Excerpts from KGI Securities report

Analyst: Joel Ng

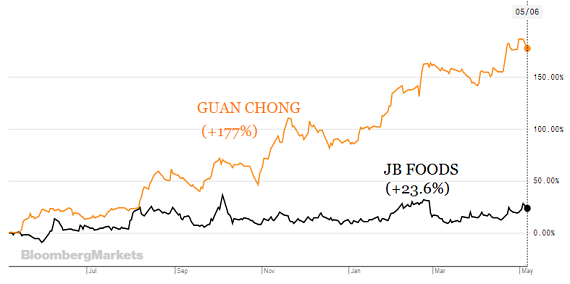

| Looking forward to 1Q19 earnings. We note from comments by JBF’s closest listed peer Guan Chong (GUAN MK), that 2019 “is looking as good as last year” because of increased capacity and sustained margins. This is according to a Bloomberg article about Malaysia’s cocoa processing industry posted on 22 April 2019. GUAN has been the best performer on the Bursa Malaysia Consumer Product Index in the past 1 year, with its shares surging 180% during this time. Meanwhile, JBF has only gained 22% over the last 1 year.  One-year return, based on 6 May 2019 prices. Chart: Bloomberg. One-year return, based on 6 May 2019 prices. Chart: Bloomberg. |

Top line growth and positive long-term outlook. Demand from customers was particularly strong as revenues in 4Q18 increased by 23% YoY to US$75mn, which was enough to offset the decline in average selling prices arising from lower cocoa bean prices.

Management remains confident on the long-term growth potential on the back of strong cocoa consumption demand.

Valuation & Action: JBF is only trading at 5.6x T12M P/E, which we believe undervalues the company when compared to peers who are trading between 10-20x P/E.

Demand growth from China and India is expected to provide a positive tailwind to JBF’s business as it continues to expand.

|

|

Risks: Key risk mainly from oversupply in the cocoa processing market, where it will have a negative impact on prices and margins of JBF.

Share price laggard. JBF has only gained 22% over the past one year compared to GUAN’s 180% surge.

Other than JBF’s weak 4Q18, we see no other reason for the significant discrepancy between their share price performances.

JBF’s earnings has grown for the fourth consecutive year, and given the strong industry tailwinds based on comments from GUAN’s management, we expect JBF to have another YoY growth in FY2019.

Full report here.

See also Bloomberg article: This World-Beating Stock May Just Be Everyone's Cup of Cocoa