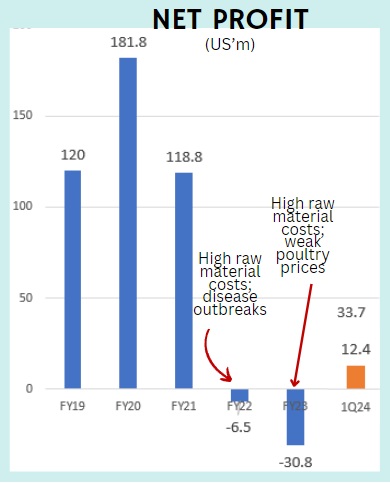

• Are turnaround stories likely to yield good gains in stock prices? Let's see if this will be the case for Japfa.  The poultry business contributes a substantial portion of Japfa's revenue, especially through its subsidiary PT Japfa Comfeed Indonesia Tbk, which is a major player in the Indonesian market.• Headquartered in Singapore, Japfa is one of the largest poultry producers in Indonesia and in the region. (Japfa also has a smaller swine business, mainly in Vietnam). The poultry business contributes a substantial portion of Japfa's revenue, especially through its subsidiary PT Japfa Comfeed Indonesia Tbk, which is a major player in the Indonesian market.• Headquartered in Singapore, Japfa is one of the largest poultry producers in Indonesia and in the region. (Japfa also has a smaller swine business, mainly in Vietnam). Japfa controls the entire work flow: from producing the feed that feeds the chickens, to breeding and raising the chickens, and finally processing and selling the chicken meat and eggs. • Japfa's stock has surged 45% since the start of 2024, from 22 cents to 32 cents recently. A key trigger for the run was a Bloomberg report in early March on a possible privatisation of the company. See: Top Asia Poultry Firm Japfa Owners Said to Mull Go Private Deal. Japfa's response is here (which didn't outright say it wasn't in the works). • The privatisation possibility aside, after 2 years of losses, Japfa is giving investors reason to anticipate a profit recovery with its 1Q2024 announcement of a net profit of US$12.4 million. EBITDA was US$99 million.  • Japfa (market cap: S$690 million) owns 55.4% of Japfa Comfeed, whose stock price on the Jakarta stock exchange has surged 44% since the beginning of the year (from 1,170 rupiah/share to 1,680 rupiah/share). This points to a recovery in the business. Read DBS Vickers' take on the upcoming performance of the parent Japfa .... |

Excerpts from DBS Vickers report

Japfa Ltd: On Cusp of a Turnaround

|

||||

Reinstate with BUY, TP: SGD0.45 for potential 46% upside. We reinstate coverage on Japfa Ltd on expectations that the turnaround seen in its operating profits in 1Q24 can be sustained through 2024.

We believe the stock is a good buy for three reasons:

| (i) attractive proxy to business recovery at Japfa Comfeed, (ii) it should benefit from a turnaround in the Vietnam business, and (iii) the market yet to price in the recovery with valuations attractive at 6.9x/ 4.3x FY24F/ 25F PE, below peers’ average of ~12x. |

Upcoming 2Q24 results could provide confidence. Based on market prices of broiler and swine prices in its key markets, we expect to see further affirmation of this turnaround from its upcoming 2Q24 earnings.

We believe both main engines – Indonesia and Vietnam operations are starting to fire up.

For Indonesia operations (Japfa Comfeed Tbk), we project its FY24F operating profit to grow ~1.5x to USD207mn, from the low of USD141mn in FY23.

For Vietnam, we project its FY24F operating profit to turn around from a loss of USD27mn to USD43mn. Japfa's subsidiary, Japfa Comfeed, produces high-quality animal proteins -- namely poultry, aquaculture and beef -- as well as branded consumer foods, and are a large-scale producer of specially formulated animal feed. Japfa partners with world-leading genetics companies to breed high performance parent livestock in modern farm facilities with advanced management systems. Photo: Company

Japfa's subsidiary, Japfa Comfeed, produces high-quality animal proteins -- namely poultry, aquaculture and beef -- as well as branded consumer foods, and are a large-scale producer of specially formulated animal feed. Japfa partners with world-leading genetics companies to breed high performance parent livestock in modern farm facilities with advanced management systems. Photo: Company

| Market has yet to fully price in the turnaround for Japfa Ltd. While Japfa’s share price has performed relatively strongly YTD, up by over 30%, we believe the market has yet to fully price in the potential recovery of its Vietnam operations as well as share price appreciation in Japfa Comfeed Tbk. Based on last traded price of Japfa Comfeed Tbk at ~IDR1,700/share (~55.4% owned), the implied equity value of Japfa’s stake is USD690mn. This stands at ~ 50% premium to Japfa’s current market cap of USD463mn. This suggests the market is not attributing any value to its operations outside of Indonesia, which is unwarranted. |