|

There are many benefits smaller investors can gain from investing in unit trusts, including leveraging on the expertise of a professional fund manager, diversifying their investments and gaining access to a wide range of markets, some of which they may not otherwise be able to invest in. These benefits are especially useful for investors with only a small amount of funds to invest. However, along with the good, there are certain negatives commonly associated with unit trusts – namely higher fees and limited control over investments. |

Unit Trust Fees And Charges

There are three main components of fees and charges we incur when we invest in a unit trust.

The first one, and also the one we’re most familiar with, is the sales and redemption fees as well as switching fees. This is the upfront fees we have to pay to get invested into the unit trust, exit fee for divesting our stakes or fees to switch our investments from one fund to another. Such fees can range from anything under 1% to as high as even 5%.

The second type of fees and charges we incur is invisible to most investors, and worse, they are recurring in nature. Commonly dubbed the TER or total expense ratio, such fees include management fees, trustee fees and miscellaneous fees such as marketing, administration and audit fees. Another type of fee that gets bundled into this cost here is the trail fee.

Trail fees are an annual fee that is paid out to the person, be it a bank representative, financial advisor or broker who sold us the unit trust investment. This is also how institutions that are increasingly promoting 0% sales charges continue to earn their cut.

|

"The total expense ratio is a recurring layer of fees that is invisible to most investors. It includes management fees, trustee fees and miscellaneous fees such as marketing, administration and audit fees." |

Lastly, similar to investing on our own, we also incur trading costs when the fund manager buys and sells investments on behalf of the unit trust.

So, remember to check all the charges that the unit trust is imposing. Take note of any promotional rates, as they may be removed in the future.

Most importantly, find out the unit trust’s TER as this is the recurring fees on the unit trust. Remember, many investors may simply forget they’re even incurring these recurring fees as they are deducted off a unit trust’s net asset value, which is typically between 1% and 2.5% of a unit trust’s net asset value.

Magic Of Compounding Applies To Fees As Well

At some point or another, we would have all come into contact with a sales representative or financial advisor telling us that we need to take advantage of compound returns to build our retirement nest egg.

The problem is that returns are never guaranteed. On the flipside, costs are guaranteed.

For our investments to grow in the long-term, our unit trust returns must beat the cost of the recurring charges. Moreover, the costs taken out of the unit trust isn’t able to help grow it anymore.

Here’s How Your Fees Compound

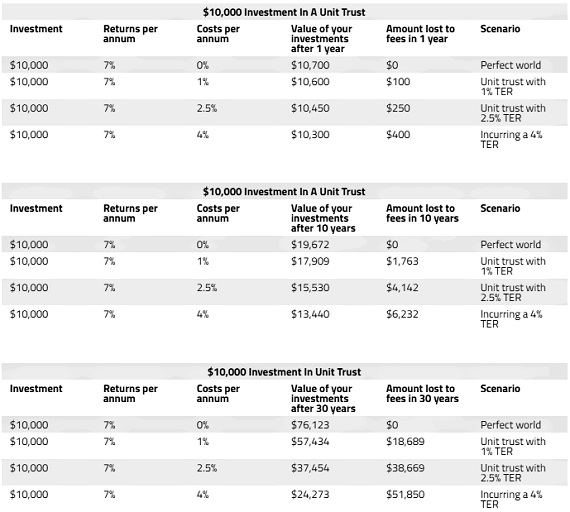

We’ll take just the TER into consideration for our calculation. This is because trading fees that fund managers incur reflect the brokerage fees we will likely incur if we invest on our own. We’ll also disregard the sales/ redemption charge as they are one-time fees.

For simplicity sake, we’ll assume the market return is close to 7% per annum. This reflects the Straits Times Index (STI) ETF returning nearly 7% since 2002.

Here’s how a $10,000 investment in the market may compound over the next one year, 10 years and 30 years. We use four scenarios – 1) a perfect world scenario where we don’t incur a TER; 2) a unit trust investment incurring 1% in TER; 3) a unit trust investment incurring 2.5% in TER; and 4) a unit trust investment incurring 4% TER.

As you can see from the above three tables, these TER of our unit trusts can take a hefty bite out of our retirement nest egg over the span of 30 years. In fact, we could end up with retirement nest egg of close to half of what we could have if we are able to steer clear of the up to 2.5% TER that a unit trust typically incurs.

|

What Else You Can Do |

|

While investing in unit trusts offer us the possibility of investing our money passively, we should not blindly jump into it. |

This article is republished with permission from Dollars and Sense.

Photo: Unsplash

Photo: Unsplash