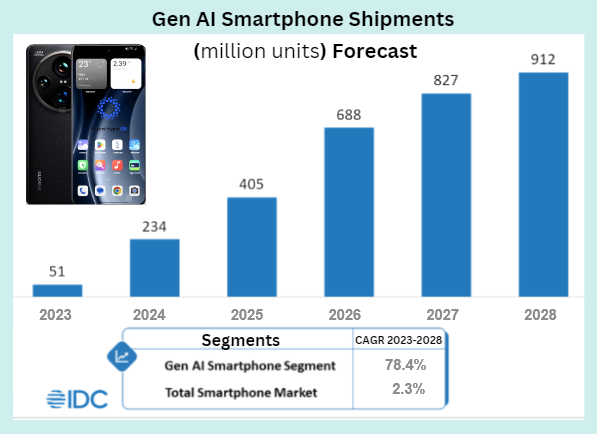

• Increasingly, AI capabilities are coming to new models of laptops and smartphones. They can run advanced generative AI applications, supported by powerful neural processing units (NPUs) and GPUs. • For more, see IDC's article: The Future of Next-Gen AI Smartphones • And Gartner predicts Worldwide Shipments of AI PCs and GenAI Smartphones to Total 295 Million Units in 2024 The uptrend is already manifesting in the bottomline of companies such as HK-listed Sunny Optical which issued a profit alert on 21 July 2024:

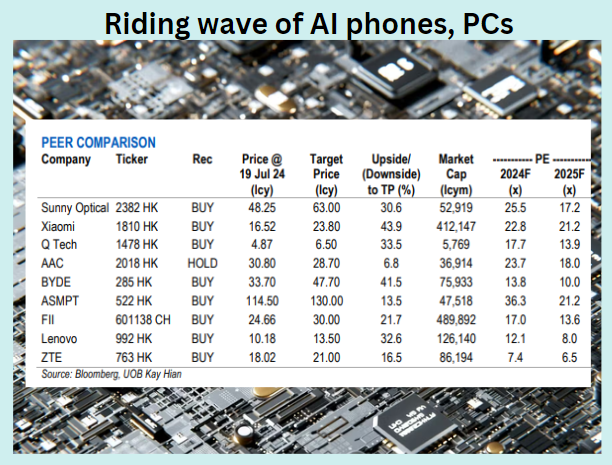

• For investing exposure to AI-enabled devices (or so-called edge AI), the Hong Kong stock market offers a number of possibilities. See excerpts of UOB KH's report today below .... |

Excerpts from UOB KH report

Analyst: Johnny Yum

| AI Investments To Remain Elevated But Edge AI Plays Are More Attractive |

| We are shifting our preference to edge AI picks, as we see an improved visibility on the recovery in global smartphone and PC shipment in 2H24. With this, coupled with the pick-up in AI device shipment towards year-end and a more undemanding valuation, we expect edge AI plays to outperform the AI infrastructure supply chain, which is now under pressure from profit-taking, and mounting geopolitical risks. Maintain OVERWEIGHT. Top picks: Lenovo and BYDE (BYD Electronic). |

WHAT’S NEW

• AI devices (edge AI) are our preferred play in 2H24. We are seeing better visibility of a recovery in consumer devices, primarily in smartphones and PCs, with growth driven by a combination of replacement demand, and a low base effect.

Shipment numbers for both smartphones and PCs in 2Q24 had surpassed our expectations, and our checks show that the demand recovery will likely be sustainable at a gradual pace in 2H24.

On top of that, although AI-ready devices' demand remains relatively muted, we believe the new launches (such as AI-enabled OS for smartphones) in 2H24 will be able to provide more meaningful boost to growth by end-24, bolstering replacement demand in the upcoming upcycle.

• Smartphones − Apple and Huawei taking the lead in AI features. Thanks to Apple and Huawei's self-owned ecosystems, we believe both brands are ahead of Android in integrating GenAI features into their devices, OS and ecosystems.

| "We are seeing better visibility of a recovery in consumer devices, primarily in smartphones and PCs, with growth driven by a combination of replacement demand, and a low base effect." |

Notably, we believe Huawei has a meaningful edge in integrating its GenAI features into the ecosystem, given the strong support from domestic developers, but nevertheless its reach could remain limited in China given the lack of access to leading edge processors and crucial services such as Google services.

For Android players, we expect key players to catch up to Apple and Huawei, with better ecosystem support and improved applications.

Google's upcoming Pixel 9 Pro launch will be an important benchmark of what Android AI is capable of.

• PCs − Demand recovery playing out; AI PC volume may pick up more meaningfully by 4Q24. We expect the global PC market to maintain a stable low-mid single-digit yoy shipment growth in 2024 from a low base, as enterprises start to replace their devices prior to the Windows update cycle.

AI PC adoption may remain slow in 3Q24, as most potential customers will likely continue to wait for:

| a) more killer app launches, and b) more new PC launches that can support Copilot+ on edge (NPU with >40TOPs). |

We believe with the launch of Intel's Lunar Lake, and better support on the Windows on Arm (WoA) framework, AI PC shipments should start to pick up towards the end of the year.

Full report here.