• So, there’s this amazing surge in the stock price of a popular café chain in Johor and in various parts of Malaysia called Oriental Kopi.

|

Excerpts from UOB Kay Hian report

Analyst: Phillip Wong

Oriental Kopi Holdings (KOPI MK)

Rising To The Top, One Pastry At A Time

| Oriental Kopi’s fully-owned cafes ensure unmatched quality that is backed by award-winning product offerings. As the company is listing at an early-stage life-cycle and has only 20 outlets nationwide, it offers explosive multiyear growth opportunities with its true regional potential still untapped. Increased scale, a planned central kitchen and inroads into a rising proportion of FMCG sales could enhance profitability as well. Initiate coverage with BUY and target price of RM0.88. |

INITIATE COVERAGE

|

Oriental Kopi |

|

|

Share price: |

Target: |

• Proof is in the coffee, tarts and more. Oriental Kopi’s fully-owned cafes emphasise quality and consistency, avoiding a franchise model to maintain control over products and services.

Learning from predecessors’ mediocre success with a franchise model, Oriental Kopi remains dedicated to high standards in a competitive market.

The brand stands out with its award-winning F&B offerings, including its signature coffee, egg tarts, and polo buns, which have earned various accolades.

A strong recipe creation team, led by Head Chef and shareholder, Ho Poh Chian, ensures menu innovation and consistent quality across all outlets.

• Hitting the sweet spot with customers. With an impressive average Google rating of 4.3 stars across its 20 outlets, Oriental Kopi enjoys widespread customer approval.

Its expansion is supported by menu standardisation, in-house tastings, and a focus on locallyinspired dishes.

The ongoing process to certify its stores halal should aid their aim for shariah compliance by May 25, and enhance their appeal to a broader demographic.

This strategic move, coupled with its focus on customer satisfaction, positions Oriental Kopi to expand its reach.

• Poised for tremendous growth off a low base, Oriental Kopi’s growth strategy is driven by its F&B cafe operations and FMCG segment.

The cafe segment, still in its infancy stage of its life-cycle, plans to open 12 additional outlets by FY25-26, bringing its total to 32.

Despite a seemingly low store count addition, it would represent a significant 44% and 23% growth (two-year CAGR: 33.3%) over FY25-26.

• Icing on the cake – FMCG growth. Meanwhile the FMCG segment will undergo a widening of distribution channels, including its own cafes, online platforms, and wholesalers.

Oriental Kopi targets to have five specialty retail stores that only sell its FMCG products by FY26, vs one at the moment.

Consequently, FMCG revenue share is projected to reach 19% by FY27 from 7% in FY22.

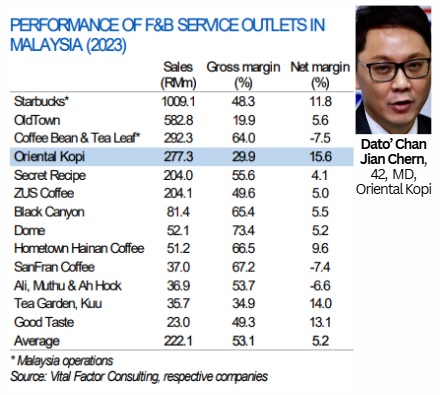

| VALUATION/RECOMMENDATION • Initiate coverage with a BUY call and a target price of RM0.88 pegged to 25.9x 2025F PE. Despite its smaller market cap, Oriental Kopi's three-year earnings CAGR of 33.1% far exceeds peers’ 11.4-13.7%. With only 20 outlets vs OldTown’s peak of 200, the company’s early-stage growth potential justifies a premium valuation. Trading near the market cap weighted average of 25.9x 2025F PE, Oriental Kopi offers a compelling investment opportunity given its robust expansion plans and superior growth trajectory. |

Full report here.