher fuel prices, but eventually will enjoy lower energy expenses. NextInsight photo

* LAND TRANSPORT

Earnings to be driven by ridership growth and lower fuel expenses.

Whilst a 2009 GDP contraction is negative for travel, public transport ridership should be more resilient than other more-expensive transportation means.

We believe the momentum of strong 2008 rail ridership growth will partly flow through into 2009.

In addition, crude oil prices have fallen to the recent US$40/bbl, a fraction of the Jun 08 month-average of US$134/bbl. This will translate to lower energy expenses for both ComfortDelgro and SMRT, though with a lag due to them having locked in prices earlier.

ComfortDelgro is a BUY with a S$1.63 target price whilst SMRT is NEUTRAL (due to its greater dependence on the more cyclical commercial space rental business) with a S$1.65 target price.

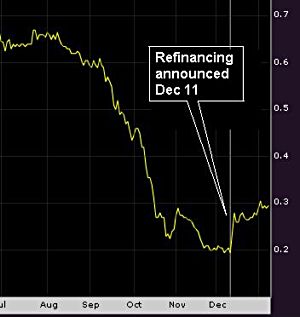

Dec 11 Cambridge REIT closed at 19.5 cts, following which it announced it had secured refinancing. Since then, the REIT'S unit price has risen, closing at 29.5 cents on Jan 9.

* REITS

We are OVERWEIGHT on REITs, largely as a result of the current compelling valuations and attractive yields, i.e. historically low average P/B ratio of 0.49x, as well as FY08-09 trading yields of 12.9-13.1%, a whopping ~ 10% premium over the 10-year Singapore bond yield.

While refinancing risks rank top of investors’ concerns, the recent successful S$390m refinancing exercise by a small-cap REIT (Cambridge Industrial Trust) implies that credit is still available, albeit at higher funding costs.

Sector is lowly geared at average of 29.8%, and even after asset valuations are factored in, REITs in general are still decently geared below the 60% regulatory mark. Recent sector sell-off has been overdone, as fundamentals remain intact.

Among the 6 REITs under our coverage, we prefer those with strong sponsor-backed statures and exposure to the more resilient industrial and retail sub-sectors.

Excerpt from The Edge magazine Dec 22-28 edition

Within the big-cap arena, Ascendas REIT (BUY\S$1.32\Target S$1.75) ranks as our sector top pick, while Frasers Centrepoint Trust (BUY\S$0.62\Target S$0.86) and Cambridge Industrial Trust (BUY\S$0.27\Target S$0.49) are the preferred recommendations from the small-mid cap space.

* TELECOMMUNICATIONS & MEDIA

Telecommunications and media companies are in a better position to weather a downturn compared to most other industries given their resilient earnings.

We believe domestically focused StarHub (BUY\S$1.95\Target S$2.68) and M1 (BUY\S$1.47\Target S$1.58) will outperform SingTel (NEUTRAL\S$2.55\Target S$2.67), with the latter’s performance being dragged down by its overseas units and foreign exchange.

Moreover, the two smaller telcos have far better yields compared to SingTel. Another high yielding stock we like is media giant SPH (BUY\S$3.11\Target S$4.35), which should continue to outperform the market with its defensive qualities. It may be hit by slowing growth in advertising revenue and higher newsprint prices, but this will be partially mitigated by contribution from its fully sold Sky@eleven development project.

Recent stories:

UOB Kayhian: 'Overweight' REITS now

CIMB-GK: "80% chance of upside this year"