Excerpts from UOB KH report

Small/Mid Cap Strategy – Singapore

|

Taking Stock Of Coal Producers Amid A Massive Rally In Coal Prices The 67% increase in Indonesia’s thermal coal prices ytd, due to shortage in global supply and better-than-expected Chinese coal demand, has triggered renewed interest in the mining sector.

The immediate beneficiaries are the upstream Indonesia producers such as Golden Energy and Geo Energy. |

||||

Operations at GEAR's mine in Indonesia. NextInsight file photo.

Operations at GEAR's mine in Indonesia. NextInsight file photo.

WHAT’S NEW

• Indonesia’s thermal coal prices near 5-year high, +67% ytd. Indonesia’s thermal coal price has started rebounding since late-2020 after hitting a 5-year low in mid-2020, as demand reduced temporarily due to lockdown in many countries to combat the COVID-19 pandemic.

| "With the sequential 37.7% qoq jump in Indo coal benchmark prices in 2Q21, the upcoming results in mid-Aug should be a standout." -- UOB Kay Hian |

In late-20, the faster-than-expected recovery in the Chinese economy coupled with the disruption in coal production have led to a massive rally in Indonesia’s thermal coal price.

On 5 Jul 21, the price of ICI 4 Indo Coal Futures (ICI 4) has increased to US$64.20/t (31 Dec 20: US$38.55/t).

Argus Seaborne Coal Outlook Report dated Jun 21 (Argus Report) highlighted that Chinese coal consumption remains very strong and the pull for non-Australian imports is skewing all coal benchmarks higher.

European coal burning is rising as gas price surge.

On the supply side, the Argus report highlighted that Australian exports have been soft and Colombia has been stuck at low levels.

Indonesian exports have also not been as responsive to higher prices as they were in previous cycles.

• The immediate beneficiaries are Golden Energy and Geo Energy as they are upstream stable coal miners. With the sequential 37.7% qoq jump in Indo coal benchmark prices in 2Q21, the upcoming results in mid-Aug should be a standout.

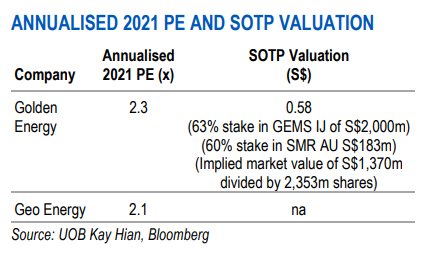

| − Just taking GEAR’s 63% stake in Jakarta-listed PT Golden Energy Mines (GEMS IJ EQUITY, Not Rated), GEAR trades at an annualised 1Q21 PE of 2.3x (63% stake x S$136m profit in 1Q21 / 2,353m shares = S$0.036 for 1Q21 EPS). This excludes a 60% indirect-stake in Australia-listed Stanmore Resources (SMR AU EQUITY, Not Rated) worth A$187m and a 50% stake in Ravenswood Gold mine, a producing mine which has total gold resource of 3.9m ounces (Moz) and a total gold reserve of 2.6 Moz.  − In 2020, Golden Energy and Resources (GEAR) delivered an all-time high production volume for energy coal of 33.5m tonnes (+9% yoy), recording revenue of US$1.16b (+4.2% yoy). This came despite the 11.3% drop in energy coal selling price to US$31.03 per metric tonne (mt) due to the global pandemic, GEAR’s 2020 EBITDA rose 14% mainly due to its record low production cost of US$21.04/mt. − For Geo Energy (GERL), 2020 revenue of US$306.8m (+23% yoy) came on the back of its highest ever coal sales of 10.7m tonnes, which also bolstered the earnings of US$95.2m. GERL trades at 2.1x PE on its annualised 1Q21 EPS of US$0.0202/share (S$0.0272/share). While it is cheaper, we note the potential risk event of the group’s expiring concessions in Feb 22, particularly after credit rating agency Fitch cited in Feb 21 that the company’s weak balance sheet profile leaves little headroom for a sizeable and credit-accretive investment. |

| • Golden Energy appears attractive given its SOTP valuation of S$0.58. On a SOTP basis, GEAR’s current market cap of S$800m is at a significant 63.4% discount to its SOTP valuation of S$0.58, based on 63% stake in GEMS and 60% indirect-stake in Australia-listed Stanmore Resources (SMR AU EQUITY, Not Rated), worth S$2,000m and S$183m, respectively. Additionally, GEAR has a greater production volume and capacity relative to GERL, which should translate to greater operating leverage and sensitivity to coal prices. |

Full report here.