An Anchor Handling Towing Supply Vessel: Assists oil rigs in laying anchors, tows rigs, and makes supply runs from shore to oilfield. Photo: Company

An Anchor Handling Towing Supply Vessel: Assists oil rigs in laying anchors, tows rigs, and makes supply runs from shore to oilfield. Photo: Company

Nam Cheong Limited, one of Malaysia’s largest Offshore Support Vessel (OSV) providers, announced that it has clinched chartering contracts for six OSVs with foreign oil majors worth RM116.4 million including options to extend.

|

Revenue visibility |

|

|

The contracts are for two accommodation work barges (“AWB”), three anchor handling tug supply (“AHTS”) vessels and one platform supply vessel (“PSV”).

The vessels will be mainly operated in East Malaysia waters to support the drilling activities of the oil majors.

Together with the RM54.8 million order clinched in December 2019, these contracts are expected to contribute positively to the Group in 2020 and 2021.

Nam Cheong’s total order book has risen to RM318.2 million, after including RM113.6 million worth of options for extension.

The vessels are to be deployed to support drilling and maintenance work in Malaysian waters.

At a results briefing last week, ie prior to the sharp fall in oil price over the weekend, Nam Cheong management said it expected that Petronas, the Malaysian national oil company, would maintain its announced capex and plans for this year.

But it might reduce them next year, depending on how the oil supply and demand dynamics evolve.

| FY19 great year for vessel chartering | |||||||||||||||||

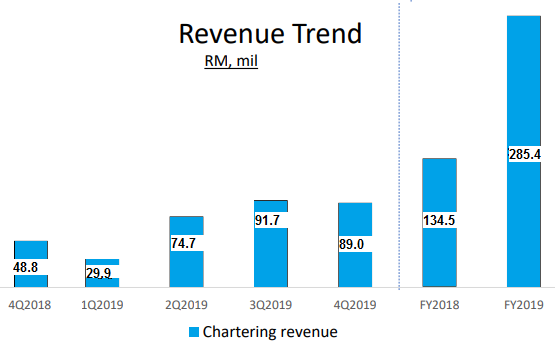

Chong Chung Fen, promoted to CFO in March 2020• Vessel chartering revenue surged 112% from RM134.5 million in FY2018 to RM285.4 million in FY2019, mainly due to its fleet size being progressively expanded from 28 vessels in FY2018 to 36 in FY2019. Chong Chung Fen, promoted to CFO in March 2020• Vessel chartering revenue surged 112% from RM134.5 million in FY2018 to RM285.4 million in FY2019, mainly due to its fleet size being progressively expanded from 28 vessels in FY2018 to 36 in FY2019. • Gross profit increased by 12.4% year-on-year to RM91.4 million in FY2019. Gross profit margin for chartering rose from 22.3% in FY2018 to 32.0% in FY2019.

• Excluding the extinguishment of debts, waiver of debts and foreign exchange differences in both years, the Group delivered:

Buoyant business has led to a jump in trade and other receivables, from RM86.7 million as at end-Dec 2018 to RM155.9 million a year later. Collection risk is minimal given that Nam Cheong's customers are Tier-1 oil players, including Petronas and ExxonMobil. Bills are paid typically within 60-90 days. Sustained business growth will position Nam Cheong to repay US$220 million of debt restructured as term loans. They are repayable in increasing amounts from 2021 to 2024, but there's no repayment-on-demand clauses. |

|||||||||||||||||