Peter Chan contributed this article on Watches.com Ltd(SGX Code: WVJ), formerly known as Ntegrator International.

– On the launch-pad for strong growth powered by burgeoning luxury watch and mid market segment.

And rising post-pandemic demand for watches

|

The Covid pandemic caused a 23% drop in the global watch market in 2020 as stores and economies closed, and consumers cut back on discretionary spending. The industry bounced back in 2021 and is on track to continue growing. |

According to Euromonitor, Statista and McKinsey, online revenue is expected to grow 12% compared to the overall global watch industry growth of 7%, with a majority of the revenue in the mid-range and affordable segment accounting for about 56% of market. Online sales in the mid-range/affordable segment accounts for 32% of the market.

While a significant majority of high-end watches are estimated to be bought offline in 2019, accounting for 88% of sales, the mid-range/affordable segment sees a 60/40 channel split favored towards online, resulting in the online sales of midrange/ affordable watches accounting for 32% of the total market and is expected to comprise 11% out of the 12% CAGR towards 2025.

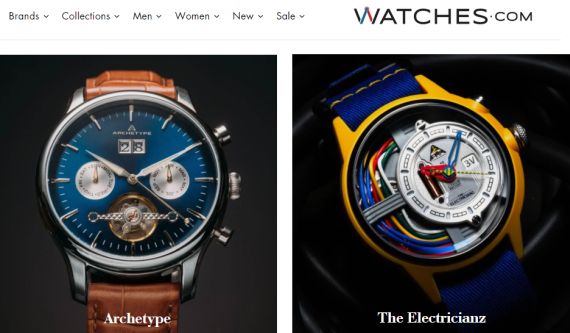

Watches.com Limited’s (“Watches.com”) proven business model is well-positioned to capture market share in the fast-growing midrange/affordable market and build additional diversified revenue streams to expand wallet share. Before the acquisition, the California-based Watches.com derived its revenue primarily from two sources: product sales and OEM sales.

With much strengthened technology support following completion of the acquisitions (details below), Watches.com will see its revenue derived from four new sources:

| (i) Marketplace revenue – selling fee, payment processing fees, subscription fees; (ii) Services revenue – featured listing fees, offsite advertising placement fees, offline shop-in-ship promotion fees; (iii) logistic revenue – fulfilment order fees, concession and consignment fees, warehousing and handling fees; (iv) Other revenue – product sales, OEM sales, private label sales and licensing fees, leveraging technology infrastructure support from its incumbent technology team and resources. |

|

Stock price |

0.8 c |

|

52-week |

0.6 – 5.1 c |

|

PE (ttm) |

- |

|

Market cap |

S$4.2 m |

|

Price-to- book |

0.26 |

|

Dividend |

-- |

|

1-year return |

- 81% |

|

Source: Yahoo! |

|

Watches.com received over 99.9% of shareholders’ approval at an EGM in March 2022 for its proposed acquisitions of Golden Ultra Limited (“GUL”) and Gadmobe Group as well as for the proposed change of name from “Ntegrator International Ltd.” to reflect its branding better, change in its business direction and prior to the acquisition of Watches.com”, “Watches.net”, “Watches.ca and “Watches.co”.

With the new ownership and team structures in place, Watches.com is strongly positioned to become the starting point for buying watches online with its scalable true global marketplace platform and operation.

| "Watches.com’s scalable proprietary platform is designed to easily connect brands with consumers on a global scale, empowering innovation and smart data." |

Its “first-to-market” advantage bridges the scattered competitive landscape and no existing large incumbent marketplaces for new watches, combined with its clear vision and strategy adds significant value to growth prospects. It expects to continue to see growth in e-commerce sales. According to forecasts by Statista in its report “Outlook Watches & Jewellery Worldwide (2020)”, global online revenue of watches and jewelry is expected to grow at a 12% CAGR between 2021 and 2025.

Watches.com’s scalable proprietary platform is designed to easily connect brands with consumers on a global scale, empowering innovation and smart data. The Group’s marketplace model allows it to provide a broad and extensive product offering with low inventory risk and reduced capital-intense operation, while focusing on ongoing dynamic and profit-driven portfolio optimization strategy.

Watches.com has significant marketplace network that attracts, more brand partners, allowing them to acquire customers and drives sales. More customers and sales will in turn attract more brand partners, establishing beneficial self-reinforcing dynamics, to be catalyzed by the Group’s existing portfolio brands. Watches.com has also a base of established strategic partner relations. Its extensive network of partners provides access to critical fulfilment and last-mile infrastructure.

Watches.com has developed and has been implementing an exact match domain and search engine optimization (“SEO”) strategy which unlocks the high potential of its superior domain names and fuels valuable organic long-term growth. Its fully integrated omni-channel offering for brands and consumers will enhance its overall competitiveness. Watches.com leverages support from its existing portfolio of technology units, accesses to proprietary technology, data insight, deep ecommerce knowledge and operational know-how to deliver the best-in-class platform experience to customers, brand and logistics partners.

CEO Christian HeilesenWatches.com’s executive management team has proven track-record and are highly dedicated. The team members hold complementary skill-sets and strong experience in watch, technology and ecommerce sectors. The management team, led by CEO Christian Kwok-Leun Yau Heilesen, has been instrumental in developing long term strategies for the Group to diversify business into the e-commerce and watch business to establish new revenue streams and improve profitability, and in turn, increase shareholder value. The management team has created an entrepreneurial and results-oriented culture based on freedom, trust and responsibility.

CEO Christian HeilesenWatches.com’s executive management team has proven track-record and are highly dedicated. The team members hold complementary skill-sets and strong experience in watch, technology and ecommerce sectors. The management team, led by CEO Christian Kwok-Leun Yau Heilesen, has been instrumental in developing long term strategies for the Group to diversify business into the e-commerce and watch business to establish new revenue streams and improve profitability, and in turn, increase shareholder value. The management team has created an entrepreneurial and results-oriented culture based on freedom, trust and responsibility.

The Group continues to maintain a robust balance sheet with cash and cash equivalents of approximately S$4.8 million as of 31 December 2021. Its healthy contract winning momentum in FY2021 contributed to an outstanding order book of S$67.9 million as of 31 December 2021. The balance of current assets of S$25.1 million, comprising S$4.8 million in cash and bank balances, S$7.9 million in trade and other receivables, S$12.0 million in contract assets and S$315,000 in inventories, already surpassed its current market capitalization at S$4.2 million as of 23 May 2022. Its shares are trading at a steep discount of approximately 83.3% to its total current assets.

GUL owns the luxury watch online platform, Bestwatch. com.hk, through its wholly-owned subsidiary, CKLY Trading Limited. Based on an independent third-party valuer, FT Consulting Limited, Bestwatch.com.hk was valued at approximately HK$138.3 million (or S$24.1 million) as of 30 June 2021.

Based on an independent third-party valuer, CHFT Advisory and Appraisal Ltd., Gadmobe Group was valued at approximately HK$80.8 million (or S$14.1 million) as of 30 June 2021. As for Watches.com, the four domain names Watches.com, Watches.net, Watches.co and Watches.ca were valued at US$4.3 million (or S$5.9 million) in aggregate, according to the third-party valuer NameExperts. Watches.com’s inventory was valued at US$500,000 (or S$688,003).

| The combined total of these valuations of approximately S$45.1 million also surpassed the Group’s market capitalization at S$4.2 million as of 23 May 2022. Its shares are heavily undervalued should Watches.com be able to extract the full valuation of these new and proposed acquisitions and harness synergistic benefits between them to deliver more earnings. |