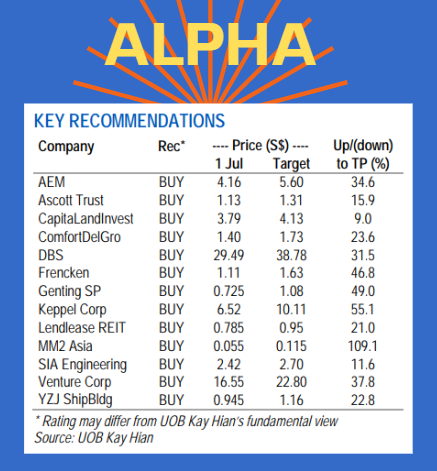

Excerpts from UOB KH report

Alpha Picks:

Add ComfortDelGro, DBS And Yangzijiang,

Remove OCBC

| Our Alpha Picks outperformed the STI in 2Q22, declining by 3.1% vs the market’s 9.0% fall. For June, however, we marginally underperformed the STI by 0.5ppt. For Jul 22, we add ComfortDelGro due to the potential for better business conditions in 2H22, and also Yangzijiang as we like its very inexpensive valuations and its defensive business for at least the next 12-18 months. We have taken out OCBC and replaced it with DBS as the latter is the most sensitive to interest rates in the Singapore banking sector. |

WHAT’S NEW

• Market review. The shipbuilding and industrial sectors were clear outperformers in 2Q22 with all four stocks delivering positive absolute returns – the highlight was Yangzijiang Shipbuilding (YZJ) which rose 17% during the quarter.

We attribute this partly to strong oil and gas prices and more importantly company-specific factors such as the announcement of the merger between Keppel Offshore Marine and Sembcorp Marine as well as the dividend in specie of YZJ’s investments business.

The sector which saw a torrid quarter was plantation, with all three stocks falling by double digits as CPO prices retreated.

• Outperforming in 2Q22. Our Alpha Picks portfolio outperformed during 2Q22, declining by 3.1% vs the STI’s 9.0% fall. For the month of June however, our portfolio marginally underperformed the STI by 0.5ppt.

The only stock in our portfolio that did not fall was MM2 (flat in June) while AEM (-8.8% mom) and Genting Singapore (-7.7%) underperformed.

| • Adding ComfortDelGro and YZJ. For July, we add ComfortDelGro as we believe the stock’s risk-reward is very favourable at present, given higher ridership domestically and in its key overseas markets. YZJ has been added as it has executed well on its projects in 2022; despite this, the company trades at a 2022F PE of 5.3x and yields 4.8%. We expect the company to re-rate as it wins more new orders in 2H22. |

• Taking out OCBC. We have removed OCBC as its share price may see increased volatility in the near term due to investor concerns over the negative impact of a recession on the financial sector.

• Switching horses in the financials sector. We have taken out OCBC in favour of DBS as the latter is the most sensitive to interest rates in the Singapore banking sector on our estimates.

Full report here.