note: Yinda Infocomm has since changed its name to ToTm Technologies and continues to be listed on the Singapore Exchange.

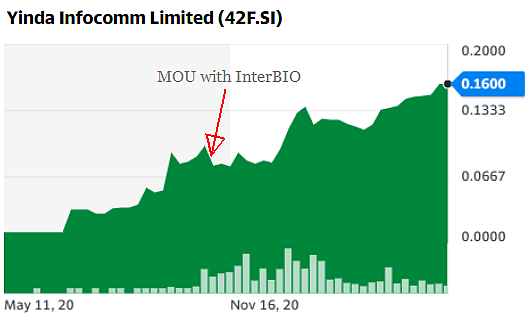

| Until Nov 2020, Singapore-listed Yinda Infocomm was a struggling business of little interest to investors. That month, however, signalled a re-birth of sorts when Yinda announced a non-binding MOU to acquire a 51% stake in International Biometrics (InterBIO), a Singapore-incorporated software company focused on biometrics. This was the first time a Singapore listco had considered entering this industry: InterBIO develops and provides identity management biometrics software technology and solutions. InterBIO controls a private company (PT International Biometrics Indonesia) which won an Indonesian national tender for a biometrics project way back in 2011. It has since been maintaining the country's national biometric system.  Yinda stock price, which was 7.8 cents when the MOU was announced, has risen 100% to 16 cents for a market cap of S$132 million. Yinda stock price, which was 7.8 cents when the MOU was announced, has risen 100% to 16 cents for a market cap of S$132 million. |

Fast forward to today. After four rounds of fund-raising via the placement of new shares, Yinda has accumulated enough cash to successfully acquire a 51% stake in InterBIO for S$35 million in cash and new Yinda shares.

With the biometrics business becoming the growth driver for Yinda, a new management has also taken over the reins of Yinda.

Last week, the company announced a further significant move into the biometrics industry.

It said it had entered into an agreement with TECH5 SA to subscribe for US$8.0 million worth of new shares of TECH5.

|

Stock price |

16 c |

|

52-week range |

1.1–16 c |

|

PE (ttm) |

-- |

|

Market cap |

S$132 m |

|

Shares outstanding |

824 m |

|

Dividend |

-- |

|

1-year return |

1,355% |

|

Source: Blg, Yahoo! |

|

The proposed investment is subject to the satisfaction of various conditions, including obtaining the approval of Yinda shareholders at an EGM to be held.

Additionally, Yinda said it intends to convert a US$2.5 million term loan extended to TECH5 on 1 April 2021 into TECH5 shares.

Following the completion of these two proposed transactions, Yinda will hold an 18.07% equity stake in TECH5. This values TECH5 at US$58 million.

To help fund its investment in TECH5, on 11 May 2021 Yinda said it is raising another S$26.325 million through a placement of new shares at 13.5 cents/share.

| TECH5 -- What it does and its track record | |

| TECH5 is headquartered in Geneva, Switzerland with subsidiary offices in Europe, USA and Asia. It focuses on developing disruptive biometric and digital ID solutions through the application of Artificial Intelligence (“AI”) and Machine Learning technologies. Its biometric algorithms are reportedly ranked top tier in the US National Institute of Standards and Technology for its face, fingerprint and iris recognition technologies. TECH5’s Automated Biometric Identification System (“ABIS”) database and biometric matching platforms also support some National ID programs in the world. TECH5 has also led the development of a mobile identity solution (“Mobile ID”) based on TECH5’s unique portfolio of Intellectual Property. A secure and private digital ID can be issued and stored on the authorized holder’s phone, or kept in printed format, that can be verified against the holder in a completely offline manner. Notably, TECH5 has made considerable progress and achieved significant milestones since the start of 2021. These include:

TECH5 has also landed its maiden National ID project on the African continent in Guinea, where TECH5’s ABIS is deployed integrated with Modular Open Source Identity Platform (“MOSIP”), a foundational ID solution financed by the Bill & Melinda Gates Foundation, Sir Ratan Tata Trust and Omidyar Network. In addition, TECH5 has signed new digital onboarding contracts for its liveness detection solution in Brazil and Iraq as well as signing on more than 10 new commercial trade partners in Asia, Europe, Africa and the Americas. On the R&D front, TECH5 has gained further fingerprint recognition technology results, where the matching hardware requirements will be 5 to 6 times smaller without compromising the accuracy. Furthermore, TECH5 has made improvements in cell phone-based finger capture technology, using advances in AI, and is currently working with third-party reputed institutions to benchmark the efficacy while delivering it to some end-customers. This technology will allow end-customer usage without having to procure finger scanners and so disrupting the device market segment. (Source: press release) |

Mr Pierre Prunier, Executive Director and CEO of Yinda Infocomm, said:

Yinda Infocomm's new CEO: Pierre Prunier 40, formerly director and chief strategy officer at International Biometrics. Yinda Infocomm's new CEO: Pierre Prunier 40, formerly director and chief strategy officer at International Biometrics. Photo: Company“Our vision is to become a leading expert in Identity Management, especially in the space of Digital On-boarding and Digital ID. Our mission is to keep building and offering state-of-the-art platforms to our customers in public and private sectors to leverage the global digital transformation movement. This will be achieved by building relevant technology stack in-house or via relevant acquisitions in the future. "Thus, the further strengthening of our partnership with TECH5 is a right move as it gives us access to continued research and development in the latest identity management biometric technologies and allows us to expand our footprint globally.” |

Mr. Machiel van der Harst, Co-Founder and CEO of TECH5, said:

| “We are delighted to announce the expansion of our partnership with Yinda. This investment will help us boost our global reach, increase TECH5 brand awareness, as well as further enforce our research and development to fuel our innovation and ensure that our partners and customers get access to true leading-edge identity management solutions.” |