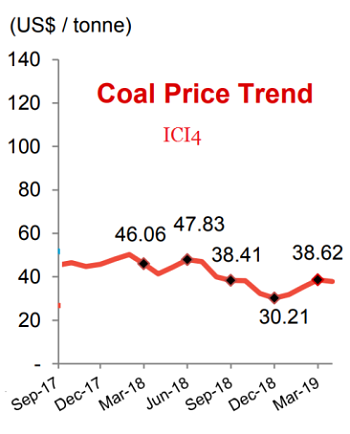

Golden Energy and Resources (GEAR) reported a 73% y-o-y fall in 1Q19 earnings attributable to shareholders -- a direct consequence of a fall in the average selling price of thermal coal. Mining operations at GEAR's key PT Borneo Indobara (BIB) mine. NextInsight file photoGEAR's 1Q19 earnings came in at US$7.2 million compared to US$26.8 million a year ago. Mining operations at GEAR's key PT Borneo Indobara (BIB) mine. NextInsight file photoGEAR's 1Q19 earnings came in at US$7.2 million compared to US$26.8 million a year ago.Blame it on the average selling price (ASP) of its coal: US$34.68 per tonne versus US$47.34 per tonne, respectively.  Coal index ICI4 has recovered since Dec 2018, touching US$39-40 per tonne recently. This was the level of GEAR's ASP of US$41.39 for the entire FY2018. Chart: GEAR. The decline reflects a general downtrend in the market since 2H18. Coal index ICI4 has recovered since Dec 2018, touching US$39-40 per tonne recently. This was the level of GEAR's ASP of US$41.39 for the entire FY2018. Chart: GEAR. The decline reflects a general downtrend in the market since 2H18.In addition, specific to GEAR, a higher proportion of its coal produced in 1Q19 came from the BIB mine (lower calorific value) compared to its KIM mine (higher calorific value). |

GEAR's profitability is affected also by the cash cost of production, which was, luckily, lower in 1Q19: U$23.29 per tonne versus US$25.56 per tonne.

Another factor is the strip ratio. At 4.2, the strip ratio in 1Q19 was similar to 1Q18, so it didn't figure in the lower cost.

Instead, GEAR's head of investments, Mark Zhou, said the lower cost was due to:

Mark Zhou, head of investments at GEAR. Mark Zhou, head of investments at GEAR.NextInsight file photo. • A standing agreement to "share the pain and the gain" between GEAR and its mining contractors -- ie, because coal prices have declined, the contractors charge a lower rate for their services. • From this year, the fee basis for coal haulage has been amended to per tonne per km instead of an hourly basis. |

Mr Zhou guided for the FY19 average cash cost to be about US$25/tonne (down 8.8 % y-o-y).

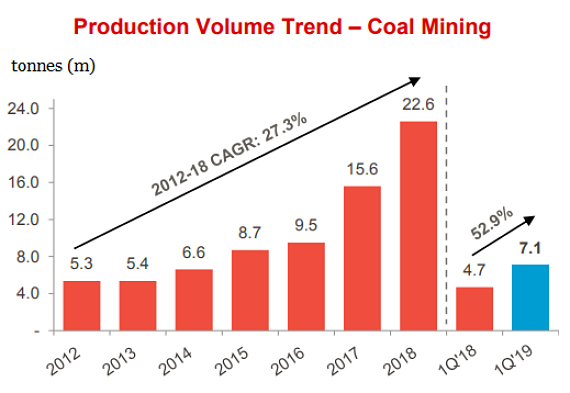

What GEAR also has going for it this year is its ability to ramp up production.

Unlike most of its Indonesian peers, GEAR has been delivering rising production volumes, which help offset lower ASPs and keep the company profitable.

In 1Q19, GEAR produced 7.1 million tonnes of coal, up 53% y-o-y.

GEAR, which produced 22.6 million tonnes in 2018, has targeted to produce 25 million tonnes this year.

It is a figure it looks set to exceed, in line with its track record of busting production targets.  GEAR targets to produce 25 million tonnes this year. Profitability would surge if ASPs rise with high production volumes. Chart: Company

GEAR targets to produce 25 million tonnes this year. Profitability would surge if ASPs rise with high production volumes. Chart: Company

On the demand side, GEAR said it continues to experience demand from its key export markets, such as China, India and South Korea, where coal remains an important source of primary energy despite ongoing efforts to promote the use of gas and renewable energy.

Since Dec 2017, GEAR has invested in gold and coking coal producers in Australia, as listed above. At the "total comprehensive income" level, GEAR reported net profit attributable to shareholders of US$26.6 million, up 54.8% y-o-y. This was contributed by "other comprehensive income" which swung from from a loss of US$9.58 million in 1Q18 to a gain of US$19.39 million in 1Q19 because of:

Note that the Group's finance costs increased by US$2.07 million or 41.6% from US$4.96 million in 1Q18 to US$7.02 million in 1Q19. This was mainly due to an increase in interest expenses resulting from the US$150 million issuance of the Company's bond (coupon: 9% a year) in February 2018 and from a new loan facility for investment purposes. |

|||||||||||||||||||||||||

|

|

The 1Q2019 Powerpoint presentation materials are here.

Phillip Securities report is here.