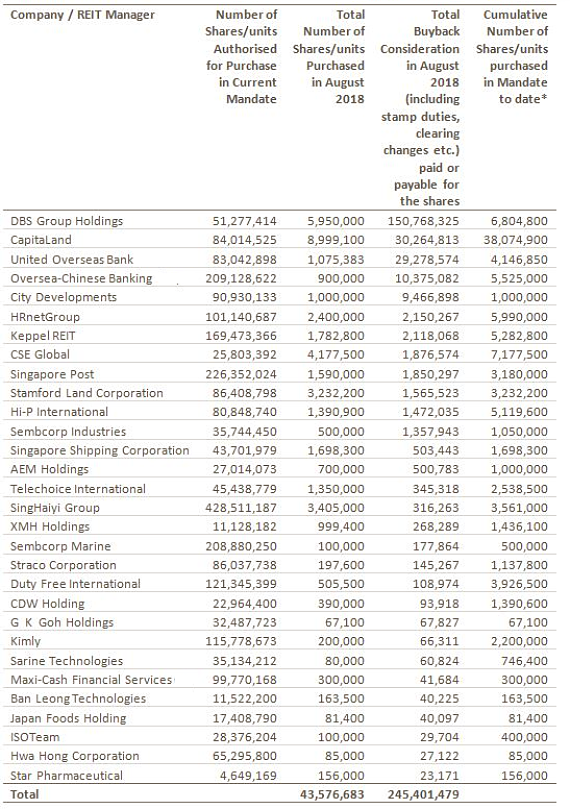

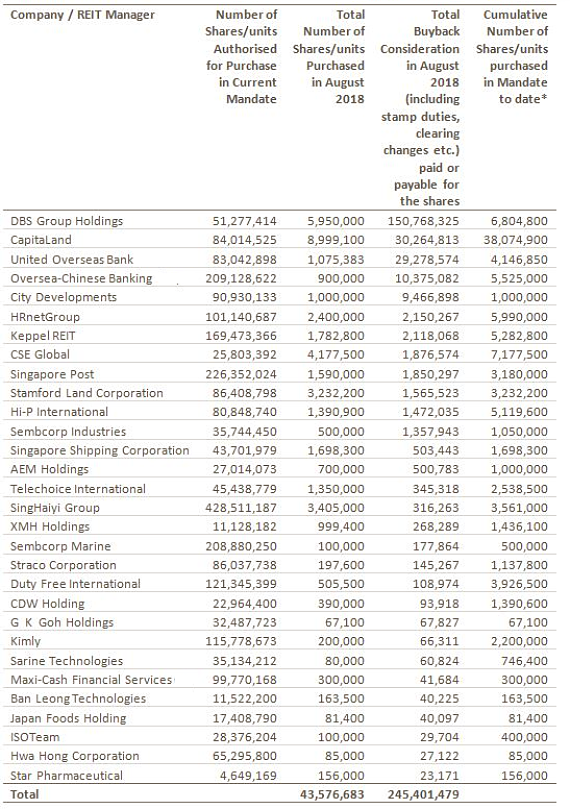

Total share buyback consideration for the month of August totaled S$245.4 million. As many as 30 SGX-listed stocks reported buybacks over the month, buying back a total of 43.58 million shares/units. The S$245.4 million buyback consideration was more than twice the previous month’s buyback consideration of S$109.0 million and more than four times August 2017’s total consideration of S$59.7 million.

During the month nine stocks have commenced new mandates. These included City Developments, Stamford Land Corporation, Singapore Shipping Corporation, G.K. Goh Holdings, Maxi-Cash Financial Services Corporation, Ban Leong Technologies, Japan Foods Holding, Hwa Hong Corporation and Star Pharmaceutical.

AEM bought back 700,000 shares in Aug 2018.

AEM bought back 700,000 shares in Aug 2018.

In picture: Chairman Loke Wai San speaking with investors. NextInsight file photo. A similar number of stocks commenced buyback mandates last month. Note that the Ban Leong Technologies buybacks in July were on a previous mandate (click here for more).

The five largest buyback considerations in the month-to-date have been maintained by five Straits Times Index (”STI”) stocks - DBS Group Holdings, CapitaLand, United Overseas Bank, Oversea-Chinese Banking Corporation and City Developments. HRnetGroup posted the largest buyback consideration by a non-STI stock in August. The recruitment agency headquartered and founded in Singapore that has agencies across Asia, bought back 2.4 million shares for a consideration of S$2.15 million.

The table below summarises the buyback considerations in August 2018. The table is sorted by the value of the total consideration amount for the month, which combines the amount of shares or units purchased and the purchasing price of the transactions.

Note: Keppel REIT Management bought back 1,782,800 units of Keppel REIT in August.

*Percentage of company’s issued shares excluding treasury shares as at the date of the share buyback resolution.

Source: SGX (Data as of 31 August 2018).

Share buyback transactions involve share issuers repurchasing some of their outstanding shares from shareholders through the open market. Once the shares are bought back, they will be converted into treasury shares, which means they are no longer categorised as shares outstanding. Other motivations for share buybacks include companies moving to align stock valuations with balance sheet objectives.

The date of the relevant share buyback mandate is also provided in the table above, in addition to the amount of shares authorised to be bought back under the mandate. The total number of shares purchased under the mandate and the percentage of the companies that issued shares that have been repurchased under the mandate are also provided.

Share buyback information can be found on the company disclosure page on the SGX website, using the Announcement category and sub-category of Share Buy Back-On Market (click here).