|

Alibaba, since hitting a post-result intraday high of HKD97.95 on 11 Aug, has slumped 14.9% to close HKD83.40 on 10 Oct. |

| Firstly, why did Alibaba’s slump 14.9% since 11 Aug? |

Some possible reasons for Alibaba’s tumble are

a) Abrupt change in leadership

On 10 Sep, Alibaba announced that Daniel Zhang will relinquish his Chairman and CEO role at Alibaba Cloud Intelligence Group. This followed its June announcement that Daniel will step down from his Chairman and CEO role at Alibaba Group Holding.

Such abrupt management changes typically cast a pallor on near term share price performance.

b) Alibaba’s delays its Freshippo IPO

On 8 Sep, Bloomberg reported that Alibaba has reportedly delayed its Freshippo IPO amid lacklustre sentiment for consumer stocks. This casts yet another pallor in terms of near-term share price performance.

c) Hongkong market is generally weak

Hang Seng closed 17,665 on 10 Oct, down 8.7% from its intraday high of 19,346 on 11 Aug. Such significant decline in the index generally has negative knock-on effects on individual stocks.

| Interesting points which catch my attention |

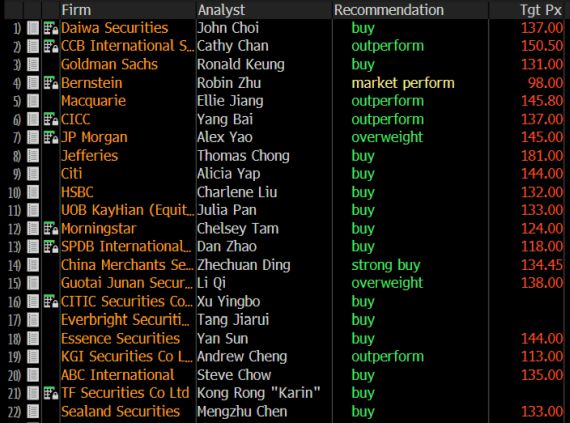

a) Analysts are generally positive on Alibaba; target price HKD136.12

Average analyst target is around HKD136.12, signifying a potential capital upside of around 63.2%.

Out of 40 analysts who cover Alibaba, 39 rate it a buy with only one “hold” call.

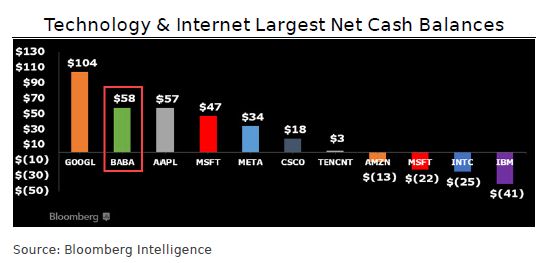

b) Solid balance sheet; more net cash than Apple, Microsoft, Meta, gives it flexibility for share buyback

Based on Bloomberg, Alibaba has US$58b of net cash on its balance sheet which is more than Apple, Microsoft, Meta etc.

Last Nov, Alibaba increased its share buyback program by US$15b to US$40b. It has used US$10.9b for buybacks in FY23 and US$3.1b in 1QFY24, with a balance of US$16.3b left for share buyback, effective through Mar 2025. Such strong net cash gives Alibaba flexibility for share buyback and perhaps an increase in share repurchase program.

c) Trades at attractive valuations

Alibaba trades at 9.3x FY24F and 8.5x FY25F PE. Consensus forecasts Alibaba’s adjusted FY24F and FY25F net profit to increase by 18.2% and 7.1% to RMB170.2b and RMB182.3b respectively on a year-on-year basis.

Valuations seem rather low for a large e-commerce player of Alibaba’s scale.

I guess it is reasonable to postulate that expectations are not high for Alibaba, leaving room for potential upside surprises.

d) Value unlocking through six-way split; Cainiao to be the first to list

On 28 Mar, Alibaba said it will be splitting into six units, viz. Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics Group, Global Digital Commerce Group and Digital Media and Entertainment Group.

| My gut feel is that it is in the interests of both China and Hong Kong to make Alibaba’s Cainiao spinoff to be a large success so that it can help to revive the moribund HK market and perhaps spur Chinese market too. |

Daniel Zhang Yong (then the chairman and chief executive of Alibaba) was reported to have said that each company will be allowed to “pursue fundraising from third parties and IPOs when they are ready.”

Cainiao is going to be the first to be listed. On 26 Sep, Alibaba submitted a spin-off proposal for its Cainiao (click HERE) to the Hong Kong Stock Exchange and the Hong Kong Stock Exchange has confirmed that the Company may proceed with the Proposed Spin-off. A spin-off listing application has been submitted to the Hong Kong Stock Exchange.

My gut feel is that it is in the interests of both China and Hong Kong to make Alibaba’s Cainiao spinoff to be a large success so that it can help to revive the moribund HK market and perhaps spur Chinese market too.

e) Cloud intelligence unit eyes fundraising ahead of its potential listing in May 2024

On 5 Sep, Bloomberg reported that Alibaba’s cloud intelligence group is seeking to raise funds amounting to RMB10-20b from Chinese state-owned enterprises in anticipation of its potential listing around May 2024. The report cited that raising funds from state-owned enterprises may increase the probability of winning government cloud contracts.

f) Cloud intelligence unit annual Aspara Conference to be held on 31 Oct – 2 Nov

Based on aastocks, Alibaba cloud intelligence unit will hold its annual Apsara Conference from 31 Oct – 2 Nov in Hangzhou with more than 1,000 industry participants invited to attend the event. The unit may showcase its Feitian core products and the Tongyi foundation model and more than 3,000 latest technologies products.

g) Singles’ Day may be a potential catalyst

Based on Technode 10 Oct, Alibaba intends to invest RMB2b to assist small and medium sized merchants achieve a revenue of RMB1m during Singles’ Day, as announced by Alimama, the company’s marketing operating system.

Alibaba’s live-streamed evening gala will return on 11 Nov, featuring celebrities and popular shows. This comes after a pause last year. Presales commence on 24 Oct and end on 11 Nov. In addition, Alibaba intends to set aside RMB50m cash as a form of support for merchants and influencers joining in livestream shopping events and making related short videos.

The success of Singles’ Day is likely to have a boost to Alibaba and vice versa.

| Risks |

The below list of risks is not exhaustive. Besides the obvious geopolitical and regulatory risks, here are some pertinent risks. It is advisable to refer to Alibaba’s analyst reports (get from your broker) and its financial statements for a complete appreciation of risks involved in trading / investing in Alibaba.

a) Weak China economy resulting in weaker than expected domestic consumption.

It is common knowledge that China’s economy is hamstrung by the beleaguered property market, staggering debts by local governments and the weak domestic consumption sentiment. Based on Reuters, as of 10 Oct, China’s stock market has slumped in 16 out of 20 sessions.

Even though some recently released China economic data have exceeded pessimistic forecasts and some market pundits (including me) believe that China economy may be near a bottom, it is still not super rosy. Thus, if China’s economy continues to be in the doldrums, it may have some negative knock-on effects on Alibaba.

b) Delay in spin offs or poor reception or lacklustre performance on their spin offs post listings.

Any delay in spin offs, or poor reception, or lacklustre performance on their spin offs post listings, may have a negative effect on Alibaba. The delay in Freshippo IPO is a case in point.

c) Geopolitical and regulatory risks

Investing in China shares subjects one to both regulatory and geopolitical risks. For example, based on an article on Bloomberg dated 5 Oct, Belgian intelligence has been monitoring Alibaba’s main Europe logistics hub in Liège for “possible espionage and/or interference activities.” This logistics hub is run by Cainiao which is seeking a listing. Any negative findings is likely to have an adverse effect on Alibaba / Cainiao at least in the short term.

d) Traders expect volatility in share price in the next XX months

Based on a Bloomberg article dated 9 Oct, a trade that appears to be a straddle comprising 4,500 calls and puts — the equivalent of 2,250,000 units of the underlying Alibaba on each leg — at a strike price of HK$90 was transacted on 6 Oct. Both buy and sell call options expire on 27 Jun 2024.

This straddle strategy is profitable if Alibaba rises above HK$98.45 or falls below HK$76.25 before 27 Jun. Thus, there are some large traders who feel that the share price may be rather volatile in the months ahead. Volatility can be either good or bad, depending on whether we catch the direction right.

|

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

*P.S: I am vested in Alibaba.

**Note: In line with my usual practice of compiling SGX stocks sorted by total potential return at the start of the month, readers who wish to receive my manual compilation of stocks sorted by total potential return can leave their contacts HERE. I will send the list out to readers around 15 Oct 2023.

With this list, it may be a good first level screening to decide which stocks to sell into strength, or add positions on weakness, or rebalance your portfolios. Nevertheless, please refer to all the important notes in the list to ensure you are aware of the limitations of such screens.

Disclaimer

Please refer to the disclaimer HERE.