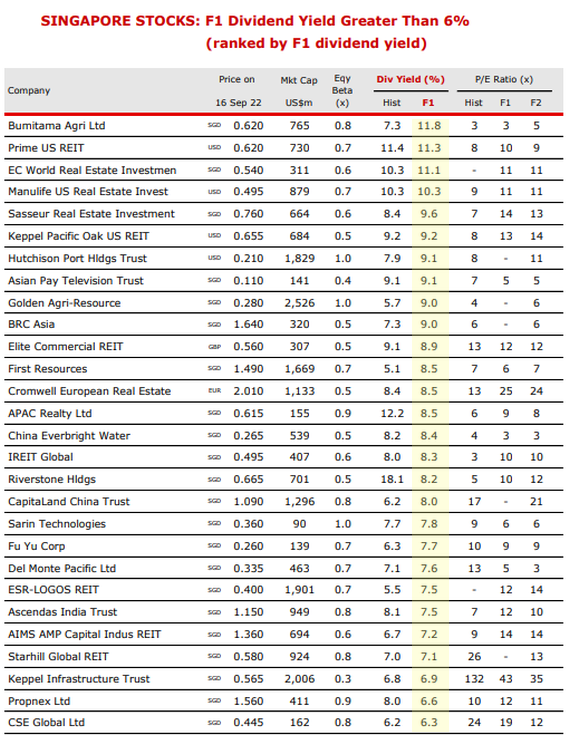

With weakening stock prices, among other factors, some stocks are offering nice dividend yields.

Check out OCBC Research's compilation below (published today) but be mindful that forecasts are based on assumptions including earnings and company distribution decisions:

(F1 = 1st Year Bloomberg consensus forecast)

| Notes: • We think Riverstone's dividend yield will be higher than forecast above as it may be backloaded. See: RIVERSTONE: Why cleanroom gloves enable it to thrive in post-pandemic crash • Geo Energy Resources doesn't appear in the table above as there is no analyst coverage. The stock's yield may continue to be supernormal. See: GEO ENERGY: 2Q dividend's in the pocket today, cash piles up in company |