This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 28 September 2018. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 28 September 2018. The article is republished with permission.

|

|

Little Red Dot

"NetLink plays a very important role in putting Singapore on the global map - we've been ranked highly in various global studies on broadband connection speeds, and this is something we can all be proud of," Tong pointed out.

According to US-based Ookla's Net Index, Singapore surpassed 132 other countries in July 2017 to clock the fastest average broadband surfing speed on computers. In a separate report by UK-based Internet consultancy firm Cable.co.uk, the city-state also topped a ranking of 189 countries for average surfing speeds, based on data collected across 12 months up to May last year.

"Today, Singapore has one of the highest wired broadband penetration rates in the world, and more than 85% of these wired broadband connections are delivered via our fibre network," he added.

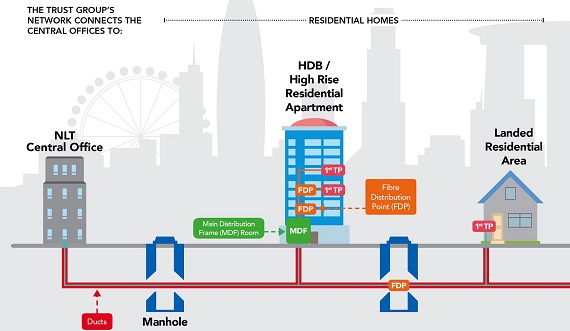

The Trust's network is the only fibre network with nationwide residential coverage in Singapore. Of the 1.5 million households in Singapore, 1.2 million are users of its network, which translates to a household penetration of 80%. This business segment contributes the bulk of Group revenue, accounting for nearly 60% share.

"Over the next three to five years, the 300,000 households - which are not using broadband or still on older technologies like broadband on cable or copper wires - will start moving to fibre-based broadband," Tong said.

NetLink also continues to expand its penetration in new housing estates, such as Sengkang, Punggol and Tengah. "Another growth factor is new households - whether HDB or private - which can come up to 20,000 to 25,000 additions per year," he noted.

According to independent industry consultant Media Partners Asia, residential fibre subscriptions are projected to increase at a compounded annual growth rate (CAGR) of 6.5% to 1.46 million by 2021, from 1.07 million in 2016.

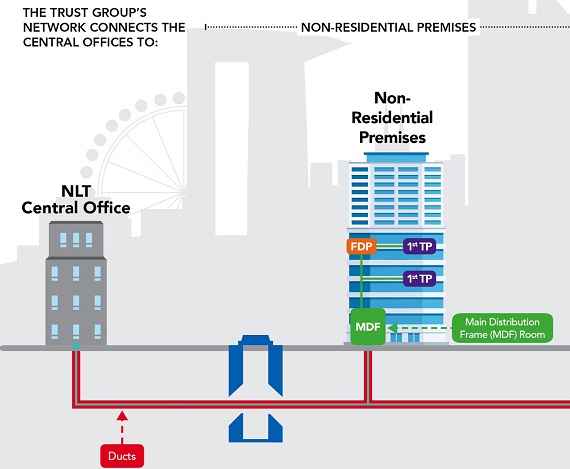

For the non-residential market, the Trust has 45,000 connections out of a total of 128,000, representing a 35% share. These include commercial users like offices, shopping malls, government departments, hospitals and schools, and account for about 8.5% of Group revenue. It is also an independent network provider for retail service providers who do not have their own established infrastructure.

Media Partners Asia estimates that NetLink's non-residential fibre subscriptions could expand at a CAGR of 9.9% to 58,680 by 2021, from 36,640 in 2016.

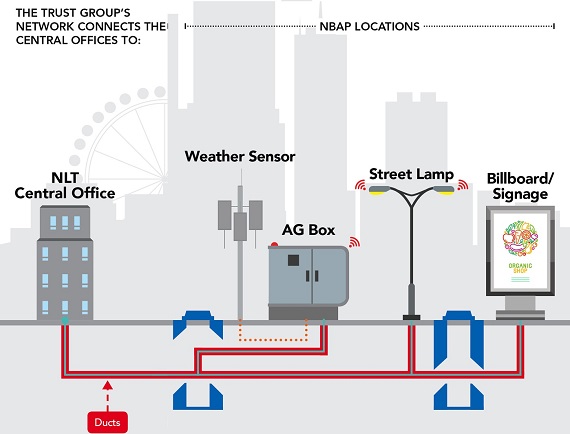

The third business segment is non-building address points (NBAPs), which are locations in Singapore that do not have a physical address or an assigned postal code, such as bus stops, multi-storey car parks and traffic lights. Applications include infrastructure for telecoms operators, cameras, sensors, signs and outdoor kiosks. Currently, the Trust has more than 1,100 NBAP connections.

These NBAP connections are forecast to expand by a CAGR of 86.2% to 6,128 by 2021, from 274 in 2016, data from Media Partners Asia showed.

|

"The question is how to make Netlink's role more meaningful, and make solid contributions to Singapore's Smart Nation efforts." - Tong Yew Heng |

Remaining Resilient

"We have a very resilient business model, with transparent and regulated revenue streams, including long-term customer contracts, as well as recurring and predictable cashflows," Tong noted.

"Pricing terms are regulated by the IMDA, while our primary customers are established players in the Singapore telecoms market," he added, referring to the Infocomm Media Development Authority, a statutory board that regulates the domestic telecoms industry and promotes adoption of infocomm technologies in the city-state.

NetLink's network also offers natural barriers to entry. "We've invested a significant amount in the design and construction of our network - in the last financial year, we put in more than S$100 million, and for our next FY, we've projected capex of another S$87 million," he said.

"The durability and longevity of the Trust's fibre cables means our existing network will continue to operate for many years without the need for material upgrades or replacements."

Beyond the next five years, NetLink will ride on the expansion of connected services driven by the government's Smart Nation initiatives, the proliferation of the Internet of Things (IoT), and adoption of 5G mobile technology, Tong said.

"The Smart Nation initiatives encourage different government agencies to deploy solutions to improve our quality of life, so that means more connections, which would support demand for our network," Tong said, pointing to potential deployment of intelligent cameras and smart street lighting to meet security and energy-saving goals.

Recently announced government Masterplans such as the Punggol Digital District and the Jurong Innovation District will also require greater connectivity and boost data usage.

"We're in a business that will continue to see a lot of growth - there're so many opportunities in Singapore, and still a lot more to be done here, so the domestic market will remain our focus for the foreseeable future," he added.

| Evolving Dynamics |

|

Despite the industry's relatively robust growth prospects, concern over changing dynamics occasionally keeps Tong up till the wee hours. |

Financial results

| Year ended 31 March (S$ '000) |

FY2017 | FY2016 | FY2015 |

| Revenue | 300,144 | 258,000 | 217,931 |

| (Loss)/Profit before income tax | 89,720 | 44,626 | (17,457) |

| (Loss)/Profit after income tax | 75,708 | 36,556 | (15,754) |

| Quarter ended 30 June (S$ mln) | Actual* | Projection^ |

% Change |

| Revenue | 86.1 | 83.8 | 2.8 |

| EBITDA | 61.0 | 58.3 | 4.5 |

| Profit after tax | 19.0 | 15.0 | 26.9 |

Source: Company data; IPO prospectus

*Actual: Results for 1 April 2018 to 30 June 2018. No comparative Consolidated Statement of Profit or Loss and Other Comprehensive Income has been prepared as NetLink NBN Trust was constituted on 19 June 2017.

^Projection: Projection for 1Q was part of Projection Year 2019's projection as disclosed in the prospectus dated 10 July 2017.

| Outlook | ||

|

||

NetLink NBN Trust

NetLink NBN Trust's nationwide network is the foundation of Singapore's Next Generation Nationwide Broadband Network (Next Gen NBN), over which ultra-high-speed internet access is delivered throughout mainland Singapore and its connected islands. The Trust Group designs, builds, owns and operates the passive fibre network infrastructure (comprising ducts, manholes, fibre cables and Central Offices) of Singapore's Next Gen NBN. The Trust Group's extensive network provides nationwide coverage to residential homes and non-residential premises in mainland Singapore and its connected islands.

NetLink NBN Trust was listed on the Mainboard of Singapore Exchange on 19 July 2017, and is a constituent of the FTSE ST Large & Mid Cap Index and the MSCI Singapore Small Cap Index.

The company website is: www.netlinknbn.com.

Click here for the company's Stockfacts page.

For the quarter ended 30 June 2018 financial results, click here.

The company website is: www.ebwater.com

The ccompany's Stock Facts page is here.

For the company's financial results for the 2nd quarter ended 30 June 2018, click here.