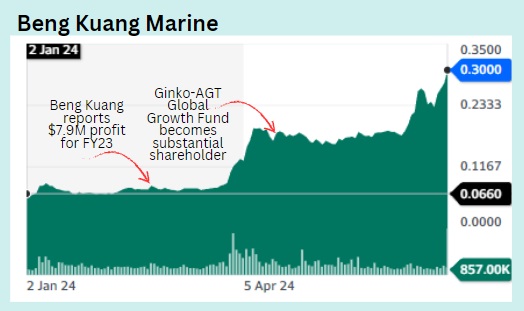

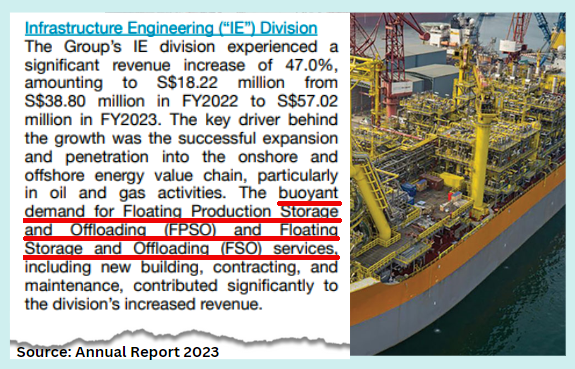

• Here's a small cap, Beng Kuang Marine, that has seen its stock price surge this year, thanks to a robust oil and gas industry. Beng Kuang (market cap: S$59 million) reaped a $7.9 million net profit in FY23 versus a loss-making FY22, thanks largely to its FPSO business. • Out at sea are FPSO (floating production storage and offloading) vessels that process oil from nearby oilfields, and store it until it can be transferred to a tanker.  Its stock price has surged 355% so far this year (from 6.6 cents to 30 cents). Its stock price has surged 355% so far this year (from 6.6 cents to 30 cents).• Many FPSOs globally are over 40 years old, requiring significant maintenance to ensure hull integrity and overall operational safety. This is particularly critical as these units operate in mature fields with slim operating margins (source: American Bureau of Shipping) • This is where Singapore-listed Beng Kuang Marine comes in, providing a wide range of engineering services. They include repair and maintenance of floating production platforms, onshore and offshore marine fabrication; and the production and supply of customised pedestal cranes and deck equipment. • Such services are provided through its 51% subsidiary, Asian Sealand Offshore and Marine Pte Ltd. See Beng Kuang Marine's commentary on its FPSO business in 2023:  Maybank Kim Eng's report today flags Beng Kuang Marine as a potential multi-bagger. Read more below ... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Beng Kuang Marine (BKM SP)

Potential FPSO multi-bagger

Through its subsidiary ASOM, Beng Kuang Marine has grown to become a major player in FPSO maintenance, repair and services as it benefited from robust global FPSO activity.

|

| Strong FY23-27E PATMI CAGR of 51% |

With the FPSO space robust, we understand that BKM’s subsidiary ASOM’s labour work count surged more than 200% over the past 2 years to about 700 in 2024.

|

BENG KUANG MARINE |

|

|

Share price: |

Target: |

It is also expecting to secure more vessels and to increase labour headcount further by 40-50% by end-2024 and potentially more in 2025.

We also expect margin expansion, both on the gross and operating level as it enjoys better margins on new contracts and also via higher operating leverage.

All in, we expect BKM to enjoy strong core FY23-27E PATMI CAGR of 51%.

| Potential dividends likely; 4.5% FY24E yield |

With BKM turning net cash backed by a series of asset sales as well as strong operating profits, we believe management is likely to reward shareholders with a potential interim dividend in 1H24E and a 20% pay-out ratio for dividends going forward.

With the remaining portion of its Batam shipyard up for sale, we expect this to fetch around SGD13.8m, close to 30% of BKM’s market capitalisation.

A sale could potentially fetch a special dividend for shareholders.

|

Full report here.