|

• There are initial signs of an upturn for China Sunsine. A CGS-CIMB analyst report today says industry data shows a strong 21% rise in recent weeks in the selling prices of rubber accelerators, the key product of China Sunsine.

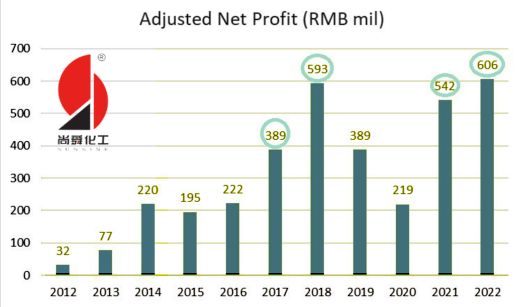

Considering its large net cashpile, its PE ex-cash is 1.5x. Read more of what CIMB analysts have to say below.... |

||||||||||

Excerpts from CGS-CIMB report

Analysts: Kenneth Tan & Ong Khang Chuen, CFA

China Sunsine Chemical Holdings

-- Strong ASPs could point to a better 2H23F

■ We turn more positive on Sunsine as rubber accelerator prices rose 21% mom in Sep on higher raw material prices and firmer downstream demand.

■ Upgrade to Add in view of its improving fundamentals and undemanding valuation (near Covid-trough of 0.56x P/BV), with a higher TP of S$0.47. |

||||

| A visit to Sunsine’s chemical plants |

Sunsine hosted a site visit to its chemical plants on 19 Sep 23, where we saw its new production lines for insoluble sulphur (IS), mercaptobenzothiazole (MBT), and trimethyl dihydroquinoline (TMQ) antioxidant.

| "Management said Sunsine’s Aug-Sep 23 sales volumes were strong due to increased downstream production, while exports remained healthy on good demand from Indonesia, Vietnam, and Thailand." |

For the IS production line, we were shown the continuous method of production which Sunsine uses, a technology developed in-house by the group.

We saw its automated MBT production line; key machinery has already been installed and undergoing testing, with commercial production likely to start early2024F, according to management.

Sunsine expects to realise c.Rmb30m in annual cost savings with the full ramp-up of the MBT line.

Management said Sunsine’s Aug-Sep 23 sales volumes were strong due to increased downstream production, while exports remained healthy on good demand from Indonesia, Vietnam, and Thailand.

Management reiterated that while competition remains intense, it is not overly concerned given Sunsine’s dominant market leadership in the global rubber chemical industry.

| Strong ASP growth gives us better confidence in margins |

Based on data from commodity data provider sci99, the rubber accelerators ASPs rose strongly in Sep 23 (+c.21% vs. end-Aug 23 price). We understand this was largely driven by

| 1) rising raw material costs (current aniline price +19% vs. end-Aug 23 price), 2) utilisation ramp-up from domestic tyre producers (to replenish low inventory), and 3) healthy export volumes (Aug 23: +20% yoy). |

| "Rubber accelerators ASPs rose strongly in Sep 23 (+c.21% vs. end-Aug 23 price)." |

This was supported by elevated domestic tyre output figures in Jul-Aug 23, which were c.15% higher vs. Jul-Aug 22 and 2018-19 average.

We are now more confident in Sunsine’s cost pass-through ability, and believe it could record h-o-h improvement in 2H23F GPM to 24.6% (1H23: 23.8%), though still lower than its elevated GPM of c.30% in FY22.

We believe our FY24/25F GPM forecasts of 24.6%/25.0% are sustainable given Sunsine’s historical 10-year average GPM of c.27%.

|

Full report here