Excerpts from analysts' report

|

Analysts: Terence Wong, CFA (left) & the OSK-DMG team Analysts: Terence Wong, CFA (left) & the OSK-DMG team

We are expecting the Singapore market to post a rebound after two disappointing years. While the tight labour market and the lack of productivity improvement will continue to be a drag on the economy, we see bright spots that are expected to lift the STI by 11% to 3,720, its highest level since 2007.

• Go contrarian. We believe in investing where most fear to tread, namely the offshore & marine and property sectors. The free-fall in oil prices will continue to grapple the market, although we believe that prices will recover some time before the middle of the year. This ought to set the stage for a rebound in the offshore & marine sector.

As for property, the physical market is likely to remain subdued, leading to a fall in residential prices by up to 10%, in our view. We expect some cooling measures to be lifted in 2H15, which should see interest returning to this segment.

|

Head for mid caps. For the past two years, we have advocated for investors to do selected stock picking in the small cap space, which have paid-off handsomely.

This year, given the slump in many prominent mid caps, we believe that this segment is the sweet spot to be in.

STI target of 3,720 based on 15x FY15F P/E. This is driven by: i) the expected positive returns from bellwether sectors, ii) productivity in Singapore turning around, and iii) attractive valuations.

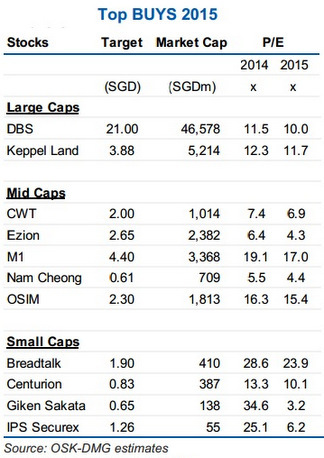

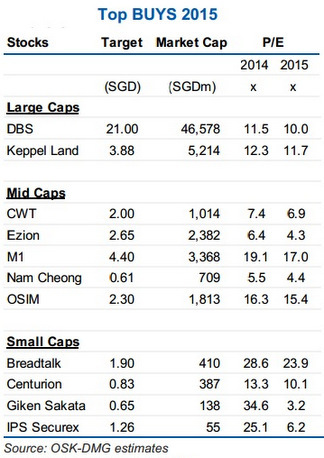

Our Top Picks. The majority of our top BUYs are mid caps, namely

»

CWT (CWT SP, BUY, TP: SGD2.00),

»

Ezion (EZI SP, BUY, TP: SGD2.65),

»

M1 (M1 SP, BUY, TP: SGD4.40),

»

Nam Cheong (NCL SP, BUY, TP: SGD0.61) and

»

OSIM International (OSIM) (OSIM SP, BUY, TP: SGD2.30).

Sydney Yeung, CEO of Giken Sakata. NextInsight file photo

Sydney Yeung, CEO of Giken Sakata. NextInsight file photoFor the large caps, we like

DBS (DBS SP, BUY, TP:SGD22.60) and

Keppel Land (KPLD SP, BUY, TP: SGD3.88).

BreadTalk (BREAD SP, BUY, TP: SGD1.90),

Centurion Corp (Centurion) (CENT SP, BUY, TP: SGD0.83),

Giken Sakata (GSS SP, BUY, TP:SGD0.65) and

IPS Securex (IPSS SP, BUY, TP: SGD1.26) get our vote in the small cap space.

Top SELLs include

Parkson Retail Asia (PRA SP, SELL, TP: SGD0.65) and

Silverlake Axis (SILV SP, SELL, TP:SGD1.03).

Click here for the full OSK-DMG report

Sydney Yeung, CEO of Giken Sakata. NextInsight file photo

Sydney Yeung, CEO of Giken Sakata. NextInsight file photo